Know the way loans work…and use it to your advantage!

Every banker knows that the majority of the money they make on a loan is made in the first few years of the loan. By understanding this fact, you can greatly reduce the amount you pay when buying your house, paying off your student loan, or buying a car. Here is what you need to know:

Every banker knows that the majority of the money they make on a loan is made in the first few years of the loan. By understanding this fact, you can greatly reduce the amount you pay when buying your house, paying off your student loan, or buying a car. Here is what you need to know:

Your payment never changes

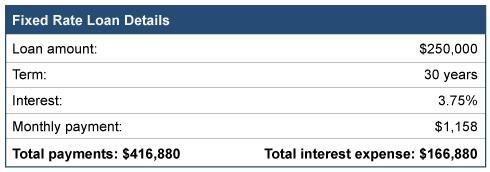

When you obtain a loan, the components of that loan are interest, the number of years to repay the loan, the amount borrowed, and the monthly payment. Assuming a fixed rate note, the payment never changes. Here is an example of a $250,000 loan.

It is important to note that your payment in month one is $1,158 and your monthly payment thirty years later is the same amount…$1,158.

Each payment has two parts

What does change every month is what is inside each payment. Every loan payment has two parts. One is a payment that reduces the amount of money you owe, called principal. The other part of the payment is for the bank, called interest expense. Now look at the component parts of the first payment and then the last payment:

So, while your monthly payment never changes, the amount used to reduce the loan each month varies DRAMATICALLY. Remember your total cost of borrowing $250,000 includes more than $166,000 in interest!

Use the knowledge to your advantage

Here’s how you can use this information to your advantage.

For new loans

- Only sign up for loans that allow you to make pre-payments without penalty.

- When borrowing money, keep some of your cash in reserve. Try to reserve a minimum of 10 to 20 percent of the amount borrowed. So, in this example, try to reserve $25,000 to $50,000 in cash.

- Immediately after getting the loan, consider using the excess cash as a pre-payment on the note. By doing this you can dramatically reduce the interest expense over the life of the note, all while keeping your payment constant. Even though your monthly payment may be a little higher, the extra payment amount will pay back the loan more quickly.

For existing loans

- Create and look at your loan’s amortization table. This table shows how much of each payment is used to pay down the loan balance and how much goes to your lender as interest. In the above example, 67 percent of the first payment is for the bank, while only ½ of 1 percent of the last payment is for the bank.

- Pay more to you than the bank. Aggressively prepay down any loan until more of each payment goes to you versus the bank. This is the crossover point of your loan.

- Find your sweet spot. After hitting the crossover point, next consider the efficiency of each prepayment and determine when you consider your prepayment ineffective. No one would consider prepaying that last payment when interest expense is only $4.00. But if more than 25% of the payment goes to interest? Keep making prepayments.

Final thought

When you make a prepayment on a loan, reduce the loan balance by your prepayment, then look at the amortization table. See how many payments are eliminated with your prepayment and add up all the interest you save. You will be amazed by the result.

Summertime means the 2020 tax filing season is firmly in the rearview mirror for millions of Americans. But summertime is also the season when the IRS sends letters to unlucky taxpayers demanding more money!

Summertime means the 2020 tax filing season is firmly in the rearview mirror for millions of Americans. But summertime is also the season when the IRS sends letters to unlucky taxpayers demanding more money!

If you receive a notice from the IRS, do not automatically assume it is correct and submit payment to make it go away. Because of all the recent tax law changes and so little time to implement the changes, the IRS can be wrong more often than you think. These IRS letters, called correspondent audits, need to be taken seriously, but not without undergoing a solid review. Here’s what you need to do if you receive one.

- Stay calm. Don’t overreact to getting a letter from the IRS. This is easier said than done, but remember that the IRS sends out millions of these correspondence audits each year. The vast majority of them correct simple oversights or common filing errors.

- Open the envelope! You would be surprised how often taxpayers are so stressed by receiving a letter from the IRS that they cannot bear to open the envelope. If you fall into this category, try to remember that the first step in making the problem go away is to open the correspondence.

- Conduct a careful review. Review the letter. Understand exactly what the IRS is explaining that needs to be changed and determine whether or not you agree with their findings. The IRS rarely sends correspondence to correct an oversight in your favor, but sometimes it happens.

