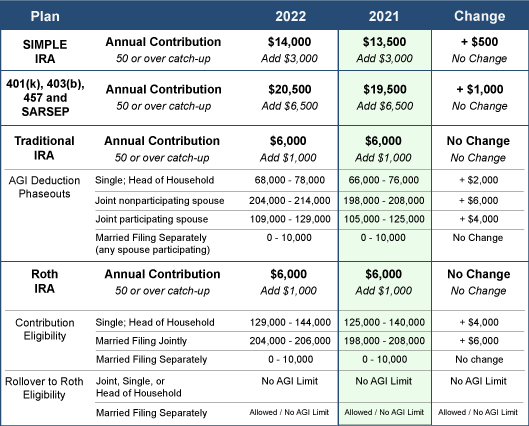

There’s good news for your retirement accounts in 2022! The IRS recently announced that you can contribute more pre-tax money to several retirement plans in 2022. Take a look at the following contribution limits for several of the more popular retirement plans:

What You Can Do

- Look for your retirement savings plan from the table and note the annual savings limit of the plan. If you are 50 years or older, add the catch-up amount to your potential savings total.

- Make adjustments to your employer provided retirement savings plan as soon as possible in 2022 to adjust your contribution amount.

- Double check to ensure you are taking full advantage of any employee matching contributions into your account.

- Use this time to review and re-balance your investment choices as appropriate for your situation.

- Set up new accounts for a spouse and/or dependents. Enable them to take advantage of the higher limits, too.

- Consider IRAs. Many employees maintain employer-provided plans without realizing they could also establish a traditional or Roth IRA. Use this time to review your situation and see if these additional accounts might benefit you or someone else in your family.

- Review contributions to other tax-advantaged plans, including flexible spending accounts (FSAs) and health savings accounts (HSAs).

Now is a great time to make 2022 a year to remember for retirement savings!

Most everyone knows you need to budget, balance and save. However, here’s a list of the ten steps to ensure you walk on stable financial ground.

- Set a budget and stick to it – Make financial goals and then create a budget that supports those goals. Account for expenses on a monthly basis and set budget limits for dinner out and other forms of entertainment.

- Pay off all debt (except a home mortgage) – Make debt payments a part of your budget until paid off.

- Set aside money for future expenses – Plan in advance for both short- and long-term big expenses and create a line item for them in your monthly budget.

- Save for emergencies – Set aside funds each month to build a reserve of three months living expenses (eventually build up to six) to guard against job loss or unexpected expenses. Having these savings automatically deducted you’re your income makes it easier.

- Take advantage of available plans – Company-sponsored 401(k) plans and/or other retirement plans, 529 savings plans and education funds will help you financially later. A little put away today can mean a lot is available tomorrow.

- Spend only what you have – Limit uses of credit vehicles like credit cards and high interest cash advances. Pay off credit cards by due dates each month.

- Manage your financial life – Regularly manage and monitor your accounts and statements, including balancing your debit/checking account and investment accounts.

- Keep an eye on your credit score – Making timely payments is one of the best ways to maintain good credit for future lending. If used responsibly, automatic payment systems like online banking can be beneficial.

- Set up Identity Theft Protection on your financial accounts – Regularly change your online and mobile passwords, and safeguard your financial statements.

- Openly communicate with your spouse about your family’s financial position – Make sure you both agree on short- and long-term goals. Teach your children the power of saving and budgeting to put them on the path to a successful financial future.