Know the way loans work…and use it to your advantage!

Every banker knows that the majority of the money they make on a loan is made in the first few years of the loan. By understanding this fact, you can greatly reduce the amount you pay when buying your house, paying off your student loan, or buying a car. Here is what you need to know:

Every banker knows that the majority of the money they make on a loan is made in the first few years of the loan. By understanding this fact, you can greatly reduce the amount you pay when buying your house, paying off your student loan, or buying a car. Here is what you need to know:

Your payment never changes

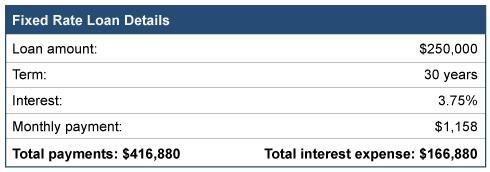

When you obtain a loan, the components of that loan are interest, the number of years to repay the loan, the amount borrowed, and the monthly payment. Assuming a fixed rate note, the payment never changes. Here is an example of a $250,000 loan.

It is important to note that your payment in month one is $1,158 and your monthly payment thirty years later is the same amount…$1,158.

Each payment has two parts

What does change every month is what is inside each payment. Every loan payment has two parts. One is a payment that reduces the amount of money you owe, called principal. The other part of the payment is for the bank, called interest expense. Now look at the component parts of the first payment and then the last payment:

So, while your monthly payment never changes, the amount used to reduce the loan each month varies DRAMATICALLY. Remember your total cost of borrowing $250,000 includes more than $166,000 in interest!

Use the knowledge to your advantage

Here’s how you can use this information to your advantage.

For new loans

- Only sign up for loans that allow you to make pre-payments without penalty.

- When borrowing money, keep some of your cash in reserve. Try to reserve a minimum of 10 to 20 percent of the amount borrowed. So, in this example, try to reserve $25,000 to $50,000 in cash.

- Immediately after getting the loan, consider using the excess cash as a pre-payment on the note. By doing this you can dramatically reduce the interest expense over the life of the note, all while keeping your payment constant. Even though your monthly payment may be a little higher, the extra payment amount will pay back the loan more quickly.

For existing loans

- Create and look at your loan’s amortization table. This table shows how much of each payment is used to pay down the loan balance and how much goes to your lender as interest. In the above example, 67 percent of the first payment is for the bank, while only ½ of 1 percent of the last payment is for the bank.

- Pay more to you than the bank. Aggressively prepay down any loan until more of each payment goes to you versus the bank. This is the crossover point of your loan.

- Find your sweet spot. After hitting the crossover point, next consider the efficiency of each prepayment and determine when you consider your prepayment ineffective. No one would consider prepaying that last payment when interest expense is only $4.00. But if more than 25% of the payment goes to interest? Keep making prepayments.

Final thought

When you make a prepayment on a loan, reduce the loan balance by your prepayment, then look at the amortization table. See how many payments are eliminated with your prepayment and add up all the interest you save. You will be amazed by the result.

One of the most common reasons businesses fail is due to lack of understanding of cash flow. The same can be said about your household’s personal financial statement. So what is this cash flow concept, how does it apply to you, and what are some ways to improve yours? In Part 1 of this two-part article, we explained explain what cash flow is and how to determine your cash flow. In Part 2, we’ll give you some ways to improve your cash flow.

Identify your challenges. See if you have months where more cash is going out than is coming into your bank account. This is often when large bills are due. Try to balance these known high-expense months out over the year if at all possible. Common causes are:

- The holidays

- Property tax payments

- Car and homeowners insurance

- Annual income tax payments

- Vacations

Build a reserve. If you know there are challenging months, project how much additional cash you will need and begin to save for this reserve in positive cash months.

Cut back on annuities. See what monthly expense drivers are in your life. Can any of them be reduced? Can you live with fewer cell phone add-ons? How about cutting costs in your cable bill? Is it time for an insurance review?

Shop your current services. Some of your larger bills may create an opportunity for savings. This is especially true with homeowners and car insurance.

Don’t confuse savings with cash flow. Think of your savings as the accumulation of positive cash flows from prior months. A high savings balance can often mask a monthly cash flow problem where more is going out than is coming in over a period of time.

Create savings “expense” to add to cash flow. Consider adding a “bill to yourself” in your cash outflows. This money saved is a simple technique to create positive cash flow each month to build an emergency reserve.