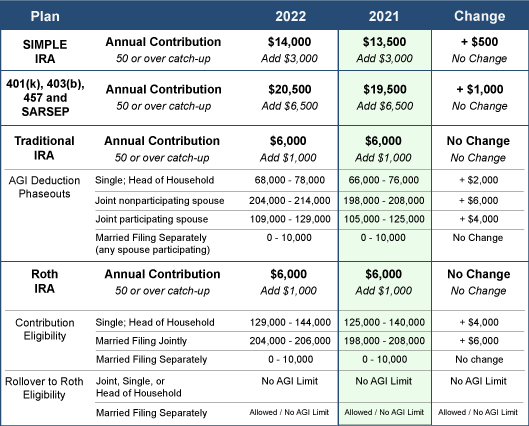

There’s good news for your retirement accounts in 2022! The IRS recently announced that you can contribute more pre-tax money to several retirement plans in 2022. Take a look at the following contribution limits for several of the more popular retirement plans:

What You Can Do

- Look for your retirement savings plan from the table and note the annual savings limit of the plan. If you are 50 years or older, add the catch-up amount to your potential savings total.

- Make adjustments to your employer provided retirement savings plan as soon as possible in 2022 to adjust your contribution amount.

- Double check to ensure you are taking full advantage of any employee matching contributions into your account.

- Use this time to review and re-balance your investment choices as appropriate for your situation.

- Set up new accounts for a spouse and/or dependents. Enable them to take advantage of the higher limits, too.

- Consider IRAs. Many employees maintain employer-provided plans without realizing they could also establish a traditional or Roth IRA. Use this time to review your situation and see if these additional accounts might benefit you or someone else in your family.

- Review contributions to other tax-advantaged plans, including flexible spending accounts (FSAs) and health savings accounts (HSAs).

Now is a great time to make 2022 a year to remember for retirement savings!

A checking account at one bank is the same as a checking account at another bank, right? Well, maybe not. In fact, according to the J.D. Power 2021 U.S. Retail Banking Satisfaction Study, now 41% of people do all their banking online. This is a pretty big shift from traditional banking.

A checking account at one bank is the same as a checking account at another bank, right? Well, maybe not. In fact, according to the J.D. Power 2021 U.S. Retail Banking Satisfaction Study, now 41% of people do all their banking online. This is a pretty big shift from traditional banking.

After reviewing the financial strength of a bank, here are several other things to consider as you decide what’s really most important to you in selecting a bank.

The online bank versus nearby location

While having a nearby brick and mortar location is important to many banking consumers, you might find better interest rates with an online-only bank because they don’t spend lots of money to maintain physical branches. As people switch to taking care of all their basic banking transactions online, one of the reasons to visit your local bank branch is to talk with a banker. If you believe you’d benefit from such discussion, make sure the online bank you’re considering will facilitate that for you.

Understand key bank fees

In addition to charging loan fees when they lend out money, banks bring in much of their revenue by charging fees on your deposit accounts. You’ll have a much more positive experience by ensuring your bank’s fees don’t outweigh the benefits of the account you’re considering. Here are three key fees to understand:

- Monthly maintenance fees. This is a monthly fee a bank charges on an account. Understand how yours works. Banks will waive these fees if your account is above a certain balance. Others waive the fees if you behave in a way they want you to behave. For instance, if you use a debit card versus writing a paper check. Others want you to make direct deposits. Still others want you to use their bill pay service. Understand this fee class and determine if you can abide by the terms your bank sets for them.

- Overdraft fees. These fees are charged to a checking account if you attempt to buy something but don’t have enough money in your account. There are a variety of ways to avoid overdraft fees, such as signing up for a protection program or linking your savings account to automatically pay the rest of the bill. Take the time to understand your bank’s options to avoid overdrafts and the cost associated with them.

- ATM fees. Some ATMs require you to pay money to use their machines, especially if the ATM you’re using isn’t in your bank’s network. Don’t overlook the opportunity to save money by ensuring that the bank you’re considering supplies ATMs in your area so you won’t have to pay a fee every time you need to use an ATM.

