5 Surprising Taxable Items

Wages and self-employment earnings are taxable, but what about the random cash or financial benefits you receive through other means? If something of value changes hands, you can bet the IRS considers a way to tax it. Here are five taxable items that might surprise you:

- Scholarships and financial aid. Applying for scholarships and financial aid are top priorities for parents of college-bound children. But be careful — if any part of the award your child receives goes toward anything except tuition, it might be taxable. This could include room, board, books, travel expenses or aid received in exchange for work (e.g., tutoring or research).

Tip: When receiving an award, review the details to determine if any part of it is taxable. Don’t forget to review state rules as well. While most scholarships and aid are tax-free, no one needs a tax surprise. - Gambling winnings. Hooray! You hit the trifecta for the Kentucky Derby. But guess what? Technically, all gambling winnings are taxable, including casino games, lottery tickets and sports betting. Thankfully, the IRS allows you to deduct your gambling losses (to the extent of winnings) as an itemized deduction, so keep good records.

Tip: Know when the gambling establishment is required to report your winnings. It varies by type of betting. For instance, the filing threshold for winnings from fantasy sports betting and horse racing is $600, while slot machines and bingo are typically $1,200. But beware, the gambling facility and state requirements may lower the limit.

- Unemployment compensation. Congress gave taxpayers a one-year reprieve in 2021 from paying taxes on 2020 unemployment income. Unfortunately, this tax break did not get extended for the 2021 tax year. So, unless Congress passes a law extending the tax break, unemployment will once again be taxable starting with your 2021 tax return.

Tip: If you are collecting unemployment, you can either have taxes withheld and receive the net amount or make estimated payments to cover the tax liability.

- Social Security benefits. If your income is high enough after you retire, you could owe income taxes on up to 85% of Social Security benefits you receive.

Tip: Consider if delaying when you start collecting Social Security benefits makes sense for you. Waiting to start benefits means you’ll avoid paying taxes on your Social Security benefits for now, plus you’ll get a bigger payment each month you delay until you reach age 70.

- Alimony. Prior to 2019, alimony was generally deductible by the person making alimony payments, with the recipient generally required to report alimony payments received as taxable income. Now the situation is flipped: For divorce and separation agreements executed since December 31, 2018, alimony is no longer deductible by the payer and alimony payments received are not reported as income.

Tip: Alimony payments no longer need to be made in cash. Consider having the low-income earning spouse take more retirement assets such as 401(k)s and IRAs in exchange for reduced alimony payments. This arrangement would allow the higher-earning spouse to make alimony payments by transferring retirement funds without paying income taxes on it.

When in doubt, it’s a good idea to keep accurate records so your tax liability can be correctly calculated and you don’t get stuck paying more than what’s required.

Prepare for this year’s tax return filing season

Tax return filing season usually gets a little crazy, but this year will be more turbulent than most. Due to new tax legislation and guidance from the IRS, you will have to cope with a wide variety of tax changes, some of which relate to the pandemic. Here are several tips for making some order out of the chaos.

Tax return filing season usually gets a little crazy, but this year will be more turbulent than most. Due to new tax legislation and guidance from the IRS, you will have to cope with a wide variety of tax changes, some of which relate to the pandemic. Here are several tips for making some order out of the chaos.

Unemployment benefits

Unemployment benefits are taxable once again in 2021. In 2020, the first $10,200 of benefits received by taxpayers with an adjusted gross income (AGI) of less than $150,000 were exempt from tax. Unfortunately, the tax-free nature of unemployment benefits in 2020 was made long after many of you filed your tax return. If this pertains to you, and you haven’t received a refund from a tax overpayment yet, you might need to file an amended 2020 tax return.

Small business loans

To kick start the economy during the pandemic, Congress created a loan program called the Paycheck Protection Program (PPP). Similarly, your small business might have received an Economic Injury Disaster Loan (EIDL) or grant. These loans may be forgiven in 2021 without any adverse tax consequences if certain conditions were met. So, gather your records—including what you received and when—for optimal tax protection.

