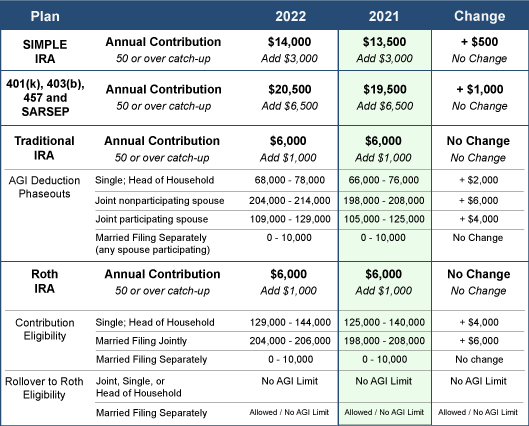

There’s good news for your retirement accounts in 2022! The IRS recently announced that you can contribute more pre-tax money to several retirement plans in 2022. Take a look at the following contribution limits for several of the more popular retirement plans:

What You Can Do

- Look for your retirement savings plan from the table and note the annual savings limit of the plan. If you are 50 years or older, add the catch-up amount to your potential savings total.

- Make adjustments to your employer provided retirement savings plan as soon as possible in 2022 to adjust your contribution amount.

- Double check to ensure you are taking full advantage of any employee matching contributions into your account.

- Use this time to review and re-balance your investment choices as appropriate for your situation.

- Set up new accounts for a spouse and/or dependents. Enable them to take advantage of the higher limits, too.

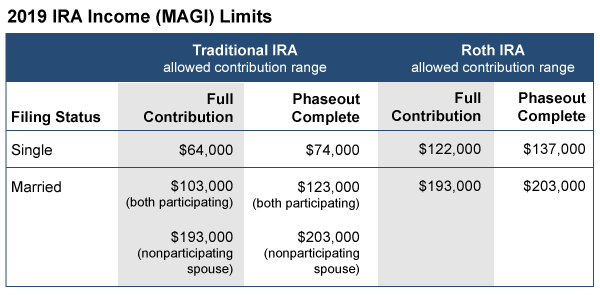

- Consider IRAs. Many employees maintain employer-provided plans without realizing they could also establish a traditional or Roth IRA. Use this time to review your situation and see if these additional accounts might benefit you or someone else in your family.

- Review contributions to other tax-advantaged plans, including flexible spending accounts (FSAs) and health savings accounts (HSAs).

Now is a great time to make 2022 a year to remember for retirement savings!

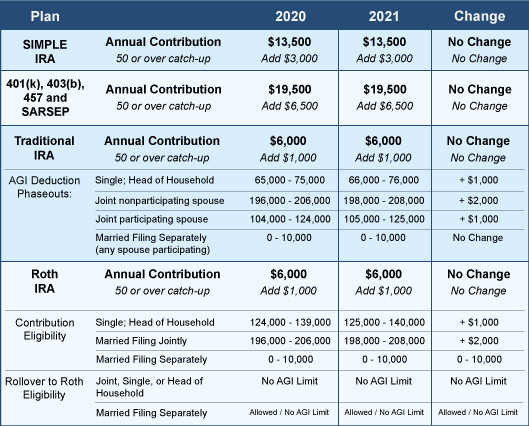

Contribute to retirement accounts. Tally up all your 2021 contributions to retirement accounts so far, and estimate how much more you can stash away between now and December 31. So, consider investing in an IRA or increase your contributions to your employer-provided retirement plans. Remember, you can reduce your 2021 taxable income by as much as $19,500 by contributing to a retirement account such as a 401(k). If you’re age 50 or older, you can reduce your taxable income by up to $26,000!

Contribute to retirement accounts. Tally up all your 2021 contributions to retirement accounts so far, and estimate how much more you can stash away between now and December 31. So, consider investing in an IRA or increase your contributions to your employer-provided retirement plans. Remember, you can reduce your 2021 taxable income by as much as $19,500 by contributing to a retirement account such as a 401(k). If you’re age 50 or older, you can reduce your taxable income by up to $26,000!

Suppose you’re switching jobs if you were furloughed because of the pandemic or you’re simply searching for greener pastures. If you have a 401(k) from your soon-to-be former employer, you must decide what to do with your retirement account when you leave. Here are your four options:

Suppose you’re switching jobs if you were furloughed because of the pandemic or you’re simply searching for greener pastures. If you have a 401(k) from your soon-to-be former employer, you must decide what to do with your retirement account when you leave. Here are your four options: Make up to $300 of charitable contributions. For the 2020 tax year only, an above-the-line deduction of $300 is available to all Americans who want to make a charitable contribution. You can donate to more than one charity, but the total amount of contributions must be $300 or less to be able to take an above-the-line deduction. While you will still need to itemize your deductions if you want a tax break for donations greater than $300, this above-the-line deduction for $300 or less helps alleviate the elimination of the charitable deduction for most taxpayers. (NOTE: $300 is the maximum above-the-line deduction per tax return, regardless of filing status.)

Make up to $300 of charitable contributions. For the 2020 tax year only, an above-the-line deduction of $300 is available to all Americans who want to make a charitable contribution. You can donate to more than one charity, but the total amount of contributions must be $300 or less to be able to take an above-the-line deduction. While you will still need to itemize your deductions if you want a tax break for donations greater than $300, this above-the-line deduction for $300 or less helps alleviate the elimination of the charitable deduction for most taxpayers. (NOTE: $300 is the maximum above-the-line deduction per tax return, regardless of filing status.)