- Respond timely. The IRS will tell you what it believes you should do and within what time frame. Ignore this information at your own risk. Delays in responses could generate penalties and additional interest payments.

- Get help. You are not alone. Getting assistance from someone who deals with this all the time makes the process go much smoother. And remember, some of these letters could be scams from someone impersonating the IRS!

- Correct the IRS error. Once you understand what the IRS is asking for, a clearly written response with copies of documentation will cure most IRS correspondence audits received in error. Often the error is due to the inability of the IRS computers to match documents it receives (for example 1099s or W-2s) to your tax return. Pointing out the information on your tax return might be all it takes to solve the problem.

- Certified mail is your friend. Any responses to the IRS should be sent via certified mail or other means that clearly show you replied to their inquiry before the IRS’s deadline. This will provide proof of your timely correspondence. Lost mail can lead to delays, penalties, and additional interest tacked on to your tax bill.

- Don’t assume it will go away. Until receiving definitive confirmation that the problem has been resolved, you need to assume the IRS still thinks you owe them money. If no correspondence confirming the correction is received, you should follow-up with another written confirmation request to the IRS.

How to tell the difference

Not all debt is created equal. Knowing the difference can change the way you look at your spending.

Not all debt is created equal. Knowing the difference can change the way you look at your spending.

Good debt adds value

Good debt often leads to financial growth, because the product or service being purchased adds more value than the debt that comes with it. Student loans are usually an example of good debt because the related education allows you to earn more income.

Some purchases result in value more directly. Taking on a mortgage, for example, can be valuable simply by giving you access to a place to live all while building equity. Additionally, a mortgage is often considered good debt because your property can be used as collateral for other debt once you’ve made some payments on it, or your home has gained in market value. Even better, good debt often comes with a tax deduction on the interest you pay on things like your mortgage or student loans.

Bad debt adds expense

Credit card debt is almost always bad debt. Not only are interest rates on credit cards higher than most other types of debt, but most purchases made with credit cards are for things that do not contribute to personal financial growth. In fact, interest expense is so high that credit card companies are now legally required to display the cost of this debt directly on their billing statements. Auto loans are another example of bad debt, because cars usually lose value quickly, often leaving more money owed on the debt than the car is worth! But even good debt can turn bad if there is too much of it. Take out too large a mortgage and you may struggle to make payments!

Debt always means higher cost

Debt’s big benefit is allowing you to pay for something over time. The cost of any purchase using debt MUST include the interest expense of taking on that debt. You can compare that with the option of saving up money and then making the purchase without interest. Is the extra interest worth the benefit? Comparing the cost of the purchase with interest, to the value you stand to gain by purchasing the asset, can help you determine whether using debt is a good or bad choice for you.

Final thoughts

Here are some ideas on how to manage good versus bad debt.

- Consider carefully what you can afford and make a plan for how you will pay off any debts before you take on the debt.

- Never carry a balance on a credit card unless it is an emergency. Pay the balance in full every month.

- Calculate the entire cost, including interest, of anything you purchase using debt. This is the REAL cost of an item.

- Use savings, whenever possible, to purchase goods and services that would otherwise be considered bad debt.

- Pay off high interest debt first.

- Financial growth is often the key measure for defining good versus bad debt, but not always. Other factors, like personal interest, growth, and well-being can also be measures for your debt decisions, as long as you can truly afford the payments.

Reach out for help if you aren’t confident whether a potential debt will be beneficial or harmful. Making the right choice could save you money.

Knowing your net worth and understanding how it is changing over time is one of the most important financial concepts that everyone needs to understand. This number is used by banks, mortgage companies, insurance companies and you! Your net worth impacts your credit score, which in turn impacts your interest rates and things as mundane as the amount you pay for auto insurance.

A simple definition

- Net worth is the result of taking all the things you own (assets) minus what you owe others (debts and liabilities).

- Assets include cash, bank account balances, investments, your home, vehicles or anything else that you could sell today for cash. Assets also include any businesses or business interests you own.

- Liabilities are what you owe others, such as a mortgage or car loan, and any other debt, like credit card or student loan debt.

Your net worth changes over time, reflecting how you spend your money. For example, if you have tons of bills and spend more than you bring in, your bank account balances will be lower. If you spend a lot on your credit cards, your debt will go up. The net effect is a lower net worth.

