Know the way loans work…and use it to your advantage!

Every banker knows that the majority of the money they make on a loan is made in the first few years of the loan. By understanding this fact, you can greatly reduce the amount you pay when buying your house, paying off your student loan, or buying a car. Here is what you need to know:

Every banker knows that the majority of the money they make on a loan is made in the first few years of the loan. By understanding this fact, you can greatly reduce the amount you pay when buying your house, paying off your student loan, or buying a car. Here is what you need to know:

Your payment never changes

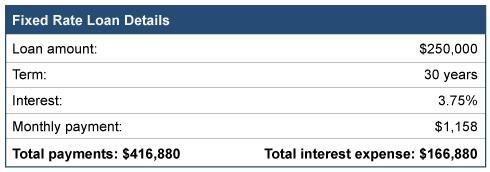

When you obtain a loan, the components of that loan are interest, the number of years to repay the loan, the amount borrowed, and the monthly payment. Assuming a fixed rate note, the payment never changes. Here is an example of a $250,000 loan.

It is important to note that your payment in month one is $1,158 and your monthly payment thirty years later is the same amount…$1,158.

Each payment has two parts

What does change every month is what is inside each payment. Every loan payment has two parts. One is a payment that reduces the amount of money you owe, called principal. The other part of the payment is for the bank, called interest expense. Now look at the component parts of the first payment and then the last payment:

So, while your monthly payment never changes, the amount used to reduce the loan each month varies DRAMATICALLY. Remember your total cost of borrowing $250,000 includes more than $166,000 in interest!

Use the knowledge to your advantage

Here’s how you can use this information to your advantage.

For new loans

- Only sign up for loans that allow you to make pre-payments without penalty.

- When borrowing money, keep some of your cash in reserve. Try to reserve a minimum of 10 to 20 percent of the amount borrowed. So, in this example, try to reserve $25,000 to $50,000 in cash.

- Immediately after getting the loan, consider using the excess cash as a pre-payment on the note. By doing this you can dramatically reduce the interest expense over the life of the note, all while keeping your payment constant. Even though your monthly payment may be a little higher, the extra payment amount will pay back the loan more quickly.

For existing loans

- Create and look at your loan’s amortization table. This table shows how much of each payment is used to pay down the loan balance and how much goes to your lender as interest. In the above example, 67 percent of the first payment is for the bank, while only ½ of 1 percent of the last payment is for the bank.

- Pay more to you than the bank. Aggressively prepay down any loan until more of each payment goes to you versus the bank. This is the crossover point of your loan.

- Find your sweet spot. After hitting the crossover point, next consider the efficiency of each prepayment and determine when you consider your prepayment ineffective. No one would consider prepaying that last payment when interest expense is only $4.00. But if more than 25% of the payment goes to interest? Keep making prepayments.

Final thought

When you make a prepayment on a loan, reduce the loan balance by your prepayment, then look at the amortization table. See how many payments are eliminated with your prepayment and add up all the interest you save. You will be amazed by the result.

According to the Federal Reserve, U.S. student loan debt is now $1.5 trillion with more than 44 million borrowers. Only mortgage debt currently has bigger numbers among types of consumer debt. Even worse, more than 10 percent of these loans are past due. Here are some tactics to help make student debt easier to manage:

According to the Federal Reserve, U.S. student loan debt is now $1.5 trillion with more than 44 million borrowers. Only mortgage debt currently has bigger numbers among types of consumer debt. Even worse, more than 10 percent of these loans are past due. Here are some tactics to help make student debt easier to manage:

- Know the loan terms. Not all student debt is created equal. Understanding the terms of all your student loans is important. With this knowledge, select the correct loan option and know which loan to pay first. Things you should know about each loan include:

- The interest rate

- The term of the loan

- Amount of any upfront fees

- Pre-payment penalties (if any)

- When interest and payments start

- Payment amounts

- Payment flexibility

- How the interest is calculated

Suggestion: Create a spreadsheet with a student loan in each column. Then note the terms under each loan. This will create a strong visual of your situation and show you which loans are most important.

