5 Surprising Taxable Items

Wages and self-employment earnings are taxable, but what about the random cash or financial benefits you receive through other means? If something of value changes hands, you can bet the IRS considers a way to tax it. Here are five taxable items that might surprise you:

- Scholarships and financial aid. Applying for scholarships and financial aid are top priorities for parents of college-bound children. But be careful — if any part of the award your child receives goes toward anything except tuition, it might be taxable. This could include room, board, books, travel expenses or aid received in exchange for work (e.g., tutoring or research).

Tip: When receiving an award, review the details to determine if any part of it is taxable. Don’t forget to review state rules as well. While most scholarships and aid are tax-free, no one needs a tax surprise. - Gambling winnings. Hooray! You hit the trifecta for the Kentucky Derby. But guess what? Technically, all gambling winnings are taxable, including casino games, lottery tickets and sports betting. Thankfully, the IRS allows you to deduct your gambling losses (to the extent of winnings) as an itemized deduction, so keep good records.

Tip: Know when the gambling establishment is required to report your winnings. It varies by type of betting. For instance, the filing threshold for winnings from fantasy sports betting and horse racing is $600, while slot machines and bingo are typically $1,200. But beware, the gambling facility and state requirements may lower the limit.

- Unemployment compensation. Congress gave taxpayers a one-year reprieve in 2021 from paying taxes on 2020 unemployment income. Unfortunately, this tax break did not get extended for the 2021 tax year. So, unless Congress passes a law extending the tax break, unemployment will once again be taxable starting with your 2021 tax return.

Tip: If you are collecting unemployment, you can either have taxes withheld and receive the net amount or make estimated payments to cover the tax liability.

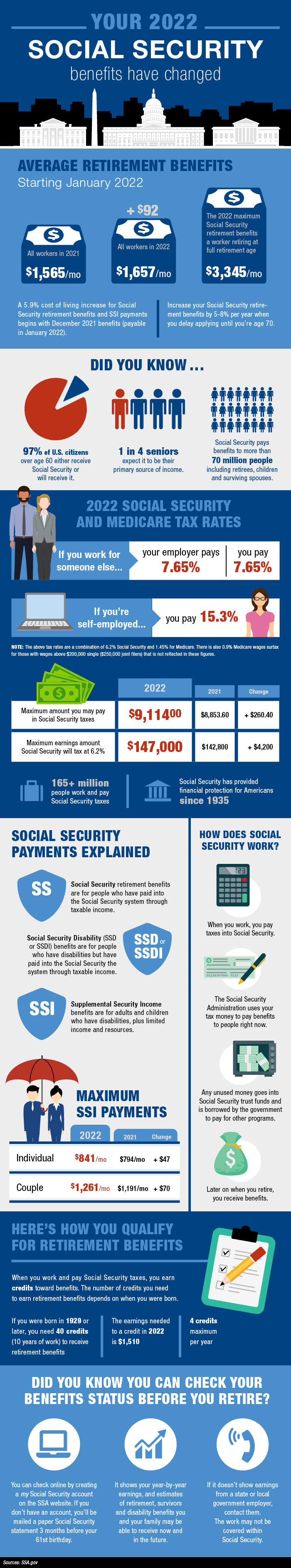

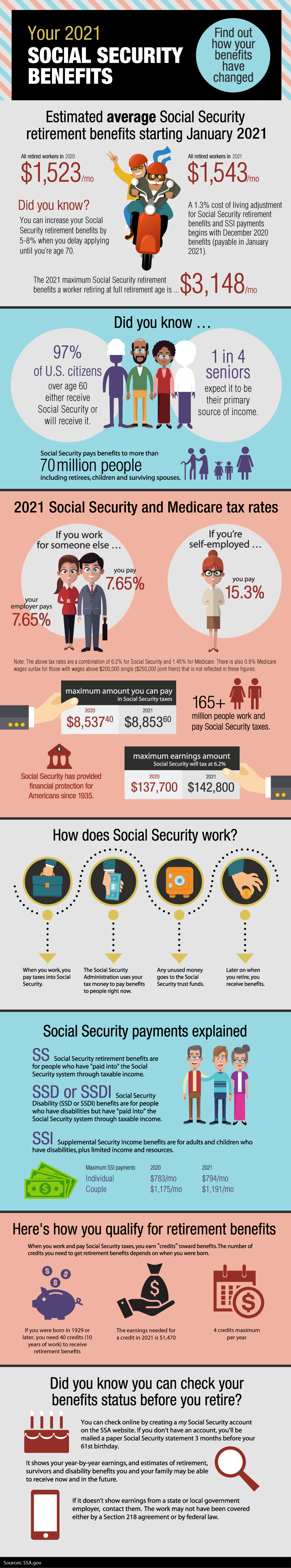

- Social Security benefits. If your income is high enough after you retire, you could owe income taxes on up to 85% of Social Security benefits you receive.

