Prepare for this year’s tax return filing season

Tax return filing season usually gets a little crazy, but this year will be more turbulent than most. Due to new tax legislation and guidance from the IRS, you will have to cope with a wide variety of tax changes, some of which relate to the pandemic. Here are several tips for making some order out of the chaos.

Tax return filing season usually gets a little crazy, but this year will be more turbulent than most. Due to new tax legislation and guidance from the IRS, you will have to cope with a wide variety of tax changes, some of which relate to the pandemic. Here are several tips for making some order out of the chaos.

Unemployment benefits

Unemployment benefits are taxable once again in 2021. In 2020, the first $10,200 of benefits received by taxpayers with an adjusted gross income (AGI) of less than $150,000 were exempt from tax. Unfortunately, the tax-free nature of unemployment benefits in 2020 was made long after many of you filed your tax return. If this pertains to you, and you haven’t received a refund from a tax overpayment yet, you might need to file an amended 2020 tax return.

Small business loans

To kick start the economy during the pandemic, Congress created a loan program called the Paycheck Protection Program (PPP). Similarly, your small business might have received an Economic Injury Disaster Loan (EIDL) or grant. These loans may be forgiven in 2021 without any adverse tax consequences if certain conditions were met. So, gather your records—including what you received and when—for optimal tax protection.

Economic impact payments

Congress handed out three rounds of Economic Impact Payments to individuals in 2020 and 2021. The third payment provided a maximum of $1,400 per person, including dependents, subject to a phaseout. For single filers, the phaseout begins at $75,000 of AGI; $150,000 for joint filers. So, review your records and be very clear what payments you received in 2021. Only then can you use your 2021 tax return to ensure you receive credit for your full stimulus payments.

Child tax credit

Many families will benefit from an enhanced Child Tax Credit (CTC) on their 2021 tax return. The new rules provide a credit of up to $3,000 per qualifying child ages 6 through 17 ($3,600 per qualifying child under age six), subject to a phaseout beginning at $75,000 of AGI for single filers and $150,000 for joint filers. What will complicate this year’s tax filing are any advance payments you received from the IRS during the second half of 2021. It is important that you accurately identify all the payments you received. Only then can correct adjustments be made on your tax return to ensure you receive the full Child Tax Credit amount.

Dependent care credit

The available dependent care credit for qualified expenses incurred in 2021 is much higher than 2020, with a corresponding increase in phaseout levels. The maximum credit for households with an AGI up to $125,000 is $4,000 for one under-age-13 child and $8,000 for two or more children. The credit is gradually reduced, then disappears completely if your AGI exceeds $440,000.

Due to the ongoing debate of proposed legislation in Washington, D.C., this year’s tax filing season will seem a bit chaotic. With proper preparation, though, your situation can be orderly…but only if you prepare!

What you need to know if one of your tax returns is stuck

The IRS is coping with a backlog of historical proportions and it is impacting millions of taxpayers. According to IRS sources, as of July 31, there are still over 13 million tax returns that are to be processed. The nearly unprecedented delay is being attributed to the COVID-19 pandemic, under staffing at the IRS, and a slew of recent tax law changes. The challenge is how to navigate the IRS notices if you are caught up in this mess.

The IRS is coping with a backlog of historical proportions and it is impacting millions of taxpayers. According to IRS sources, as of July 31, there are still over 13 million tax returns that are to be processed. The nearly unprecedented delay is being attributed to the COVID-19 pandemic, under staffing at the IRS, and a slew of recent tax law changes. The challenge is how to navigate the IRS notices if you are caught up in this mess.

Complicating your tax life

- You’ve filed for an extension via mail, but the IRS says you haven’t filed your return yet and issues notices and penalties.

- You keep getting letters from the IRS after responding to initial inquiries.

- You filed your tax return on time, but the IRS says it doesn’t have your return, even though you may have received a confirmation.

What you can do

While you may not be able to get your tax return processed any faster, there are steps you can take to stay informed and make it easier for the IRS to work with your tax situation:

- Track your refund status. The IRS has developed an online tool, “Where’s My Refund?” that can provide updates. Find it at https://www.irs.gov/refunds.

- Check out IRS2Go. The agency also provides a mobile app called IRS2Go that checks your tax refund status. You can see if your return has been received, approved, and sent.