- Avoid accruing interest. Some student loans accrue interest while you are in school. With the compounding of this interest, your student loan amount continues to grow with each passing year before repayment begins. Banks love this — you should not.

Suggestion: Figure out how to make some or all of the interest payments while in school. This will not only lock the amount you owe, it will reduce the amount of overall loan payments.

- Pay a little extra in the early days. The math of loans benefits banks in the early years of the repayment period. This is because the vast majority of interest is paid in the first years of repayment. By the time you get to the last year of repayment, payments are primarily the principal balance and interest is nil.

Suggestion: Pay extra every month as soon as payments start. While this seems impossible as you enter the workforce, even $25 extra per month can dramatically reduce the amount of total payments you make over the life of your loan. For example, a $25 extra payment on a 10-year $50,000 student loan with 5 percent interest would cut six months off the loan, save $834 in interest, AND save $3,180 in future loan payments!

- Make small cuts elsewhere. Having a hard time finding a few extra dollars to make extra payments? Consider observing and then changing your spending habits.

Suggestion: Purchase one less latte a week. Drop one monthly service from a bill. Eat in more often. Then use these savings as a bonus payment on your student loan principal.

While student debt is often an unavoidable outcome of getting a college education, it can be minimized if actively managed. Small changes can yield results if planned for in advance.

With summertime activities in full swing, tax planning is probably not on the top of your to-do list. But putting it off creates a problem at the end of the year when there’s little time for changes to take effect. If you take the time to plan now, you’ll have six months for your actions to make a difference on your 2019 tax return. Here are some ideas to get you started.

Know your upcoming tax breaks. Pull out your 2018 tax return and take a look at your income, deductions and credits. Ask yourself whether all these breaks will be available again this year. For example:

- Are you expecting more income that will bump you to a higher tax rate?

- Will increased income cause a benefit to phase out?

- Will any of your children outgrow a tax credit?

Any changes to your tax situation will make planning now much more important.

Make tax-wise investment decisions. Have some loser stocks you were hoping would rebound? If the prospects for revival aren’t great, and you’ve owned them for less than one year (short-term), selling them now before they change to long-term stocks can offset up to $3,000 in ordinary income this year. Conversely, appreciated stocks held longer than one year may be candidates for potential charitable contributions or possible choices to optimize your taxes with proper planning.

Make tax-wise investment decisions. Have some loser stocks you were hoping would rebound? If the prospects for revival aren’t great, and you’ve owned them for less than one year (short-term), selling them now before they change to long-term stocks can offset up to $3,000 in ordinary income this year. Conversely, appreciated stocks held longer than one year may be candidates for potential charitable contributions or possible choices to optimize your taxes with proper planning.

Adjust your retirement plan contributions. Are you still making contributions based on last year’s limits? Maximum savings amounts increase for retirement plans in 2019. You can contribute up to $13,000 to a SIMPLE IRA, up to $19,000 to a 401(k) and up to $6,000 to a traditional or Roth IRA. Remember to add catch-up contributions if you’ll be 50 by the end of December!

Plan for upcoming college expenses. With the school year around the corner, understanding the various tax breaks for college expenses before you start doling out your cash for post-secondary education will ensure the maximum tax savings. There are two tax credits available, the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit. Plus there are tax benefits for student loan interest and Coverdell Savings accounts. Add 529 college savings plans, and you quickly realize an educational tax strategy is best established early in the year.

Add some business to your summer vacation. If you own a business, you might be able to deduct some of your travel expenses as a business expense. To qualify, the primary reason for your trip must be business-related. Keep detailed records of where and when you work, plus get receipts for all ordinary and necessary expenses!

Great tax planning is a year-round process, but it’s especially effective at midyear. Making time now not only helps reduce your taxes, it puts you in control of your entire financial situation.