Tip: Consider if delaying when you start collecting Social Security benefits makes sense for you. Waiting to start benefits means you’ll avoid paying taxes on your Social Security benefits for now, plus you’ll get a bigger payment each month you delay until you reach age 70.

- Alimony. Prior to 2019, alimony was generally deductible by the person making alimony payments, with the recipient generally required to report alimony payments received as taxable income. Now the situation is flipped: For divorce and separation agreements executed since December 31, 2018, alimony is no longer deductible by the payer and alimony payments received are not reported as income.

Tip: Alimony payments no longer need to be made in cash. Consider having the low-income earning spouse take more retirement assets such as 401(k)s and IRAs in exchange for reduced alimony payments. This arrangement would allow the higher-earning spouse to make alimony payments by transferring retirement funds without paying income taxes on it.

When in doubt, it’s a good idea to keep accurate records so your tax liability can be correctly calculated and you don’t get stuck paying more than what’s required.

Is a worker an independent contractor or an employee? This seemingly simple question is often the contentious subject of IRS audits. As an employer, getting this wrong could cost you plenty in the way of Social Security, Medicare, and other employment-related taxes. Here is what you need to know.

Is a worker an independent contractor or an employee? This seemingly simple question is often the contentious subject of IRS audits. As an employer, getting this wrong could cost you plenty in the way of Social Security, Medicare, and other employment-related taxes. Here is what you need to know.

The basics

As the worker. If you are a contractor and not considered an employee, you must:

- Pay self-employment taxes (Social Security and Medicare-related taxes)

- Make estimated federal and state tax payments

- Handle your own benefits, insurance and bookkeeping

As the employer. You must ensure your employee versus independent contractor determination is correct. Getting this wrong in the eyes of the IRS can lead to:

- Payment and penalties related to Social Security and Medicare taxes

- Payment of possible overtime including penalties for a contractor reclassified as an employee

- Legal obligation to pay for benefits

Things to consider

When the IRS re-characterizes an independent contractor as an employee, they look at the business relationship between the employer and the worker. The IRS focuses on the degree of control exercised by the employer over the work done and they assess the worker’s independence. Here are some guidelines:

- The more the employer has the right to control the work (when, how and where the work is done), the more likely the worker is an employee

- The more the financial relationship is controlled by the employer, the more likely the relationship will be seen as an employee and not an independent contractor To clarify this, an independent contractor should have a contract, have multiple customers, invoice the company for work done, and handle financial matters in a professional manner

- The more businesslike the arrangement, the more likely you have an independent contractor relationship

While there are no hard-set rules, the more reasonable your basis for classification and the more consistently it is applied, the more likely an independent contractor classification will not be challenged.

Two-thirds of the Baby Boomer generation are now working or plan to work beyond age 65, according to a recent Transamerica Institute study. Some report they need to work because their savings declined during the financial crisis, while others say they choose to work because of the greater sense of purpose and engagement that working provides. Whatever your reason for continuing to work into your golden years, below is Part 1 of a 2-part series with tips to make sure you get the greatest benefit from your efforts.

- Consider delaying Social Security. You can start receiving Social Security retirement benefits as early as age 62, but if you continue to work it may make sense to delay taking it until as late as age 70. This is because your Social Security benefit may be reduced or be subject to income tax due to your other income. In addition, your Social Security monthly benefit increases when you delay starting the retirement benefit. These increases in monthly benefits stop when you reach age 70.

- Don’t get bracket-bumped. Keep in mind that you may have multiple income streams during retirement that can bump you into a higher tax bracket and make other income taxable if you’re not careful. For instance, Social Security benefits are only tax-free if you have less than a certain amount of adjusted gross income ($25,000 for individuals and $32,000 for married filing jointly in 2017), otherwise as much as 85 percent of your benefits are taxable. Required distributions from pensions and retirement accounts can also add to your taxable income. Be aware of how close you are to the next tax bracket and adjust your plans accordingly.