Other banking tools

Banks often provide tools to help you budget your daily and monthly expenses. Many offer free credit scores and credit monitoring. Others offer automatic transfers into a savings account. Still others offer the ability to open multiple savings accounts and label each account for different purposes.

Keep these tips in mind the next time you need to choose a new bank. With many different banks to choose from, a little research can ensure the bank you choose fits your financial needs and priorities.

Tax and financial planning is a year-round proposition. In fact, you can benefit personally from a continuous, 12-month rolling forecast, much like a business does.

What is a rolling forecast?

Rolling forecasts let you continuously plan with a constant number of periods 12 months into the future. For example, on January 1, you would plan what your financial picture looks like each month through January 1 of the following year. When February 1 rolls around, you would then drop the beginning month and add a forecast month at the end of the 12-month period. In this case, you add February of the next year into your 12-month forecast.

The month you add at the end of the 12 months uses the finished month as a starting point. You then make adjustments based on what you think might happen one year from now. For example, if you know you are going to get a raise at the end of the year, your next-year February forecast would reflect this change.

The month you add at the end of the 12 months uses the finished month as a starting point. You then make adjustments based on what you think might happen one year from now. For example, if you know you are going to get a raise at the end of the year, your next-year February forecast would reflect this change.

How to take advantage of a rolling forecast

By doing tax and financial planning in rolling 12-month increments, you may find yourself in position to cash in on tax- and money-saving opportunities within the next 12 months. Here are several strategies to consider:

- Plan your personal budget. Will you need to put a new roof on your house? How about getting a new vehicle? Do you need to start saving for your kids’ college education? A rolling 12-month forecast can help you plan for these expenses throughout the year.

- Plan your healthcare expenses. If you have a flexible spending account (FSA) for healthcare or dependent care expenses, forecast the amount you should contribute for the calendar year. Although unused FSA amounts are normally forfeited at year-end, your employer may permit a 12-month grace period (up from 2½ months) for 2021. This means that you could potentially roll over your entire unused FSA balance from 2021 to 2022. Your forecast can help you see the impact of this change.

- Plan your contributions to a Health Savings Account (HSA). When an HSA is paired with a high-deductible health insurance plan, you can take distributions to pay qualified healthcare expenses without owing any tax on the payouts. For 2021, the contribution limit is $3,600 for an individual and $7,200 for family coverage. In this case, you can forecast an increase in contributions and double-check to ensure you have enough money on hand to pay future bills.

- Plan your estimated tax payments. This is often significant for self-employed individuals and retirees with investment earnings. The quarterly due dates for paying federal and state tax liabilities are April 15, June 15, September 15, and January 15 of the following year (or the next business day if the deadline falls on a holiday or weekend). So, if your personal income is seeing a recovery from the pandemic, your rolling forecast will show this and allow you to plan for the estimated tax payments.

- Plan your retirement contributions. If you participate in your company’s 401(k) plan, you can defer up to $19,500 to your account in 2021 ($26,000 if you’re 50 or over). Contributions and earnings compound tax-deferred. As the year winds down, you might boost your deferral to save even more for retirement.

While initially setting up a rolling 12-month forecast can be a bit of a pain, once established, it is pretty easy to keep up-to-date as you are simply rolling forward last month into the future. A well-planned system can often be the first sign of future challenges or potential windfalls!

New Year’s resolutions get a bad rap — and for good reason. They are wildly unsuccessful. Millions of people have well-intentioned aspirations for the New Year, but only about one in 10 actually accomplish their goal, according to the Statistic Brain Research Center.

New Year’s resolutions get a bad rap — and for good reason. They are wildly unsuccessful. Millions of people have well-intentioned aspirations for the New Year, but only about one in 10 actually accomplish their goal, according to the Statistic Brain Research Center.

