Your business has a story to tell. And one of the ways to hear your business’s story is by reading through comparative financial statements.

Your business has a story to tell. And one of the ways to hear your business’s story is by reading through comparative financial statements.

The importance of comparative financial statements

An up-to-date balance sheet, income statement and statement of cash flows are essential financial reports you should consistently analyze. But these financial statements by themselves don’t tell the whole story about your business. Consider the following:

- Company XYZ: The most current balance sheet shows $1 million in liquid assets with zero liabilities.

- Company ABC: The most current income statement has a net profit margin of 35%.

- Company 123: The statement of cash flows shows that the company has consistently brought in more cash than it has spent over the past three years.

And here’s the rest of the story:

- Company XYZ: Liquid assets decreased from $5 million to $1 million over the past 12 months.

- Company ABC: Net profit margin is typically around 20% for this company. However, a recent round of layoffs temporarily pushed total salaries and wages lower, while pushing the net profit margin much higher.

- Company 123: There has been a steady decline in positive cash flow over the past three years.

These examples show the importance of analyzing your financial statements in comparison with something else. Reading through the first list of bullet points only tells part of the story.

What you can do

Here are several types of comparative financial statements you can create for your business and some tips for getting the most out of these reports.

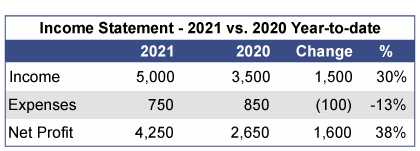

- Current period vs. Prior period. Compare this month to the same month one year prior (October 2021 vs. October 2020) or compare by year (2021 Year-to-Date vs. 2020 Year-to-Date).

- Current period vs. Current period forecast. This is known as a variance analysis. You compare what you think was going to occur during a particular period to what actually happened. This report can also be done either by month [October 2021 (actual) vs. October 2021 (forecast)] or by year [2021 Year-to-Date (actual) vs. 2021 Year-to-Date (forecast)]

- Use both absolute figure and percentages. Percentages allow you to quickly see the degree of change between the two periods that are being compared. Here’s an example of what this could look like:

- Ask for help! Please contact your financial advisor or accountant if you would like help creating or analyzing comparative financial statements for your business.

As summer winds down, your business’s financial statements may be due for a quick check-up. Here are several review suggestions to help determine the health of your business prior to year-end.

- Balance sheet reconciliations. Reconcile each asset and liability account every quarter. A well-supported balance sheet can guide decisions about cash reserves, debt financing, inventory management, receivables, payables, and property. Regular monitoring can highlight vulnerabilities, providing time for corrective action.

- Debt service coverage. Do you have enough cash to adequately handle principal and interest payments? Calculate your cash flow to ensure you can handle both current and future monthly loan payments.

- Projected revenue. Take a look at your income statements and see how your revenue has performed so far this year versus what you thought your revenue was going to be. If revenue varies from what you expect, get with your sales and marketing team to pinpoint what has gone better, or worse, than expected.

- Projected expenses. Put a stop to disappearing cash by conducting a variance analysis of your expenses. What did you expect to spend so far in 2021 on salaries and wages compared to what you actually paid your employees? What about other big expenses like rent or insurance? Take the amount of money actually spent so far in 2021 in each of your major expense accounts and compare it to your spending forecast. Then create an updated forecast for the balance of the year.

A review of your financial statements now will help you be prepared if you need to navigate an obstacle or capitalize on potential opportunities to expand your business.

A sad and oft-repeated truth is that half of all new businesses fail within the first five years. Although many factors contribute to business failure, a common culprit is poor cash management. All businesses, large and small, must deal with the uncertainty of fluctuating sales, inventories and expenses. Follow these practices to moderate the ebb and flow of cash in your business:

Analyze cash flow. If you don’t know it’s broken, you can’t fix it. The starting point for any meaningful action to control cash is discovering where the money’s coming from and where it’s going. Get a handle on cash by monitoring your bank accounts for at least one complete business cycle; then use that information to establish a realistic forecast. This should be done throughout the year to help you understand your seasonal cash needs.

Monitor receivables. Extending credit to risky customers, failing to identify late payers, refusing to collect payment on a timely basis — these practices amplify cash flow problems. Mitigate receivable fluctuations by generating aging reports. Use the report to follow up when payments are late. You may even wish to offer discounts to customers who pay early.

Monitor receivables. Extending credit to risky customers, failing to identify late payers, refusing to collect payment on a timely basis — these practices amplify cash flow problems. Mitigate receivable fluctuations by generating aging reports. Use the report to follow up when payments are late. You may even wish to offer discounts to customers who pay early.

Slow down payments. Prudent cash flow management dictates that you retain cash as long as possible. So pay your vendors on time — not too early. Of course, if suppliers offer discounts for early payment, take advantage of cost savings whenever possible. Also consider negotiating with suppliers to extend payment terms.

Time large expenses. If you know a property tax payment is due in May, start setting aside money in a separate fund in October. The same holds true for any large payment that comes due during the year. If your equipment is nearing the end of its useful life or your roof is showing signs of wear, start saving now. Don’t let big expenditures catch you by surprise.

By taking these steps and endeavoring to smooth out cash fluctuations, proficient managers keep their companies strong throughout the business cycle.