- Be smart about health care. When you reach age 65, you’ll have the option of making Medicare your primary health insurance. If you continue to work, you may be able to stay on your employer’s health care plan, switch to Medicare, or adopt a two-plan hybrid option that includes Medicare and a supplemental employer care plan. Look over each option closely. You may find that you’re giving up important coverage if you switch to Medicare prematurely while you still have the option of sticking with your employer plan.

As school winds down, a number of students will hit the job market for summer employment. When this is a first job, it is often one of the first times you experience the world of taxes. Please use this information to help make the move to the workforce a little more understandable.

Form I-9 – When you get the job, your new employer will have you fill out tax form I-9, Employment Eligibility Information. This is a legal requirement to show you have the right to work and it confirms your tax information. You will be asked to provide proof of identity, including showing your Social Security card.

Form W-4 – You will also be asked to fill out a tax withholding form. This form gives employers instructions on how much they should withhold from your paycheck to send in to taxing authorities like the IRS. By filling out the form correctly, enough will be withheld from your pay to ensure you do not owe too much in tax when you file your tax return.

Other Taxes – You will notice your check amount is also reduced for your contributions to Social Security and Medicare. Your paycheck will be reduced by 6.2% for Social Security and 1.45% for Medicare payments. You are not in this alone. Your employer matches your payments and sends both of them to the government.

Self-employed? – If you start up your own summer business like mowing lawns or providing nanny services you will have tax obligations similar to those as an employee. In addition to income taxes, you will need to file estimated tax statements to cover Social Security and Medicare taxes. These two taxes amount to 15.3% of your net income, so plan accordingly. But also remember to save receipts for your job related expenses. They can help reduce your taxable income.

Tips are taxed – If you receive any tips, these too are taxable. Most employers that have tip-earning employees will help you file the appropriate forms. If they do not, you will need to ask for help to ensure your taxes are paid on your tip income.

Review your pay – Remember to review your initial paycheck. There are often errors in setting up employee records. Should you find an error or need an explanation, feel free to ask your employer for help. Errors not caught early can become expensive surprises later on during the year.

When would you like to retire? Even if the answer is later versus sooner, most of us would like the freedom to decide. To do this, consider what it would take to create financial independence in retirement. Here are some ideas to help plan for an early retirement.

- Start early – Establish your desire to retire early as soon as possible. Have a discussion with your spouse and loved ones to ensure you have the same retirement date goal. With this stated goal, meeting savings targets and establishing spending priorities get much easier.

- Know what you want to do – Have you always wanted to visit national parks? Do you have a passion for art? If you have a dream that can be fulfilled in retirement, it makes any hardships to get there more tolerable. Once you set retirement goals, creating a plan to get there will have more meaning.

- Pay yourself first – People who retire early have higher savings rates than most of us. Consider saving in excess of 10% of your earnings. To do this might mean holding off on a big vacation once in a while or delaying a major home improvement or purchase. While a hardship, knowing the long-term dividend makes it worthwhile. The larger your savings become, the more flexible you are in acquiring assets that generate more wealth for you.

- No debt and credit cards paid in full – It’s hard to retire early if you are making large loan payments. Having a mindset to save money before you buy something versus taking out loans is the way to go for prospective early retirees. Why pay the credit card company interest when you could use that money during your non-working days?

- Financial independence mindset – Save enough to not have to worry about Social Security or other government programs to take care of you. Said another way, never over-spend your own resources as you will need to depend on yourself and not others for your financial independence.

- Use common sense when investing – Many investment alternatives may no longer make financial sense when compared to the income potential of the underlying asset or property. For example, if you own rental property, determine if the cash flows create a reasonable rate of return for the price you paid for the property. If you use common sense, more of your investments may help generate income in retirement.

- Other resources – Go through a retirement planning process with a qualified expert. This exercise can help you understand what your projected financial needs will be during your retirement years. Project your potential savings. Look into other sources of projected income from pension plans and retirement savings accounts. Create an estimate of possible Social Security benefits. Understand what other resources will be available to you during retirement.

While this list is not meant to be all-inclusive, it should help start the conversation toward your early retirement dream. Remember to ask for help to understand your situation and to develop your own personal plan.