If you dig a little deeper into the reasons why they fail, you find it’s usually not the resolution itself, it’s in the execution. Here are four popular New Year’s resolutions and how to avoid messing them up:

- Resolution #1: Becoming healthier. The most popular resolution can take on many forms — losing weight, getting in better shape, eating healthier, and so on. This resolution usually fails because to be successful, it takes a major lifestyle change. You’re fighting against months or maybe years of poor behaviors, so expecting wholesale changes right out of the gate is not reasonable.

Make it fail-proof: Start with smaller, simpler goals like not eating after 8 p.m., or exercising for 20 minutes a day for three times a week. Hitting manageable goals will build momentum and create good habits. - Resolution #2: Spending less money. Depending on how much you spent on Christmas, this one might take care of itself for a few weeks. But if you don’t have a spending plan or budget, old spending habits will re-emerge.

Make it fail-proof: Take some time at the beginning of the year to jot down some long-term spending and savings goals and then work backwards to figure out how those goals will affect your weekly purchases. As the year goes on, continue to track your progress and evaluate your purchases. - Resolution #3: Getting more organized. Going from being disorganized to organized is not a quick fix. To make the switch, it takes an evaluation of your entire environment. Most people don’t have the time for such an extensive process so they buy some bins, stuff them full and call it good. That’s not going to work and it’ll cost you money.

Make it fail-proof: Instead, start small. Pick one room in your house or one aspect of your life to focus on, like health care bills or your tax documents. Once you get some traction, you can apply the methods you learned to other things. Incremental improvement is the best long-term approach. - Resolution #4: Spending less time on electronics. If this is a resolution that’s important to you, odds are you’ve had some trouble keeping electronic usage under control. With so many games, social media and streaming options at our fingertips, our brains are now conditioned to be engaged electronically at all times.

Make it fail-proof: One way to start to break this habit is to change the accessibility you have to your devices. Remove apps from your phone and keep your devices out of reach when you don’t need them. Another way to curb electronic usage is to form a different habit, such as reading.

Resolutions, whether at New Year’s or any other time, are a good thing. To be successful, more planning and attention are required than most people think. And if you slip up, don’t quit! Learn from your mistakes and keeping going.

With summertime activities in full swing, tax planning is probably not on the top of your to-do list. But putting it off creates a problem at the end of the year when there’s little time for changes to take effect. If you take the time to plan now, you’ll have six months for your actions to make a difference on your 2019 tax return. Here are some ideas to get you started.

Know your upcoming tax breaks. Pull out your 2018 tax return and take a look at your income, deductions and credits. Ask yourself whether all these breaks will be available again this year. For example:

- Are you expecting more income that will bump you to a higher tax rate?

- Will increased income cause a benefit to phase out?

- Will any of your children outgrow a tax credit?

Any changes to your tax situation will make planning now much more important.

Make tax-wise investment decisions. Have some loser stocks you were hoping would rebound? If the prospects for revival aren’t great, and you’ve owned them for less than one year (short-term), selling them now before they change to long-term stocks can offset up to $3,000 in ordinary income this year. Conversely, appreciated stocks held longer than one year may be candidates for potential charitable contributions or possible choices to optimize your taxes with proper planning.

Make tax-wise investment decisions. Have some loser stocks you were hoping would rebound? If the prospects for revival aren’t great, and you’ve owned them for less than one year (short-term), selling them now before they change to long-term stocks can offset up to $3,000 in ordinary income this year. Conversely, appreciated stocks held longer than one year may be candidates for potential charitable contributions or possible choices to optimize your taxes with proper planning.

Adjust your retirement plan contributions. Are you still making contributions based on last year’s limits? Maximum savings amounts increase for retirement plans in 2019. You can contribute up to $13,000 to a SIMPLE IRA, up to $19,000 to a 401(k) and up to $6,000 to a traditional or Roth IRA. Remember to add catch-up contributions if you’ll be 50 by the end of December!

