Know the way loans work…and use it to your advantage!

Every banker knows that the majority of the money they make on a loan is made in the first few years of the loan. By understanding this fact, you can greatly reduce the amount you pay when buying your house, paying off your student loan, or buying a car. Here is what you need to know:

Every banker knows that the majority of the money they make on a loan is made in the first few years of the loan. By understanding this fact, you can greatly reduce the amount you pay when buying your house, paying off your student loan, or buying a car. Here is what you need to know:

Your payment never changes

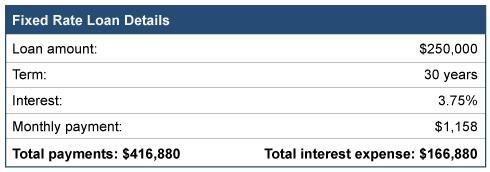

When you obtain a loan, the components of that loan are interest, the number of years to repay the loan, the amount borrowed, and the monthly payment. Assuming a fixed rate note, the payment never changes. Here is an example of a $250,000 loan.

It is important to note that your payment in month one is $1,158 and your monthly payment thirty years later is the same amount…$1,158.

Each payment has two parts

What does change every month is what is inside each payment. Every loan payment has two parts. One is a payment that reduces the amount of money you owe, called principal. The other part of the payment is for the bank, called interest expense. Now look at the component parts of the first payment and then the last payment:

So, while your monthly payment never changes, the amount used to reduce the loan each month varies DRAMATICALLY. Remember your total cost of borrowing $250,000 includes more than $166,000 in interest!

Use the knowledge to your advantage

Here’s how you can use this information to your advantage.

For new loans

- Only sign up for loans that allow you to make pre-payments without penalty.

- When borrowing money, keep some of your cash in reserve. Try to reserve a minimum of 10 to 20 percent of the amount borrowed. So, in this example, try to reserve $25,000 to $50,000 in cash.

- Immediately after getting the loan, consider using the excess cash as a pre-payment on the note. By doing this you can dramatically reduce the interest expense over the life of the note, all while keeping your payment constant. Even though your monthly payment may be a little higher, the extra payment amount will pay back the loan more quickly.

For existing loans

- Create and look at your loan’s amortization table. This table shows how much of each payment is used to pay down the loan balance and how much goes to your lender as interest. In the above example, 67 percent of the first payment is for the bank, while only ½ of 1 percent of the last payment is for the bank.

- Pay more to you than the bank. Aggressively prepay down any loan until more of each payment goes to you versus the bank. This is the crossover point of your loan.

- Find your sweet spot. After hitting the crossover point, next consider the efficiency of each prepayment and determine when you consider your prepayment ineffective. No one would consider prepaying that last payment when interest expense is only $4.00. But if more than 25% of the payment goes to interest? Keep making prepayments.

Final thought

When you make a prepayment on a loan, reduce the loan balance by your prepayment, then look at the amortization table. See how many payments are eliminated with your prepayment and add up all the interest you save. You will be amazed by the result.

With home sales booming throughout much of the country, you may decide that now’s the right time to put your abode on the market. If you do put your primary residence up for sale, try to steer clear of the following mistakes.

With home sales booming throughout much of the country, you may decide that now’s the right time to put your abode on the market. If you do put your primary residence up for sale, try to steer clear of the following mistakes.

- Not qualifying for the home sale exclusion. If you’ve owned and used your home as your principal residence at least two out of the last five years, you can exclude from your taxable income the first $250,000 of gain if you’re single and $500,000 if you’re married.

What you can do: Consider a delay of selling your home until you meet the 2-out-of-5-year threshold. If you can’t qualify for a full exclusion, you may qualify for a partial exclusion if your sale results from an employment change, a need for medical care or other IRS-approved circumstances.

- Forgetting to deduct points. If you have points from your current mortgage that you haven’t deducted on a previous tax return, include the balance of these points on your next tax return. Too many taxpayers forget to do this and lose thousands in deductions.

What you can do: Review your loan documents before selling your property. Identify all costs, including points, that are included in the loan. Save the document with your tax records to ensure the deduction is not forgotten.

- Not double-checking your settlement statement. Closely review the closing statement. It is easy to assume all the numbers are correct and the math is done right. Often this is not the case! And a mistake here could be costly.

What you can do: Review the closing document multiple times. Have your Realtor and closing agent explain items you don’t understand. Pay special attention to property taxes. The property tax bill will be allocated between the seller and the buyer. Only pay the share of the bill that covers the time period when you’re the owner.