Your net worth changes over time, reflecting how you spend your money. For example, if you have tons of bills and spend more than you bring in, your bank account balances will be lower. If you spend a lot on your credit cards, your debt will go up. The net effect is a lower net worth.

Everyone has a net worth

Yes, everyone. Even a 6-year-old with money in their piggy bank has a net worth. If your child is saving up for a bike, they will convert one asset (cash) into another asset (their new bike)!

Calculating your net worth

- Step one. Reconcile your bank accounts and loans. Try doing this every month, as these are the easiest parts of your net worth to track and calculate.

- Step two. Calculate the value of all your remaining assets. For some of your assets, such as stocks, you can go online and find the current value of the stocks you own. For other assets, you’ll have to estimate what you could sell that asset for today.

- Step three. Add up all your asset values, then subtract all your debts. What you’re left with is your net worth (and yes, your number could be negative)!

Why you should know your net worth

Knowing your net worth contributes to the big picture of your financial circumstances. Here’s why it’s beneficial to know your net worth:

- You want to apply for student loans. You’ll likely need to submit an application that details all your cash and other assets when applying for student loans. If your net worth is high enough, you may have to foot some of the tuition bill yourself.

- You want to get insurance. Some types of insurance use your credit score as part of the calculation for determining your premium payments. Knowing if you have a high net worth may help in obtaining a favorable premium amount.

- You want to diversify your investments. Certain investments are available only to individuals who have a high enough net worth.

- You want to buy a home. Banks want to see that you have plenty of cash when compared to your debts. If you have too much debt, you may need to either pay down the debt or increase your down payment.

Knowing your net worth and how to calculate it can help you achieve some of your financial goals. Please call if you’d like help calculating and understanding your net worth.

The best way to weather a storm is often by being prepared before the storm hits. In the case of small businesses, this means building a fortress balance sheet.

What is a fortress balance sheet?

This long-standing idea means taking steps to make your balance sheet shockproof by building liquidity. Like a frontier outpost or an ancient walled city, businesses that prepare for a siege—in the form of a recession, natural disaster, pandemic, or adverse regulatory change—can often hold out until the crisis passes or the cavalry arrives.

This long-standing idea means taking steps to make your balance sheet shockproof by building liquidity. Like a frontier outpost or an ancient walled city, businesses that prepare for a siege—in the form of a recession, natural disaster, pandemic, or adverse regulatory change—can often hold out until the crisis passes or the cavalry arrives.

Consider these suggestions for building your own fortress balance sheet.

- Control inventory and receivables. These two asset accounts often directly impact cash reserves. For example, carrying excess inventories can deplete cash because the company must continue to insure, store, and manage items that aren’t generating a profit. Also take a hard look at customer payment trends. Clients who are behind on payments can squeeze a firm’s cash flow quickly, especially if they purchase significant levels of goods and services—and then fail to pay.

- Keep a tight rein on debt. In general, a company should use debt financing for capital items such as plant and equipment, computers, and fixtures that will be used for several years. By incurring debt for such items, especially when interest rates are low, a firm can direct more cash towards day-to-day operations and new opportunities. Two rules of thumb for taking on debt are don’t borrow more than 75 percent of what an asset is worth, and aim for loan terms that don’t exceed the useful life of the underlying asset. A fortress balance sheet also means that debt as a percent of equity should be as low as possible. So, total up your debt, equity and retained earnings. If debt is less than 50% of the total, you are on your way to building a stronger foundation for your balance sheet.

- Monitor credit. A strong relationship with your banker can help keep the business afloat if the economy takes a nosedive. Monitor your business credit rating regularly and investigate all questionable transactions that appear on your credit report. As with personal credit, your business credit score will climb as the firm makes good on its obligations.

- Reconcile balance sheet accounts quarterly. It’s crucial to reconcile asset and liability accounts at least every quarter. A well-supported balance sheet can guide decisions about cash reserves, debt financing, inventory management, receivables, payables, and property. Regular monitoring can highlight vulnerabilities in your fortress, providing time for corrective action.

- Get rid of non-performing assets. Maybe you own a store across town that’s losing money or have a warehouse with a lot of obsolete inventory. Consider getting rid of these and other useless assets in exchange for cash.

- Calculate ratios. Know how your bank calculates the lending strength of businesses. Then calculate them for your own business. For example, banks want to know your debt service coverage. Do you have enough cash to adequately handle principal and interest payments? Now work your cash flow to provide plenty of room to service this debt AND any future debt! But don’t forget other ratios like liquidity and working capital ratios. The key? Improve these ratios over time.