Economic impact payments

Congress handed out three rounds of Economic Impact Payments to individuals in 2020 and 2021. The third payment provided a maximum of $1,400 per person, including dependents, subject to a phaseout. For single filers, the phaseout begins at $75,000 of AGI; $150,000 for joint filers. So, review your records and be very clear what payments you received in 2021. Only then can you use your 2021 tax return to ensure you receive credit for your full stimulus payments.

Child tax credit

Many families will benefit from an enhanced Child Tax Credit (CTC) on their 2021 tax return. The new rules provide a credit of up to $3,000 per qualifying child ages 6 through 17 ($3,600 per qualifying child under age six), subject to a phaseout beginning at $75,000 of AGI for single filers and $150,000 for joint filers. What will complicate this year’s tax filing are any advance payments you received from the IRS during the second half of 2021. It is important that you accurately identify all the payments you received. Only then can correct adjustments be made on your tax return to ensure you receive the full Child Tax Credit amount.

Dependent care credit

The available dependent care credit for qualified expenses incurred in 2021 is much higher than 2020, with a corresponding increase in phaseout levels. The maximum credit for households with an AGI up to $125,000 is $4,000 for one under-age-13 child and $8,000 for two or more children. The credit is gradually reduced, then disappears completely if your AGI exceeds $440,000.

Due to the ongoing debate of proposed legislation in Washington, D.C., this year’s tax filing season will seem a bit chaotic. With proper preparation, though, your situation can be orderly…but only if you prepare!

Individual tax return deadline moved to May 17

Congress’ recent move to retroactively make a portion of 2020 unemployment income tax-free is creating havoc during this year’s tax filing season. Here is what you need to know.

Background

Unemployment compensation was received by millions of Americans during 2020 because of the pandemic. While unemployment income was necessary for many who lost a job, it’s also normally classified as taxable income to be reported on your tax return. Recently-passed legislation now makes the first $10,200 of 2020 unemployment compensation tax-free on your tax return.

The problem

The new legislation which contains this tax break didn’t become law until March of 2021, a full three months after the end of the tax year and after millions of Americans had already filed their 2020 tax return!

Understanding your situation

- If you’ve already filed your 2020 tax return: Wait for further instructions. The IRS is trying to figure out a way to automatically apply this tax break for taxpayers who have already filed their 2020 tax return. This will avoid the need to file an amended tax return. There is no need to call at this time as the IRS has not provided further guidance.

- If you HAVE NOT filed your 2020 tax return: The IRS has issued guidance on how to report this tax break on your 2020 tax return if you have not already filed. You will be notified once your tax return has been prepared.

- Tax deadline moved to May 17. Because of all this havoc, the April 15 deadline for individual tax returns is now May 17. This extension applies only to Form 1040s. First quarter estimated tax payments for the 2021 tax year are still due by April 15.

Be assured you will be informed once the IRS issues further instruction on how to claim your tax break. In the meantime, enjoy the extra tax savings you’ll get sometime in the near future!

Don’t get shocked by a high tax bill! Be prepared for these pandemic-related tax surprises when you file your 2020 tax return. Please note: This information may change with ongoing legislation.

Don’t get shocked by a high tax bill! Be prepared for these pandemic-related tax surprises when you file your 2020 tax return. Please note: This information may change with ongoing legislation.

- Taxes on unemployment income. If you received unemployment benefits in 2020, you need to report these benefits on your tax return as taxable income. Check to see if either federal or state taxes were withheld from unemployment payments you received. If taxes were not withheld, you may need to write a check to the IRS when you file your tax return.

- Taxes from side jobs. Did you pick up a part-time gig to make ends meet? Payments received for performing these jobs may not have had your taxes withheld. If this is the case, you’ll need to pay your taxes directly to the IRS on April 15.

- Unusual profit-and-loss. If you run a business that was hit by the pandemic, you may find your estimated tax payments were either overpaid or underpaid compared to normal. Now that 2020 is in the books, run a quick projection to ensure you are not surprised with an unexpected tax bill when you file your tax return.

- Underpayment penalty. If you did not have proper tax withholdings from your paycheck or your estimated tax payments weren’t enough, you could be subject to an underpayment penalty. While it’s too late to avoid a penalty on your 2020 tax return, the solution in the future is to make high enough estimated tax payments each quarter in 2021 or have the appropriate amount withheld from your 2021 paychecks.

