Your business has a story to tell. And one of the ways to hear your business’s story is by reading through comparative financial statements.

Your business has a story to tell. And one of the ways to hear your business’s story is by reading through comparative financial statements.

The importance of comparative financial statements

An up-to-date balance sheet, income statement and statement of cash flows are essential financial reports you should consistently analyze. But these financial statements by themselves don’t tell the whole story about your business. Consider the following:

- Company XYZ: The most current balance sheet shows $1 million in liquid assets with zero liabilities.

- Company ABC: The most current income statement has a net profit margin of 35%.

- Company 123: The statement of cash flows shows that the company has consistently brought in more cash than it has spent over the past three years.

And here’s the rest of the story:

- Company XYZ: Liquid assets decreased from $5 million to $1 million over the past 12 months.

- Company ABC: Net profit margin is typically around 20% for this company. However, a recent round of layoffs temporarily pushed total salaries and wages lower, while pushing the net profit margin much higher.

- Company 123: There has been a steady decline in positive cash flow over the past three years.

These examples show the importance of analyzing your financial statements in comparison with something else. Reading through the first list of bullet points only tells part of the story.

What you can do

Here are several types of comparative financial statements you can create for your business and some tips for getting the most out of these reports.

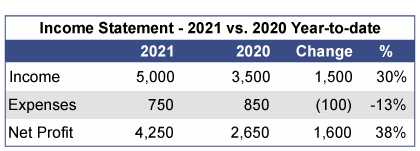

- Current period vs. Prior period. Compare this month to the same month one year prior (October 2021 vs. October 2020) or compare by year (2021 Year-to-Date vs. 2020 Year-to-Date).

- Current period vs. Current period forecast. This is known as a variance analysis. You compare what you think was going to occur during a particular period to what actually happened. This report can also be done either by month [October 2021 (actual) vs. October 2021 (forecast)] or by year [2021 Year-to-Date (actual) vs. 2021 Year-to-Date (forecast)]

- Use both absolute figure and percentages. Percentages allow you to quickly see the degree of change between the two periods that are being compared. Here’s an example of what this could look like:

- Ask for help! Please contact your financial advisor or accountant if you would like help creating or analyzing comparative financial statements for your business.

When tracking and planning your business objectives, it’s easy to focus your analysis on two reports — the income statement and balance sheet. But one of the primary keys to your business’s success relies more on how you handle the money flowing in and out of the business. The appearance of a solid profit can hide a lurking cash flow problem.

When tracking and planning your business objectives, it’s easy to focus your analysis on two reports — the income statement and balance sheet. But one of the primary keys to your business’s success relies more on how you handle the money flowing in and out of the business. The appearance of a solid profit can hide a lurking cash flow problem.

Here are practices to help you give your cash flow the attention it deserves:

- Understand your cash position. Start with simply getting in the habit of monitoring your bank account activity daily to watch for mistakes or unforeseen charges. Then look at each business process that involves cash — purchasing, inventory, collections and payroll are good examples. Consider extending terms for paying vendors, establishing shorter terms for customers to pay and implementing a review process to ensure accurate payroll calculations. Also explore opportunities to turn over your inventory faster.

- Create a cash flow statement forecast. With your knowledge of cash, create a forward-looking statement of monthly cash flow. It will reflect the ebbs and flow of cash throughout the year and identify times of cash crunch. You can then see the impact of changes you are making on your company’s cash position.

- Identify relevant ratios. There are many helpful cash flow ratios. Identify ratios that are especially helpful to your business. Have debt? Consider the cash flow coverage ratio (operating cash flow ÷ by debt) to help plan for scheduled debt payments. Making a lot of capital purchases? Use the free cash flow calculation (operating cash flow – capital expenditures) to determine how much cash will be left over after the purchases.

- Build in some contingencies. Most businesses experience seasonality. Understanding your business cycles can help you strategically manage cash in high cash months to cover shortfalls that come in low cash months. Set up a line of credit so it’s available in the case of an emergency, or as a bridge during short-term liquidity needs. A line of credit only charges interest only when used, so it’s a perfect tool to have at your disposal.

- Watch for hidden cash hijackers. Oftentimes, large cash expenditures can be hidden on your income statement or balance sheet. A few examples are payments on capital purchases, debt obligations, dividends, guaranteed payments to partners and taxes. Income taxes, when not accounted for correctly, can cause a twofold problem — a large lump sum that is due in a short amount of time, plus a larger obligation to account for going forward. Don’t wait until the end of the year to project your tax provision.

- Appoint someone to manage cash. As with many business processes, important details can fall through the cracks if there is not clear accountability as to who is responsible for the task. So assign yourself or someone you trust to manage the company’s cash flow.

When businesses fail, it’s usually because they run out of money. By making cash flow a central part of your business plan, you greatly reduce this risk.