Remember, the best time to get money from a bank is when it looks like you don’t need it. You do this by creating a fortress balance sheet!

Understanding how our tax system works can be tricky for anyone. Whether you’re an adult who never paid much attention to the taxes being withheld from your paycheck or a kid who just got his or her first job, understanding the basics can help refine and define questions you may have.

Understanding how our tax system works can be tricky for anyone. Whether you’re an adult who never paid much attention to the taxes being withheld from your paycheck or a kid who just got his or her first job, understanding the basics can help refine and define questions you may have.

Many schools don’t teach these tax lessons. This results in many people entering life with a pretty incomplete picture of how taxes work, unless someone else takes the time to explain these tax concepts. Here are some pointers to help you or someone you know navigate our tax maze.

Taxes are mandatory!

While we can have a debate about how much each person should pay, there’s no debating that local, state and federal governments need tax revenue to run the country. These funds are used to build roads, support education, help those who need financial assistance, pay interest on our national debt and defend the country.

There are many types of taxes

When you think of taxes, most think of the income tax, which is a tax on business and personal income you earn from performing a job. But there are also other types of taxes. Here are some of the most common.

- Payroll taxes. While income taxes can be used to pay for pretty much anything the government needs money for, payroll taxes are earmarked to pay for Social Security and Medicare benefits.

- Property taxes. These are taxes levied on property you own. The most common example of this is the property tax on a home or vacation property.

- Sales tax. These are taxes placed on goods and services you purchase. While most of this tax is applied at the state and local levels, there are also federal sales taxes on items like gasoline.

- Capital gains taxes. If you sell an investment or an asset for a profit, you may owe capital gains taxes. The most common example of this is when you sell stock for a gain. Capital gains taxes could also come into play with other assets, such as a rental property you sell for a profit.

- Estate taxes. This tax is applied to assets in your estate after you pass away.

Not all income is subject to tax

Most, but not all, of your income is subject to tax.

- While your paycheck is subject to tax, interest earned from certain municipal bonds is not. And the government often excludes things like benefits from the tax man.

- Capital gains taxes have exclusions for gains on the sale of your home and donated stock.

- Estate taxes have an exclusion, so only estates in excess of the exclusion are taxed.

This is why having someone in the know can be really helpful in navigating these rules.

The progressive nature of income tax

When it comes to income taxes, the government gets to take the first bite. The question is how BIG of a bite the government gets to take.

For example, if you only have one chocolate chip cookie, the government’s bite is really, really small. If you have 1,000 chocolate chip cookies, the government takes a small bite from the first 100 cookies, a larger bite from the next 100 cookies, and an even larger bite from the remaining 800 cookies.

This is called a progressive tax rate system. For example, if you’re considered single for tax purposes in 2021, the first $9,950 of taxable money you earn gets taxed at 10%. The next $30,575 you earn gets taxed at 12%. The next $45,850 gets taxed at 22%. Money you earn above this point will get taxed at either 24%, 32%, 35% or 37%.

Understanding the progressive nature of our tax system is a key concept in managing the size of the bite the government takes. That is why tax planning is so important!

Deductions can decrease the government’s tax bite

The progressive tax system is complex because it is manipulated in a big way by our elected officials. This is typically done through credits, deductions and phaseouts of tax benefits.

For example, there is a fairly complex deduction for families with children, and the earned income tax credit is an added tax cut for those in the lower end of the progressive income tax base. There are also credits and deductions for businesses, homeowners, education and many more types of taxpayers.

As you can imagine, the U.S. tax system is very complex with many nuances. Please seek help if you have further questions or are facing a complicated taxable transaction.

No one likes surprises from the IRS, but they do occasionally happen. Here are some examples of unpleasant tax situations you could find yourself in and what to do about them.

No one likes surprises from the IRS, but they do occasionally happen. Here are some examples of unpleasant tax situations you could find yourself in and what to do about them.

- An expected refund turns into a tax payment. Nothing may be more deflating than expecting to get a nice tax refund and instead being met with the reality that you actually owe the IRS more money.

What you can do: Run an estimated tax return and see if you may be in for a surprise. If so, adjust how much federal income tax is withheld from your paycheck for the balance of the year. Consult with your company’s human resources department to figure out how to make the necessary adjustments for the future. If you’re self-employed, examine if you need to increase your estimated tax payments due in January, April, June and September.