Selling a home is full of tax implications. Since selling a home is not an everyday occurrence, it is easy to make a mistake. So, if you need help with these or any other tax questions surrounding the sale of your house, contact your financial advisor…before you sell!

Knowing your net worth and understanding how it is changing over time is one of the most important financial concepts that everyone needs to understand. This number is used by banks, mortgage companies, insurance companies and you! Your net worth impacts your credit score, which in turn impacts your interest rates and things as mundane as the amount you pay for auto insurance.

A simple definition

- Net worth is the result of taking all the things you own (assets) minus what you owe others (debts and liabilities).

- Assets include cash, bank account balances, investments, your home, vehicles or anything else that you could sell today for cash. Assets also include any businesses or business interests you own.

- Liabilities are what you owe others, such as a mortgage or car loan, and any other debt, like credit card or student loan debt.

Your net worth changes over time, reflecting how you spend your money. For example, if you have tons of bills and spend more than you bring in, your bank account balances will be lower. If you spend a lot on your credit cards, your debt will go up. The net effect is a lower net worth.

Your net worth changes over time, reflecting how you spend your money. For example, if you have tons of bills and spend more than you bring in, your bank account balances will be lower. If you spend a lot on your credit cards, your debt will go up. The net effect is a lower net worth.

Everyone has a net worth

Yes, everyone. Even a 6-year-old with money in their piggy bank has a net worth. If your child is saving up for a bike, they will convert one asset (cash) into another asset (their new bike)!

Calculating your net worth

- Step one. Reconcile your bank accounts and loans. Try doing this every month, as these are the easiest parts of your net worth to track and calculate.

- Step two. Calculate the value of all your remaining assets. For some of your assets, such as stocks, you can go online and find the current value of the stocks you own. For other assets, you’ll have to estimate what you could sell that asset for today.

- Step three. Add up all your asset values, then subtract all your debts. What you’re left with is your net worth (and yes, your number could be negative)!

Why you should know your net worth

Knowing your net worth contributes to the big picture of your financial circumstances. Here’s why it’s beneficial to know your net worth:

- You want to apply for student loans. You’ll likely need to submit an application that details all your cash and other assets when applying for student loans. If your net worth is high enough, you may have to foot some of the tuition bill yourself.

- You want to get insurance. Some types of insurance use your credit score as part of the calculation for determining your premium payments. Knowing if you have a high net worth may help in obtaining a favorable premium amount.

- You want to diversify your investments. Certain investments are available only to individuals who have a high enough net worth.

- You want to buy a home. Banks want to see that you have plenty of cash when compared to your debts. If you have too much debt, you may need to either pay down the debt or increase your down payment.

Knowing your net worth and how to calculate it can help you achieve some of your financial goals. Please call if you’d like help calculating and understanding your net worth.

If you or your business received funds from the Paycheck Protection Program (PPP), the recently passed Emergency Coronavirus Relief Act of 2020 will help to dramatically cut your tax bill. Here’s what you need to know.

Background

The PPP program was created by the CARES Act in March 2020 to help businesses which were adversely affected by the COVID-19 pandemic. Qualified businesses could apply for and receive loans of up to $10 million. Loan proceeds could be used to pay for certain expenses incurred by a business, including salaries and wages, other employee benefits, rent and utilities.

The PPP program was created by the CARES Act in March 2020 to help businesses which were adversely affected by the COVID-19 pandemic. Qualified businesses could apply for and receive loans of up to $10 million. Loan proceeds could be used to pay for certain expenses incurred by a business, including salaries and wages, other employee benefits, rent and utilities.

If the business used at least 60% of loan proceeds towards payroll expenses, the entire amount of the loan would be forgiven.

The Dilemma

While the CARES Act spelled out that a business’s forgiven PPP loan would not be considered taxable income, the legislation was silent about how to treat expenses paid for using PPP loan proceeds if the loan was ultimately forgiven.

Congress intended for these expenses to be deductible for federal tax purposes. But since the legislation was silent on this issue, the IRS swooped in and deemed these expenses to be nondeductible.

There was considerable debate over the latter half of 2020, with Congressional politicians explaining that their intent was that the expenses be deductible and the IRS responding “Too bad, they’re nondeductible.”

The Solution

Congress overruled the IRS’s position in the Emergency Coronavirus Relief Act of 2020. The legislation officially makes deductible for federal tax purposes all expenses paid for using proceeds from a forgiven PPP loan.