- Stay calm and keep responding. If the IRS sends you notices, keep detailed records of the notices and your timely replies. Eventually, they will get caught up. So keep good records by leaving a digital footprint and back up electronic records with paper versions.

- Prior correspondence is your friend. When you’re replying to IRS notifications, attach copies of prior correspondence with your latest letter. Make it easy for the IRS to follow your paper trail by dating each response and keeping the most recent response on top.

- Keep proof of delivery. Use express delivery or certified mail to confirm that the IRS receives your responses in a timely manner.

Remember that the IRS is working as quickly as it can to clear this backlog.

With home sales booming throughout much of the country, you may decide that now’s the right time to put your abode on the market. If you do put your primary residence up for sale, try to steer clear of the following mistakes.

With home sales booming throughout much of the country, you may decide that now’s the right time to put your abode on the market. If you do put your primary residence up for sale, try to steer clear of the following mistakes.

- Not qualifying for the home sale exclusion. If you’ve owned and used your home as your principal residence at least two out of the last five years, you can exclude from your taxable income the first $250,000 of gain if you’re single and $500,000 if you’re married.

What you can do: Consider a delay of selling your home until you meet the 2-out-of-5-year threshold. If you can’t qualify for a full exclusion, you may qualify for a partial exclusion if your sale results from an employment change, a need for medical care or other IRS-approved circumstances.

- Forgetting to deduct points. If you have points from your current mortgage that you haven’t deducted on a previous tax return, include the balance of these points on your next tax return. Too many taxpayers forget to do this and lose thousands in deductions.

What you can do: Review your loan documents before selling your property. Identify all costs, including points, that are included in the loan. Save the document with your tax records to ensure the deduction is not forgotten.

- Not double-checking your settlement statement. Closely review the closing statement. It is easy to assume all the numbers are correct and the math is done right. Often this is not the case! And a mistake here could be costly.

What you can do: Review the closing document multiple times. Have your Realtor and closing agent explain items you don’t understand. Pay special attention to property taxes. The property tax bill will be allocated between the seller and the buyer. Only pay the share of the bill that covers the time period when you’re the owner.

Selling a home is full of tax implications. Since selling a home is not an everyday occurrence, it is easy to make a mistake. So, if you need help with these or any other tax questions surrounding the sale of your house, contact your financial advisor…before you sell!

Individual tax return deadline moved to May 17

Congress’ recent move to retroactively make a portion of 2020 unemployment income tax-free is creating havoc during this year’s tax filing season. Here is what you need to know.

Background

Unemployment compensation was received by millions of Americans during 2020 because of the pandemic. While unemployment income was necessary for many who lost a job, it’s also normally classified as taxable income to be reported on your tax return. Recently-passed legislation now makes the first $10,200 of 2020 unemployment compensation tax-free on your tax return.

The problem

The new legislation which contains this tax break didn’t become law until March of 2021, a full three months after the end of the tax year and after millions of Americans had already filed their 2020 tax return!

Understanding your situation

- If you’ve already filed your 2020 tax return: Wait for further instructions. The IRS is trying to figure out a way to automatically apply this tax break for taxpayers who have already filed their 2020 tax return. This will avoid the need to file an amended tax return. There is no need to call at this time as the IRS has not provided further guidance.

- If you HAVE NOT filed your 2020 tax return: The IRS has issued guidance on how to report this tax break on your 2020 tax return if you have not already filed. You will be notified once your tax return has been prepared.

- Tax deadline moved to May 17. Because of all this havoc, the April 15 deadline for individual tax returns is now May 17. This extension applies only to Form 1040s. First quarter estimated tax payments for the 2021 tax year are still due by April 15.

Be assured you will be informed once the IRS issues further instruction on how to claim your tax break. In the meantime, enjoy the extra tax savings you’ll get sometime in the near future!

Here are four ways to make sure the preparation of your tax return keeps humming along until it gets filed.

- Keep tax documents in one place. Missing items are one of the biggest reasons filing a tax return gets delayed! Find a place in your home and put all tax documents in this one place as you receive them. Common missing items this year will include the new 1099-NEC for any taxpayers that are contractors, consultants or part of the gig economy.