- Getting a letter from the IRS. Official tax forms such as W-2s and 1099s are mailed to both you and the IRS. If the figures on your income tax return do not match those in the hands of the IRS, you will get a letter from the IRS saying that you’re being audited. These audits are now done by mail and are commonly known as correspondence audits. The IRS assumes their figures are correct and will demand payment for the taxes you owe on the amount of income you omitted on your tax return.

What you can do: Assuming you already know you received all your 1099s and W-2s and confirmed their accuracy, verify the information in the IRS letter with your records. Believe it or not, the IRS sometimes makes mistakes! It is always best to ask for help in how to correspond and make your payments in a timely fashion, if they are justified.

- Getting a tax bill for an emergency retirement distribution. Due to the pandemic, you can withdraw money from retirement accounts in 2020 without getting a 10% early withdrawal penalty, but you’ll still have to pay income taxes on the amount withdrawn. If you don’t plan for this extra tax you will be surprised with an additional tax bill. And you may still get an underpayment penalty bill from the IRS because you did not withhold enough during the year. You may also still receive an early withdrawal penalty in error because the IRS is still scrambling to update their systems with all of this year’s tax relief changes.

What you can do: Set aside a percentage of your distribution for taxes. Your account administrator may withhold funds automatically for you when you request the withdrawal, so check your statements. Your review should be for both federal and any state tax obligations. If the withholding is not sufficient, consider sending in an estimated tax payment. And if you are charged a withdrawal penalty, ask for help to correspond with the IRS to get this charge reversed.

No one likes surprises when filing their taxes. With a little planning now, you can reduce the chance of having a surprise hit your tax return later.

Find out if you owe the IRS an estimated tax payment

You may owe the IRS a tax payment for your 2020 tax return and not know it.

Most Americans have income taxes withheld from their paychecks, with their employer sending a tax payment to the IRS on their behalf. This year, however, many more Americans will have to write Uncle Sam a check to pay a portion of their 2020 taxes on or before July 15. You may be one of these people!

Most Americans have income taxes withheld from their paychecks, with their employer sending a tax payment to the IRS on their behalf. This year, however, many more Americans will have to write Uncle Sam a check to pay a portion of their 2020 taxes on or before July 15. You may be one of these people!

Who needs to pay now!

You may need to make a payment if one of the following situations applies to you:

- Paychecks are under-withheld. Your employer withholds a portion of your paychecks for income tax purposes, then submits a payment to the IRS on your behalf. The amount that is withheld from your paychecks, however, may not cover your entire tax liability, resulting in you needing to write the IRS a check. If you’re not withholding enough, ask your employer to increase the withholding amount from your future paychecks so you don’t come up short again in the future.

- Unemployment compensation paychecks are under-withheld. Unemployment compensation is subject to federal income tax and subject to income taxes in several states. While some unemployment benefit checks withhold a percentage of your payment for income tax purposes, you may need to pay more in taxes than is being withheld.

- Self-employed workers. Unlike employees, self-employed workers don’t have income tax withheld from pay and must make four estimated tax payments over a period of 12 months. Self-employed workers include gig economy workers, freelancers, S corporation shareholders and partners in a partnership.

- Retirees. You may owe tax on Social Security benefits, as well as income from investments distributed to you or other unearned income. A portion of pension plan distributions may be withheld, but many times the amount withheld does not cover your entire tax liability, resulting in an underpayment.

- Sold a major asset. You may owe tax after selling an asset that results in a large capital gain, such as a house, or from the sale of securities.

- Receive alimony. If you’re being paid alimony under a divorce decree entered into before 2019, the payments constitute taxable income to you. Alimony from post-2018 agreements, however, are not taxable.

What you need to do

Estimate your total income for 2020, then calculate your total 2020 tax bill and divide it by 2. Compare this amount to how much has been withheld from your paychecks, unemployment benefits and any other payments you’ve made to the IRS. If you’re short, consider making an estimated payment by July 15 to make up the difference. This payment is made with Form 1040-ES.

If you do not make this payment on time, the IRS may impose a penalty plus interest on top of the underpaid taxes. Fortunately, you can avoid a penalty by paying at least 90% of the current year’s tax liability or 100% of the prior year’s tax liability (110% if your adjusted gross income for the prior year exceeds $150,000).

