Your business has a story to tell. And one of the ways to hear your business’s story is by reading through comparative financial statements.

Your business has a story to tell. And one of the ways to hear your business’s story is by reading through comparative financial statements.

The importance of comparative financial statements

An up-to-date balance sheet, income statement and statement of cash flows are essential financial reports you should consistently analyze. But these financial statements by themselves don’t tell the whole story about your business. Consider the following:

- Company XYZ: The most current balance sheet shows $1 million in liquid assets with zero liabilities.

- Company ABC: The most current income statement has a net profit margin of 35%.

- Company 123: The statement of cash flows shows that the company has consistently brought in more cash than it has spent over the past three years.

And here’s the rest of the story:

- Company XYZ: Liquid assets decreased from $5 million to $1 million over the past 12 months.

- Company ABC: Net profit margin is typically around 20% for this company. However, a recent round of layoffs temporarily pushed total salaries and wages lower, while pushing the net profit margin much higher.

- Company 123: There has been a steady decline in positive cash flow over the past three years.

These examples show the importance of analyzing your financial statements in comparison with something else. Reading through the first list of bullet points only tells part of the story.

What you can do

Here are several types of comparative financial statements you can create for your business and some tips for getting the most out of these reports.

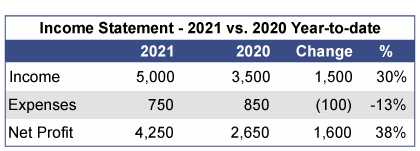

- Current period vs. Prior period. Compare this month to the same month one year prior (October 2021 vs. October 2020) or compare by year (2021 Year-to-Date vs. 2020 Year-to-Date).

- Current period vs. Current period forecast. This is known as a variance analysis. You compare what you think was going to occur during a particular period to what actually happened. This report can also be done either by month [October 2021 (actual) vs. October 2021 (forecast)] or by year [2021 Year-to-Date (actual) vs. 2021 Year-to-Date (forecast)]

- Use both absolute figure and percentages. Percentages allow you to quickly see the degree of change between the two periods that are being compared. Here’s an example of what this could look like:

- Ask for help! Please contact your financial advisor or accountant if you would like help creating or analyzing comparative financial statements for your business.

There are always moves you can make to reduce your taxable income. Some of these tax-saving moves, however, must be completed by December 31. Here are several to consider:

- Tax loss harvesting. If you own stock in a taxable account that is not in a tax-deferred retirement plan, you can sell your underperforming stocks by December 31 and use these losses to reduce any taxable capital gains. If your net capital losses exceed your gains, you can even net up to $3,000 against other income such as wages. Losses over $3,000 can be used in future years. Just be sure you do not repurchase the same stock within 30 days, or the loss will be deferred.

- Take a peek at your estimated 2022 income. If you have appreciated assets that you plan on selling in the near future, estimate your 2022 taxable income and compare it to your 2021 taxable income. If your 2022 income looks like it may be significantly higher than 2021, you may be able to sell your appreciated assets in 2021 to take advantage of a lower tax rate. The opposite also holds true. If your estimated 2022 taxable income looks like it may be significantly lower than your 2021 taxable income, lower tax rates may apply if you wait to sell your assets in 2022.

Max out pre-tax retirement savings. The deadline to contribute to a 401(k) plan and be able to reduce your taxable income on your 2021 tax return is December 31. See if you can earmark a little more money from each of your paychecks through the end of the year to transfer into your retirement savings accounts. For 2021, you can contribute up to $19,500 to a 401(k), plus another $6,500 if you’re age 50 or older. Even better, you have until April 18, 2022, to contribute to a traditional IRA and be able to reduce your taxable income on your 2021 tax return.

Max out pre-tax retirement savings. The deadline to contribute to a 401(k) plan and be able to reduce your taxable income on your 2021 tax return is December 31. See if you can earmark a little more money from each of your paychecks through the end of the year to transfer into your retirement savings accounts. For 2021, you can contribute up to $19,500 to a 401(k), plus another $6,500 if you’re age 50 or older. Even better, you have until April 18, 2022, to contribute to a traditional IRA and be able to reduce your taxable income on your 2021 tax return.- Make cash charitable contributions. If you’re like 90% of all taxpayers, you get no tax benefit from charitable contributions because you don’t itemize your personal deductions. On your 2021 tax return, however, you may contribute up to $300 in cash to a qualified charity and deduct the amount whether or not you itemize your deductions. Married taxpayers who file jointly may contribute $600. You can make your contribution by check, credit card, or debit card. Remember that this above-the-line deduction is for cash contributions only. It does not apply to non-cash contributions.

- Bunch deductions so you can itemize. Are your personal deductions near the amount of the standard deduction for 2021: $12,550 for singles, $18,800 for head of household and $25,100 for married filing jointly? If so, consider bunching your personal deductions into 2021 so you can itemize this year. For most, the easiest way is to bunch two years of charitable contributions into a single year. These can include gifts of appreciated stock where you get to deduct the fair market value without paying capital gains tax.

Summer’s almost here, and soon most children will be on their long-awaited summer vacation. If you own or manage a business, have you thought of hiring your children, nieces, or nephews for a summer job?

If you do it right, it can be a win-win situation for everyone.

The kids will earn some money and gain valuable real-life experience in the workplace while your business will have some extra help during summer months when other staff may be on vacation. If it’s a family business, there might even be some tax advantages as well.

If your child is doing a valid job and the pay is reasonable for the work, your business can generally claim a normal tax expense for wages paid. Your child will probably pay no or very little income tax on the wages they earned. And if the child is under age 18 and your business is unincorporated, neither your child nor your business will have to pay Social Security or Medicare payroll taxes in most cases.

If your child is doing a valid job and the pay is reasonable for the work, your business can generally claim a normal tax expense for wages paid. Your child will probably pay no or very little income tax on the wages they earned. And if the child is under age 18 and your business is unincorporated, neither your child nor your business will have to pay Social Security or Medicare payroll taxes in most cases.

To make the arrangement work, follow the following guidelines:

- Ensure it’s a real job. It could be a simple job, such as office filing, packing orders, or simple production activities. But it needs to be an actual job.

- Treat your child like any other employee. Expect your child to work regular hours and exhibit appropriate behavior. Don’t show favoritism or you risk upsetting regular employees.

- Keep proper documentation. Keep records of hours worked just as you would for any employee. If possible, pay your child using your normal payroll system and procedures.

- Avoid family disputes. If the arrangement is not working, or is disrupting the business, help your child find a summer job at another business.