- A chance to claim missing stimulus payments. (A good surprise!) If any of your stimulus payments were for less than what you should have received, you can get money for the difference as a tax credit when you file your 2020 tax return.

Please use these examples to prepare yourself for a potential tax surprise during the uncertainty caused by the ongoing pandemic.

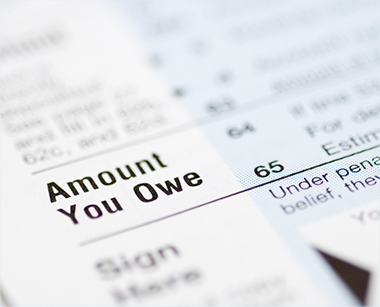

Find out if you owe the IRS an estimated tax payment

You may owe the IRS a tax payment for your 2020 tax return and not know it.

Most Americans have income taxes withheld from their paychecks, with their employer sending a tax payment to the IRS on their behalf. This year, however, many more Americans will have to write Uncle Sam a check to pay a portion of their 2020 taxes on or before July 15. You may be one of these people!

Most Americans have income taxes withheld from their paychecks, with their employer sending a tax payment to the IRS on their behalf. This year, however, many more Americans will have to write Uncle Sam a check to pay a portion of their 2020 taxes on or before July 15. You may be one of these people!

Who needs to pay now!

You may need to make a payment if one of the following situations applies to you:

- Paychecks are under-withheld. Your employer withholds a portion of your paychecks for income tax purposes, then submits a payment to the IRS on your behalf. The amount that is withheld from your paychecks, however, may not cover your entire tax liability, resulting in you needing to write the IRS a check. If you’re not withholding enough, ask your employer to increase the withholding amount from your future paychecks so you don’t come up short again in the future.

- Unemployment compensation paychecks are under-withheld. Unemployment compensation is subject to federal income tax and subject to income taxes in several states. While some unemployment benefit checks withhold a percentage of your payment for income tax purposes, you may need to pay more in taxes than is being withheld.

- Self-employed workers. Unlike employees, self-employed workers don’t have income tax withheld from pay and must make four estimated tax payments over a period of 12 months. Self-employed workers include gig economy workers, freelancers, S corporation shareholders and partners in a partnership.

- Retirees. You may owe tax on Social Security benefits, as well as income from investments distributed to you or other unearned income. A portion of pension plan distributions may be withheld, but many times the amount withheld does not cover your entire tax liability, resulting in an underpayment.

- Sold a major asset. You may owe tax after selling an asset that results in a large capital gain, such as a house, or from the sale of securities.

- Receive alimony. If you’re being paid alimony under a divorce decree entered into before 2019, the payments constitute taxable income to you. Alimony from post-2018 agreements, however, are not taxable.

What you need to do

Estimate your total income for 2020, then calculate your total 2020 tax bill and divide it by 2. Compare this amount to how much has been withheld from your paychecks, unemployment benefits and any other payments you’ve made to the IRS. If you’re short, consider making an estimated payment by July 15 to make up the difference. This payment is made with Form 1040-ES.

If you do not make this payment on time, the IRS may impose a penalty plus interest on top of the underpaid taxes. Fortunately, you can avoid a penalty by paying at least 90% of the current year’s tax liability or 100% of the prior year’s tax liability (110% if your adjusted gross income for the prior year exceeds $150,000).

Numerous new laws provide economic relief to individuals and businesses hardest hit by this year’s pandemic. This much-needed financial assistance, however, comes with a few strings attached.

Numerous new laws provide economic relief to individuals and businesses hardest hit by this year’s pandemic. This much-needed financial assistance, however, comes with a few strings attached.

Here are three potential surprises if you use the available economic relief packages:

- Getting a tax bill for unemployment benefits. While the $1,200 economic impact payments most Americans received does not have to be reported as taxable income on your 2020 tax return, there is currently no such luck with unemployment benefits. In addition to paying federal taxes on your unemployment compensation, more than half of states also impose a tax on unemployment benefits.