Stay tuned for updates as to how this new legislation affects your business.

With the onset of COVID-19, small business banks are more nervous about potential loan losses than ever. Here are several tips for your business to maintain a great working relationship with your lender. These same tips can also be used if you want to plant seeds with your banker for potential future loans.

- Produce timely financial statements. Your lender may require you to produce financial statements over the duration of your loans to ensure that you have enough cash to make consistent, on-time payments. Strive to produce up-to-date financial statements and send them to your bank before they ask for them. Not only will timely financial statements make your lenders happy, the pro-active nature of your financials will show a level of transparency to them. Be prepared to include a note explaining major changes and schedule regular phone calls to go over the business.

- Implement solid internal controls. How does a lender have faith that the dollar amounts on your financial statements are accurate? By properly implementing internal controls. You’ll have a happy banker if your company can provide evidence that your internal controls are operating properly.

- Communicate. If your business encounters turbulent financial waters, the best thing to do is immediately let your lender know about it. Better yet, by keeping in constant communication, your lender will most likely be able to spot if your business starts experiencing a downturn and will try devising a plan before you begin missing payment deadlines.

Remember, your banker probably has their hands full right now. These tips allow them to spend more time on their problem loans, and one of them will not be yours.

Remember, your banker probably has their hands full right now. These tips allow them to spend more time on their problem loans, and one of them will not be yours.

You’re ready to take out a loan to buy a house, a car or get a credit card. You fill out the application and wait to hear back from your bank on its decision whether to loan you the money.

And then you get the dreaded phone call. Your credit score wasn’t high enough to approve the loan! Was there anything you could have done to get a higher credit score?

And then you get the dreaded phone call. Your credit score wasn’t high enough to approve the loan! Was there anything you could have done to get a higher credit score?

Getting and maintaining a high credit score is just like playing a game. But just like any game, you first need to understand the rules so you can create a winning game plan. Here are the rules of the credit score game you need to understand so you can get the highest score possible.

- Rule 1 – Pay your bills on time (Comprises 35% of your credit score equation). Payment history is the most important component of your credit score and is pretty straightforward – it’s a record of whether or not you’ve paid your bills on time.

Action: Don’t be late paying your bills! A one-time late payment may not affect your score, but multiple late payments will drag down your score. Even better, understand what vendors report your payment history and which ones do not.

- Rule 2 – Refrain from maxing out your credit (30%). Just because you have a $10,000 credit limit doesn’t mean you should use it all. Using close to or all of your credit limit signals to lenders that you may be a high-risk borrower. Insurance companies also love to use high-limit spending as a reason to increase your home and auto insurance, so be forewarned!

Action: Don’t use more than 25% of your available revolving credit, and pay the outstanding credit card balance in full each month.

- Rule 3 – Build a long history of using credit responsibly (15%). Lenders want to see a track record that you can handle being entrusted with a credit limit. If you have old credit accounts that are still open and in good standing, that signals your trustworthiness, which is reflected in a higher credit score.

Action: When you open a credit account, keep it active for as long as possible. If you stop using an account, consider leaving that account open, but only if it will help your score and not hurt you in obtaining new credit.

- Rule 4 – Use multiple types of credit (10%). Lenders like to see you with both revolving debt (credit cards) and installment debt (car and house loans).

Action: If you have a low credit limit, request a limit increase. Many banks will honor the request, especially if you’ve had a history of making on-time payments. If you don’t have a history of using installment loans, consider making a small purchase (such as an appliance or electronic device) using an installment loan.

- Rule 5 – Avoid too many credit inquiries (10%). Applying for many loans or credit cards in a short period of time tells lenders you may be attempting to acquire more credit than you can handle.

Action: Apply for only one type of credit at a time. Multiple inquiries for the same type of credit, for example a mortgage loan, within a short period of time will only count as one inquiry.

You can improve your credit score by understanding these rules and putting them into practice.

More than 70% of small businesses in America now have loan proceeds from the Paycheck Protection Program (PPP) to help retain employees during the current pandemic. The entire amount of a PPP loan is eligible to be forgiven if the funds are used for qualified expenses. Recent legislation liberalizes the terms of loan forgiveness for funds used for payroll, utilities and rent. It is now based on a 24-week period, not just eight weeks.