The Social Security Administration is now doing a better job in sending out earnings reports by mailing paper statements to workers every five years beginning at age 25. The reports are also available online at https://www.ssa.gov. These reports recap historic earnings and contain an estimate of potential benefits.

When you receive your report, spend a few minutes reviewing the statement. Here are some suggestions on how to do this.

- Review your earnings history – Towards the back of the report is a recap of your earnings record. This should accurately reflect reported earnings on your tax return. This number is a summary of all your earnings subject to Social Security as reported by your employer on your W-2 forms. But if you are self-employed or have many employers, you must make sure that the income properly reflects what you earned.

Action: Employees: Pull out your W-2s and make sure the totals match. Self-employed: Pull out your tax return and confirm totals match. Review history: Review historic figures as well. Your Social Security benefits use your full work history to calculate future benefits.

- Review your potential retirement benefits – The Social Security statement will provide you with an estimate of your benefit amount using current dollars and current work history. The value of your benefit will show three benefit amounts. One for the minimum retirement age of 62, one for the maximum amount if you start your benefits at age 70, and one for your full retirement age between the ages of 65 and 67.

Action: Consider these monthly benefit amounts in terms of your retirement plan to help create a realistic picture of what you will have available to you when you retire.

- Note other benefits – Remember, Social Security is not just about your retirement benefits. There are also estimates presented for disability and surviving family benefits. Please review these estimates to understand the potential benefits these programs may provide.

- Remember current benefits are just estimates – The benefits noted on this statement are estimates. Actual benefit amounts rise with inflation, change with tax laws, and adjust with your future earnings. Your benefit statement will show you the assumptions used in creating your estimated amounts.

Action: Review the assumptions used by the Social Security Administration. Pay special attention to the future earnings used by them to create the benefit amounts. If you do not think they are accurate, you may need to create revised estimates with more accurate assumptions.

Should you find any errors in the statement correct them immediately. The last page of the statement provides a means for doing this.

To most people “ghosting” is the act of breaking up with a boyfriend or girlfriend by breaking off all contact. Now there is a new ghosting phenomena; stealing the identity of a recently deceased loved one.

Ghosting protocol

Would-be identity thieves scour obituaries to find as much personal information as possible about the recently departed. The more information available about the loved one the better. With this information, thieves can make purchases, open credit cards, create false IDs, and file fraudulent tax returns. This activity can go unchecked until all the proper paper work is filed on the deceased. It can be a nightmare to clear up the mess, all while dealing with the grief associated with losing someone close to you.

What can be done – There are actions available to reduce the risk of this happening:

Less is more – When creating an obituary, avoid being too specific on information that could be used by ID thieves. Print a birth year, but not the day and month. Omit the maiden name and the address of the deceased.

Home unattended – During the funeral and visitation, consider having a friend or relative stay at the home of the deceased. Thieves are known to target homes for burglary during the service.

Notify the bank – Remove the deceased’s name from joint bank and credit card accounts. Immediately close solo credit card accounts. Closely monitor any activity in the accounts.

Be proactive – Knowing it can take Social Security months to inform all interested parties of the death, proactively contact anyone who may need to know of the death. Report the death to Social Security. File a final tax return. Cancel the driver’s license to avoid duplicates being ordered.

Work with credit agencies – Contact the major credit agencies and follow their instructions to place a death notice in their records. This should help stop a thief from opening new accounts. Obtain a free credit report from one of the credit agencies and look for suspicious activity. Wait a few months and review a free credit report from a second agency. Continue to monitor activity on the deceased’s credit reports.

Fortunately, as long as your name is not on the accounts, family members are rarely liable for any illegal activity. But cleaning up the mess can be a real hassle.

Are you one of those who have carefully planned ahead for your retirement – setting up tax-advantaged savings accounts and researching the best place to live? You might be surprised to learn about the many tax issues that apply to retirees which should be taken into consideration when planning your retirement.

For example, you could face taxes on distributions from retirement or investment accounts, required minimum distributions from some retirement accounts and potential taxes on Social Security payments. You also need to consider state and local income, sales or property taxes – as well as state taxes on retirement benefits and estates.

The good news is, there’s still time to anticipate and reduce some of those complications. Take the time now to properly plan your tax burden so your retirement is secure.