- What you need to do: See if your unemployment compensation check withholds a portion of your pay for taxes. Even if your check does have withholding for income tax purposes, the withholding amount may not be enough. If possible, talk to your state unemployment office and try to get withholding amounts revised.

- Paying estimated tax payments. If you normally receive a paycheck from your employer, you may have never needed to write a check to the IRS to pay estimated future taxes. Your employer withholds your taxes from your paychecks and sends it to the IRS for you. If you’re collecting unemployment benefits, however, you may be required to pay tax on the unemployment benefits received during the first six months of 2020 by July 15, 2020.

- What you need to do: Estimate the amount of tax you owe for all sources of income, then compare that number with the amount of money withheld from your income to pay these taxes. If necessary, send in quarterly estimated tax payments to the U.S. Treasury and, in some cases, state revenue departments. This must be done each quarter with the next payment due July 15. You may need to send money in on September 15, 2020 and January 15, 2021 as well.

- Reporting emergency distributions from retirement accounts: You may withdraw up to $100,000 in 2020 from various retirement accounts to help cover pandemic-related emergency expenses without incurring penalties. While you will not be required to pay an early withdrawal penalty, you will still be subject to income tax when filing your 2020 tax return.

- What you need to do: If you plan to withdraw funds from your retirement account, reserve enough of the money to pay the tax! The amount you reserve depends on your potential tax situation so call for a tax review before taking money out of the account.

5 Surprising Taxable Items

Wages and self-employment earnings are taxable, but what about the random cash or financial benefits you receive through other means? If something of value changes hands, you can bet the IRS considers a way to tax it. Here are five taxable items that might surprise you:

Wages and self-employment earnings are taxable, but what about the random cash or financial benefits you receive through other means? If something of value changes hands, you can bet the IRS considers a way to tax it. Here are five taxable items that might surprise you:

1. Scholarships and financial aid. Applying for scholarships and financial aid are top priorities for parents of college-bound children. But be careful — if any part of the award your child receives goes toward anything except tuition, it might be taxable. This could include room, board, books, travel expenses or aid received in exchange for work (e.g., tutoring or research).

Tip: When receiving an award, review the details to determine if any part of it is taxable. Don’t forget to review state rules as well. While most scholarships and aid are tax-free, no one needs a tax surprise.

2. Gambling winnings. Hooray! You hit the trifecta for the Kentucky Derby. But guess what? Technically, all gambling winnings are taxable, including casino games, lottery tickets and sports betting. Thankfully, the IRS allows you to deduct your gambling losses (to the extent of winnings) as an itemized deduction, so keep good records.

Tip: Know when the gambling establishment is required to report your winnings. It varies by type of betting. For instance, the filing threshold for winnings from fantasy sports betting and horse racing is $600, while slot machines and bingo are typically $1,200. But beware, the gambling facility and state requirements may lower the limit.

3. Unemployment compensation. Unfortunately the IRS doesn’t give you a break on the taxes for unemployment income. Unemployment benefits you receive are taxable.

Tip: If you are collecting unemployment, you can either have taxes withheld and receive the net amount or make estimated payments to cover the tax liability.

4. Crowdfunding. A popular method to raise money for new ventures or to support a special cause is crowdfunding through websites. Whether or not the funds are taxable depends on two things: your intent for the funds and what the giver receives in return. Generally, funds used for a business purpose are taxable and funds raised to cover a life event (e.g., special causes or medical assistance) are considered a gift and not taxable to the recipient.

Tip: Prior to using these online tools to raise money, review the terms and conditions and ask for a tax review of what you are doing. If you need to account for taxes, reserve some of what you raise for this purpose.

5. Cryptocurrency. Cryptocurrencies like Bitcoin are considered property by the IRS. So if you use cryptocurrency, you must keep track of the original cost of the coin and its value when you use it. This information is needed so the tax on your gain or loss can be properly calculated. Remember, the tax rate on property can vary if you own the cryptocurrency more than a year, so record all dates.

Tip: For those considering replacing cash with things like Bitcoin, you need to understand the gain or loss complications. For this reason, many people using cryptocurrency do so for speculative investment purposes.

When in doubt, it’s a good idea to keep accurate records so your tax liability can be correctly calculated and you don’t get stuck paying more than what’s required.