A letter in the mailbox with the IRS as the return address is sure to raise your blood pressure. Here are some tips for handling the situation if this happens to you:

A letter in the mailbox with the IRS as the return address is sure to raise your blood pressure. Here are some tips for handling the situation if this happens to you:

- Stay calm. Try not to overreact to the correspondence. They are often in error. This is easier said than done, but remember the IRS sends out millions of notices each year. The vast majority of them correct simple oversights or common filing errors.

- Open the envelope. You would be surprised at how often people are so stressed by receiving a letter from the IRS that they cannot bear to open the envelope. If you fall into this category, try to remember that the first step in making the problem go away is to simply open the correspondence.

- Carefully review the letter. Understand exactly what the IRS thinks needs to be changed and determine whether or not you agree with its findings. Unfortunately, the IRS rarely sends correspondence to correct an oversight in your favor, but its assessment of your situation is often wrong.

- Respond timely. The correspondence should be very clear about what action the IRS believes you should take and within what timeframe. Delays in responses could generate penalties and additional interest payments.

- Get help. You are not alone. Getting assistance from someone who deals with this all the time makes going through the process much smoother.

- Correct the IRS error. Once the problem is understood, a clearly written response with copies of documentation will cure most of these IRS correspondence errors. Often the error is due to the inability of the IRS computers to conduct a simple reporting match. Pointing the information out on your tax return might be all it takes to solve the problem.

- Use certified mail. Any responses to the IRS should be sent via certified mail. This will provide proof of your timely correspondence. Lost mail can lead to delays, penalties and additional interest on your tax bill.

- Don’t assume it will go away. Until a definitive confirmation that the problem has been resolved is received, you need to assume the IRS still thinks you owe the money. If no correspondence confirming the correction is received, a written follow-up will be required.

Individual Rule Changes

Congress has passed tax reform that will take effect in 2018, ushering in some of the most significant tax changes in three decades. Here are some of the most important items in the new bill that impact individual taxpayers.

Reduces income tax rates. The bill retains seven brackets, but at reduced rates, with the highest tax bracket dropping to 37 percent from 39.6 percent.

Doubles standard deductions. The standard deduction nearly doubles to $12,000 for single filers and $24,000 for married filing jointly. To help cover the cost, personal exemptions are suspended, as well as most additional standard deductions (except for the blind and elderly).

Limits itemized deductions. Many itemized deductions are no longer available, or are now limited. Here are some of the major examples:

- Caps state and local tax deductions. State and local tax deductions are limited to $10,000 total for all property, income and sales taxes.

- Caps mortgage interest deductions. Mortgage acquisition indebtedness interest will be deductible for no more than $750,000. Existing homeowners are unaffected by the new cap. The bill also suspends the deductibility of interest on home equity debt.

- Limits theft and casualty losses. These deductions are now only available for federally declared disaster areas.

- Removes 2 percent miscellaneous deductions. Most miscellaneous deductions subject to the 2 percent of adjusted gross income threshold are now gone.

Cuts some above-the-line deductions. Moving expense deductions get eliminated except for active-duty military personnel, along with alimony deductions beginning in 2019.

Weakens the alternative minimum tax (AMT). The bill retains the alternative minimum tax but changes the exemption to $109,400 for joint filers and the phaseout threshold to $1 million. The changes mean the AMT will affect far fewer people than before.

Bumps up child tax credit, adds family tax credit. The child tax credit increases to $2,000 from $1,000, with $1,400 of it refundable even if no tax is owed. The phaseout threshold increases sharply to $400,000 from $110,000 for joint filers, making it available to more taxpayers. Also, dependents ineligible for the child tax credit can qualify for a new $500-per-person family tax credit.

Expands use of 529 education savings plans. Qualified distributions from 529 education savings plans now include amounts to pay tuition for students in K-12 private schools.

Doubles estate tax exemption. Estate taxes will apply to fewer people, with the exemption doubled to $11.2 million ($22.4 million for a married couple).

Reduces pass-through business taxes. Most owners of pass-through entities such as S corporations, partnerships and sole proprietorships will see their income tax lowered with a new 20 percent income reduction calculation.

Because major tax reform like this happens so seldom, it’s worth scheduling a tax planning consultation to ensure you reap the most tax savings possible during 2018.