- Organize documents by type. Every tax professional has a story of someone bringing their documents to them in a shoebox or storage container. All this does is increase the amount of time it takes to prepare your return, so it’s best to sort your documents in tax return order. Pull out last year’s tax return and create folders for each section including income, business/rental information, adjustments to income, itemized deductions, tax credit information and a not-sure bucket.

- Create list of special events. You receive a Form W-2 from your employer every year. You may get a 1099-INT from your bank if you earn interest income on your deposit accounts. But selling a home usually doesn’t happen every year. Retiring from a 40-year job doesn’t happen every year. Sending a child to college also doesn’t happen every year (although it might seem like it does!). If you don’t write down these unusual events as they happen, you might forget them when your tax return is being prepared. And you may not remember until the moment your return is about to be filed. This is sure to cause delays.

- Don’t forget your signature! You may be surprised to learn that even if you electronically file your tax return, you still must sign Form 8879, which authorizes the e-filing of your return. So, whether it’s a traditionally-filed paper tax return or one filed electronically, a signature is required.

These are four of the more common reasons why the preparation of your tax return may get delayed. Be prepared and file your return without a hitch!

These are four of the more common reasons why the preparation of your tax return may get delayed. Be prepared and file your return without a hitch!

In 2018, the government attempted to “simplify” the tax-filing process by drastically shortening Form 1040. The result was six new schedules that created a lot of confusion. Now the IRS is attempting to ease some of that pain by revising the form and removing some schedules. Will it help? Here is what you need to know:

In 2018, the government attempted to “simplify” the tax-filing process by drastically shortening Form 1040. The result was six new schedules that created a lot of confusion. Now the IRS is attempting to ease some of that pain by revising the form and removing some schedules. Will it help? Here is what you need to know:

- More information on the main form. To make it easier for the IRS to match pertinent information across related tax returns, new fields have been added on the main Form 1040. For example, there’s now a spot for your spouse’s name if you choose the married filing separate status. In addition, there’s a separate line for IRA distributions to more clearly differentiate retirement income.

- 3 schedules are gone. What was your favorite memory of Schedules 4, 5 and 6? Was it the unreported Social Security tax on Schedule 4? Or the credit for federal fuels on Schedule 5? While those schedules will no longer exist, those lines (and many others) have found a new home on one of the first three schedules. Less paperwork, but still the same amount of information.

- You can keep your pennies! For the first time, the IRS is eliminating the decimal spaces for all fields. While reporting round numbers has been common practice, it’s now required.

- Additional changes on the way. The current versions of Form 1040 and Schedules 1, 2 and 3 are in draft form and awaiting comments on the changes. Because of the importance of the 1040, the IRS is expecting to make at least a few updates in the coming weeks (or months) before they consider it final. Stay tuned for more developments.

How to prepare for the changes

The best way to prepare is to be aware that 1040 changes are coming. The information required to file your taxes will remain the same, but some additional hunting will be necessary to find the shifting lines and fields on the modified form.

Remember, changes bring uncertainty and potential for delays, so getting your tax documents organized as early as possible will be key for a timely tax-filing process.

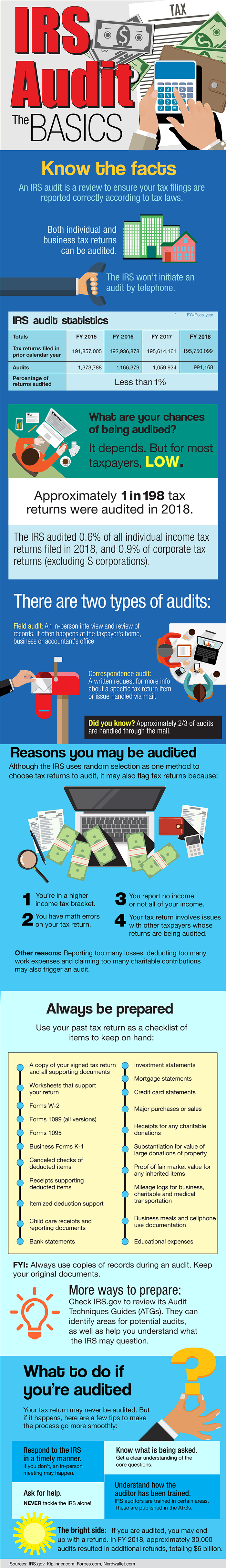

The IRS recently released its 2018 Data Book, including information on its audit activities for the last fiscal year. This infographic details what you need to know regarding your audit risk, how to prepare for and what to expect in an IRS audit.