Plan for upcoming college expenses. With the school year around the corner, understanding the various tax breaks for college expenses before you start doling out your cash for post-secondary education will ensure the maximum tax savings. There are two tax credits available, the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit. Plus there are tax benefits for student loan interest and Coverdell Savings accounts. Add 529 college savings plans, and you quickly realize an educational tax strategy is best established early in the year.

Add some business to your summer vacation. If you own a business, you might be able to deduct some of your travel expenses as a business expense. To qualify, the primary reason for your trip must be business-related. Keep detailed records of where and when you work, plus get receipts for all ordinary and necessary expenses!

Great tax planning is a year-round process, but it’s especially effective at midyear. Making time now not only helps reduce your taxes, it puts you in control of your entire financial situation.

Ah, summer. The weather is warm, kids are out of school, and it’s time to think about tax saving opportunities! Here are five ways you can enjoy your normal summertime activities and save on taxes:

- Rent out your property tax-free. If you have a cabin, condo, or similar property, consider renting it out for two weeks. The rental income you receive on property rented for less than 15 days per year is not considered taxable income. In addition, you can still deduct your mortgage interest expense and property taxes in full as itemized deductions! Track the rental days closely — going over 14 days means all rent is taxable and rental income rules apply.

- Take a tax credit for summer childcare. For many working parents, the summer comes with the added challenge of finding care for their children. Thankfully, the Child and Dependent Care Credit can cover 20-35 percent of qualified childcare expenses for your children under the age of 13. Eligible types of care include day care, nanny fees and day camps (overnight camps and summer school do not qualify).

- Hire your kids. If you own a business, hire your kids. If you are a sole proprietor and your child is under age 18, you can pay them to work without withholding or paying Social Security and Medicare tax.

- Have a garage sale. In general, the money you make from a yard or garage sale is tax-free because you sell your goods for less than you originally paid for them. Once the sale is over, donate the remaining items to a qualified charity to get a potential charitable donation deduction. Just remember to keep a log of the items you donate and ask for a receipt.

- Start a Roth IRA for your children. Roth IRA contributions are limited to the amount of income your child earns, so earned income is key. This can include income from mowing lawns or selling lemonade. Start making contributions as soon as your child makes some money to take advantage of the tax-free earnings available in a Roth IRA.

Taking the time this summer to execute these tips can put extra money in your pocket right away and provide you tax-saving happiness in the future.

As the year draws to a close, there are several tax-saving ideas you should consider. Use this checklist to make sure you don’t miss an opportunity before the year is out.

As the year draws to a close, there are several tax-saving ideas you should consider. Use this checklist to make sure you don’t miss an opportunity before the year is out.

Retirement distributions and contributions. Make final contributions to your qualified retirement plan, and take any required minimum distributions from your retirement accounts. The penalty for not taking minimum distributions can be high.

Investment management. Rebalance your investment portfolio, and take any final investment gains and losses. Capital losses can be used to net against your capital gains. You can also take up to $3,000 of capital losses in excess of capital gains each year and use it to lower your taxable ordinary income.

Last-minute charitable giving. Make a late-year charitable donation. Even better, make the donation with appreciated stock you’ve owned more than a year. You often can make a larger donation and get a larger deduction without paying capital gains taxes.

Noncash donation opportunity. Gather up non-cash items for donation, document the items, and give those in good condition to your favorite charity. Make sure you get a receipt from the charity, and take a photo of the items donated.

Gifts to dependents and others. You may provide gifts to an individual of up to $14,000 per year in total. Remember that all gifts given (birthdays, holidays, etc.) count toward the annual total.

Organize records now. Start collecting and organizing your end-of-year tax records. Estimate your tax liability and make any required estimated tax payments.

Two-thirds of the Baby Boomer generation are now working or plan to work beyond age 65, according to a recent Transamerica Institute study. Some report they need to work because their savings declined during the financial crisis, while others say they choose to work because of the greater sense of purpose and engagement that working provides. Whatever your reason for continuing to work into your golden years, below is Part 2 of a 2-part series with tips to make sure you get the greatest benefit from your efforts.