More than 70% of small businesses in America now have loan proceeds from the Paycheck Protection Program (PPP) to help retain employees during the current pandemic. The entire amount of a PPP loan is eligible to be forgiven if the funds are used for qualified expenses. Recent legislation liberalizes the terms of loan forgiveness for funds used for payroll, utilities and rent. It is now based on a 24-week period, not just eight weeks.

But how can you best position your company to fully benefit from PPP loan forgiveness? Here are five tips to help meet the challenge.

- Restore your staff. If possible, restore the number of full-time equivalent (FTE) employees to previous levels by the safe-harbor due date of December 31 (extended from June 30). Bring back furloughed FTEs as soon as you can. Of course, this should fit into your overall business plan. If an employee does not return, document the refusal. All these actions will help when the forgiveness formula is applied to your loan.

- Pile on payroll costs. Run payroll and other remaining qualified expenses—including mortgage interest, rent and utilities—on the last day of the 24-week period. This will enable your business to maximize the amount of loan forgiveness allowed under the calculation.

- Reward employees. Consider paying out reasonable incentive amounts to maximize the forgiveness of payroll costs. The bonuses can even go to family members like your spouse or children. But remember that you can only count up to $100,000 of wages per person, pro-rated for the covered year, and you must be able to defend these payments as reasonable.

- Use the simplified application form. There are two loan forgiveness forms – the regular form (Form 3508) and a simplified version called Form 3508EZ. Review both forms before deciding which one is right for your situation. For instance, there are fewer calculations on the simplified form with less documentation required. To qualify for the simplified form, you must meet at least one of these requirements:

- You’re self-employed and have no other employees.

- You didn’t reduce employee hours or reduce their wages and salaries by more than 25%.

- You lost business due to health directives relating to COVID-19 and didn’t reduce employee wages and salaries by more than 25%.

- Document everything. Once you receive PPP loan funds, keep supporting documentation on everything related to the loan. Document when you receive the loan, each time you spend part of the loan and accrued interest expense on the loan. Also keep copies of receipts and invoices to document all loan expenditures, including bank account statements and journal entries.

Each year a new crop of graduating high school seniors begin their collegiate careers while college graduates consider the opportunities that graduate school provides. As a result, the mountain of student debt continues to build. While this debt is unavoidable, here are some ideas to help make that mountain a little less insurmountable.

Know the note – Not all student debt is created equal. Understanding the terms of all your student loans is important. With this knowledge, select the correct loan option and know which loan to pay first. Things you should know about each loan include:

- The interest rate

- The term of the loan

- Amount of any up-front fees

- Pre-payment penalties (if any)

- When interest and payments start

- Payment amounts

- Payment flexibility

- How interest is calculated

Suggestion: Create a spreadsheet with a student loan in each column. Then note the variables from this list under each note. It will create a strong visual of your student loan situation.

Pay the interest – Some student loans accrue interest while you are in school. With the compounding of this interest, your student loan amount continues to grow with each passing year before repayment begins. Banks love this. You should not.

Suggestion: Figure out how to make the interest payments while in school. This will not only lock the amount you owe, it will reduce the amount of interest payments you will be paying on your interest.

Pay a little extra in the early days – The math of loans benefits banks in the early years of the note. This is because the vast majority of interest is paid by you in the first years of repayment. The last year of your loan repayment is primarily principal payments.

Suggestion: Pay extra every month as soon as payments start. While this seems impossible as you enter the workforce, even $10 extra a month can dramatically reduce the amount of total payments you make over the life of your loan.

While student debt is an unavoidable outcome of getting a great education, it can be minimized if actively managed. Remember small changes can yield results if planned for in advance.

Imagine this – you’ve given us all your documents early, we’ve prepped and processed your tax return, you’ve reviewed it and signed the eFile forms… then we call you and advise you that your tax return rejected eFiling because someone has already filed using your social security number! Sadly, this can happen if you become one of the growing number of victims of tax return identity theft. At least one estimate shows tax-related identity theft cases have increased 650% since 2008. Identity theft can delay your tax refund, but other consequences could be credit card debt or loans taken out in your name.

To avoid becoming a victim, we recommend the following:

- Safeguard your social security number and other financial information. Don’t send financial documents via email unless you use an encryption program. To send documents to us, use our LeapFile application to securely send us documentation.

- Check your bank and credit card transactions regularly and monitor your credit ratings.

- Don’t give out your information on the phone, even if the caller identifies themselves as an agent of the IRS or other authorities.