Getting audited by the IRS is no fun. Some taxpayers are selected for random audits every year, but the chances of that happening to you are very small. You are much more likely to fall under the IRS’s gaze if you make one of several common mistakes.

Getting audited by the IRS is no fun. Some taxpayers are selected for random audits every year, but the chances of that happening to you are very small. You are much more likely to fall under the IRS’s gaze if you make one of several common mistakes.

That means your best chance of avoiding an audit is by doing things right before you file your return this year. Here are some suggestions:

Don’t leave anything out. Missing or incomplete information on your return will trigger an audit letter automatically, since the IRS gets copies of the same tax forms (such as W-2s and 1099s) that you do.

Double-check your numbers. Bad math will get you audited. People often make calculation errors when they do their returns, especially if they do them without assistance. In 2016, the IRS sent out more than 1.6 million examination letters correcting math errors. The most frequent errors occurred in people’s calculation of their amount of tax due, as well as the number of exemptions and deductions they claimed.

Don’t stand out. The IRS takes a closer look at business expenses, charitable donations and high-value itemized deductions. IRS computers reference statistical data on which amounts of these items are typical for various professions and income levels. If what you are claiming is significantly different from what is typical, it may be flagged for review.

Have your documentation in order. Be meticulous about your recordkeeping. Items that will support the tax breaks you take include: cancelled checks, receipts, credit card and investment statements, logs for mileage and business meals and proof of charitable donations. With proper documentation, a correspondence letter from the IRS inquiring about a particular deduction can be quickly resolved before it turns into a full-blown audit.

Remember, the average person has a less than 1 percent chance of being audited. If you prepare now, you can narrow your audit chances even further and rest easy after you’ve filed.

In an effort to reduce the amount of money paid to identity thieves who file fraudulent returns, the IRS will be implementing changes in the timing and way they handle the processing of tax returns.

These steps will continue to evolve, but recent changes will impact millions who depend on receiving an early refund.

Earlier filing of form W-2s and 1099-MISC – The timing required to send these forms to employees and vendors remains the end of January. However, the extended deadline for filing the electronic version of these forms to the IRS and Social Security Administration is now a full month earlier. This is done to allow the IRS to match records with early filed tax returns. The prior timing gap was ideal for thieves to file fraudulent tax returns.

Earned Income Tax Credit and Additional Child Tax Credit – If you file a tax return that contains either of these credits, do not expect to receive an early refund. The IRS has been mandated to hold these refund payments until February 15th or later. Given the payment backlog this will create, it is still important to file early to get your refund in the queue.

Begin planning now to be prepared for these upcoming changes. Rest assured, we can all look forward to further changes as the IRS continues to address the multi-billion dollar identity theft problem plaguing the Agency.

Last week we gave you the first half of a list of items that are often overlooked that cause trouble in filing a timely tax return. Here’s the second half of the list!

Name mismatch – If you’ve recently married or divorced, make sure your last name on your tax return matches the one on file at the Social Security Administration.

Inconsistent information – Most tax preparation software will check a tax return for inconsistencies. The message “Diagnostic Error!” will make you cringe. When one occurs, they must be resolved prior to filing your tax return. An example might be you filing Married Filing Separate, while your soon-to-be ex-spouse files as Married Filing Joint or Single.

No information for a common deduction – If you claim a deduction, you will need to provide support to document the claim.

Missing cost information for transactions – Brokers send out their statements with the sales transactions. You will need to also provide the cost and purchase information (cost basis) or the tax return cannot be filed.

Missing K-1 – If you have ownership of a partnership, Sub Chapter S or LLC, you should receive a Form K-1 that reports your share of the profit or loss from the business activity. Without this K-1, you cannot file your tax return.

Forms with no explanation – If you receive a tax form, but have no explanation for the form, questions arise. For instance, if you receive a retirement account distribution form, it may be deemed income. If it is part of a qualified rollover, no tax is due. An explanation is required to file your information correctly.

Hopefully, by knowing these common missing pieces of information, you can prepare to have your tax filing process a smooth one!