4. Consider your expenses. If you’re reducing your working hours or taking a part-time job, you also have to consider the cost of your extra income stream. Calculate how much it costs to commute and park every day, as well as the expense of meals, clothing, dry cleaning and any other expenses. Now consider how much all those expenses amount to in pre-tax income. Be aware whether the benefits you get from working a little extra are worth the extra financial cost.

5. Time to downsize or relocate? Where and how you live can be an important factor determining the kind of work you can do while you’re retired. Downsizing to a smaller residence or moving to a new locale may be a good strategy to pursue a new kind of work and a different lifestyle.

6. Focus on your deeper purpose. Use your retirement as an opportunity to find work you enjoy and that adds value to your life. Choose a job that expresses your talents and interests, and that provides a place where your experiences are valued by others.

One of the most common reasons businesses fail is due to lack of understanding of cash flow. The same can be said about your household’s personal financial statement. So what is this cash flow concept, how does it apply to you, and what are some ways to improve yours? In Part 1 of this two-part article, we explained explain what cash flow is and how to determine your cash flow. In Part 2, we’ll give you some ways to improve your cash flow.

Identify your challenges. See if you have months where more cash is going out than is coming into your bank account. This is often when large bills are due. Try to balance these known high-expense months out over the year if at all possible. Common causes are:

- The holidays

- Property tax payments

- Car and homeowners insurance

- Annual income tax payments

- Vacations

Build a reserve. If you know there are challenging months, project how much additional cash you will need and begin to save for this reserve in positive cash months.

Cut back on annuities. See what monthly expense drivers are in your life. Can any of them be reduced? Can you live with fewer cell phone add-ons? How about cutting costs in your cable bill? Is it time for an insurance review?

Shop your current services. Some of your larger bills may create an opportunity for savings. This is especially true with homeowners and car insurance.

Don’t confuse savings with cash flow. Think of your savings as the accumulation of positive cash flows from prior months. A high savings balance can often mask a monthly cash flow problem where more is going out than is coming in over a period of time.

Create savings “expense” to add to cash flow. Consider adding a “bill to yourself” in your cash outflows. This money saved is a simple technique to create positive cash flow each month to build an emergency reserve.

Since you can’t get away from taxes, the best thing to do is be prepared for them. If you own a small business, taxes become a bit more complicated, but there are several ways to make sure tax time is less stressful. Here are tips 1 and 2 for small business owners.

- Think Taxes Year Around

Thinking about your taxes all year does not seem to be a way to avoid stress, but in reality, tax planning is a year-round activity when you run a small business. If you keep up with documentation and recording requirements throughout the year, you are more likely to arrive at tax time with the right paperwork ready to go.

It is also easier to take advantage of tax savings and deductions over the course of time instead of trying to put together a package of write-offs at the last minute.

- Keep accurate records all year

- Save all business related receipts, both paper and electronic, and log them for easy access

- Keep mileage logs and other expense records so they are accurate

You will find tax time much less stressful, and you will be set up to monitor changes from year to year.

- Keep Up with the Tax News

It may seem that the legislature does nothing, but laws do get passed every year. You need to keep an eye on happenings in the federal government that can impact your tax liability and business organization.

For example:

- The Affordable Care Act is still rolling out. As of 2015 it applied to businesses with 51 to 99 employees and carried stiff penalties for failing to provide health insurance to employees. Penalties also applied if you did not report the type of coverage you provided.

- Taxation of online sales is still winding its way through Congress. You need to monitor the situation, so you know if it becomes law and how it could affect you if you are an online seller if you gross more than $1 million annually.

- The Section 179 Property Deduction was extended but not made permanent. It allows business to deduct the full amount of eligible property as expenses in the year the business began using it. “Property” includes any property used in manufacturing, transporting, and producing goods, any facility used for business or research, or any buildings used to hold livestock or horticultural products.

Tax laws change all the time; keep up with the business news for ongoing legislation or last minute tax breaks.