A new year. New resolutions. Here are five ideas to consider to help improve your financial health in the upcoming year.

A new year. New resolutions. Here are five ideas to consider to help improve your financial health in the upcoming year.

- Save more for retirement. Plan for the future by feathering your retirement nest egg. For instance, you can contribute up to $20,500 to a 401(k) account in 2022, plus another $6,500 if you’re age 50 or older. Plus, your company may provide matching contributions up to a stated percentage of compensation. And you can supplement this account with contributions to IRAs and/or other qualified plans.

- Update your estate plan. Now is a good time to review your will and make any necessary adjustments. For example, your will may need to be updated due to births, deaths, marriages or divorces in the family or other changes in your personal circumstances. Also review trust documents, powers of attorney (POAs) and healthcare directives or create new ones to facilitate your estate plan.

- Rebalance your portfolio. Due to the volatility of equity markets, it’s easy for a portfolio to lose balance against your investment objectives. To bring things back to where you want, review your investments periodically and reallocate funds to reflect your main objectives, risk tolerance, and other personal preferences. This will put you in a better position to handle the ups and downs of the markets.

- Review, consolidate, and lower debt levels. One sure-fire method for improving your financial health is to spend less and save more. Start by chipping away at any existing debts. This may mean giving up some luxuries, but it’s generally well worth it in the long run. Pay extra attention to debts with high interest charges like credit card debt. If possible, consider consolidating several of these debts into one or two obligations if you can lower your interest rate in the process.

- Contingency planning. No one can foresee every twist and turn that 2022 will take. To avoid potential financial hardship, look to improve your emergency fund by setting aside enough funds to pay for six months or more of your expenses in case of events like a job loss or a severe health issue.

These five tips can help you thrive in 2022!

As summer winds down, your business’s financial statements may be due for a quick check-up. Here are several review suggestions to help determine the health of your business prior to year-end.

- Balance sheet reconciliations. Reconcile each asset and liability account every quarter. A well-supported balance sheet can guide decisions about cash reserves, debt financing, inventory management, receivables, payables, and property. Regular monitoring can highlight vulnerabilities, providing time for corrective action.

- Debt service coverage. Do you have enough cash to adequately handle principal and interest payments? Calculate your cash flow to ensure you can handle both current and future monthly loan payments.

- Projected revenue. Take a look at your income statements and see how your revenue has performed so far this year versus what you thought your revenue was going to be. If revenue varies from what you expect, get with your sales and marketing team to pinpoint what has gone better, or worse, than expected.

- Projected expenses. Put a stop to disappearing cash by conducting a variance analysis of your expenses. What did you expect to spend so far in 2021 on salaries and wages compared to what you actually paid your employees? What about other big expenses like rent or insurance? Take the amount of money actually spent so far in 2021 in each of your major expense accounts and compare it to your spending forecast. Then create an updated forecast for the balance of the year.

A review of your financial statements now will help you be prepared if you need to navigate an obstacle or capitalize on potential opportunities to expand your business.

Tips for enhancing your digital privacy

Companies are following your every move. When you have a cell phone, they are tracking what apps you use, where you go, who you talk to and more! Other smart devices listen to your conversations in your home, keep track of what you view on your TV, and report where you visit and what routes you take to get there. Even worse, the more you share the greater the chance a hacker gets this information.

Consider these tips to more actively protect yourself and your information.

The power of the opt out

Apple recently introduced an opt out feature on their iPhones. Historically, when you download a new app onto an iPhone, you have to manually opt out of sharing your device’s data. Now when you download a new app on your iPhone, you’ll be asked whether you want to opt in and allow the app to have access to your information.

So, if you are an iPhone user, start with the opt out and then deliberately select who you wish to give access to your information. And opt out does not have to be global. For instance, a direction function needs your location when you use it. But it does not need to be turned on all the time.

Actions:

- Leave opt-out as default on iPhones and set default to opt-out on other mobile phone brands.

- Review all apps and turn off tracking and data sharing.

- Actively turn off your phone if you do not wish to be tracked.

- Review all smart devices and select your opt out options. Include TVs and personal assistants in your review.

Protect your web browsing

Companies love to keep tabs on your browsing habits. And it is not just limited to their own sites. They might spy on ALL your activity. They see every website you visit, monitor all your clicks, and track all social media likes and videos you view. They then use this information to determine what you see and read. In short, they control your world view, both in content and in what ads you see.

Companies love to keep tabs on your browsing habits. And it is not just limited to their own sites. They might spy on ALL your activity. They see every website you visit, monitor all your clicks, and track all social media likes and videos you view. They then use this information to determine what you see and read. In short, they control your world view, both in content and in what ads you see.

Actions:

- Actively use ad blockers such as AdBlock and uBlock.

- Turn off cookies and periodically empty your cache.

- Avoid downloading any and all extensions unless absolutely required.

Use best data protection practices

As the internet and smart devices evolve, so do the thieves that wish to steal your identity and your financial resources. So, keep up-to-date on best data protection practices.

Actions:

- Vary passwords and user IDs. Keep track of them outside of your computer.

- Keep operating systems and software up-to-date.

- Encrypt your emails and computer hard drive.

- Keep banking information off your cell phone.

- Back up all your devices remotely.

- Use current antivirus software.

- Monitor your credit reports for any suspicious activity.

- Confirm before opening suspicious emails or attachments.

Most importantly, stay informed. In the end, the burden of protecting your data always falls on you.

As a small business, once you decide to extend credit to a customer, you now have a financial stake in continuing that relationship even if you suspect there might be trouble brewing. While you don’t want to crack down on a good customer too hard, too soon, you also don’t want to be taken advantage of by a customer who has become unable or unwilling to pay. Here are some ideas to help you manage this risk.

As a small business, once you decide to extend credit to a customer, you now have a financial stake in continuing that relationship even if you suspect there might be trouble brewing. While you don’t want to crack down on a good customer too hard, too soon, you also don’t want to be taken advantage of by a customer who has become unable or unwilling to pay. Here are some ideas to help you manage this risk.

Develop a rating system. Score each customer with a number. The number represents to whom you will sell on credit and how much risk you are willing to take. Also have scores that represent customers you will not bill and those who you will no longer take orders from because of credit risk. Develop a system to objectively assign the score. Payment history and external credit scoring reports are both good indicators of whether a particular customer will be an acceptable credit risk.

Consider credit applications. Create a simple credit application. The application should be signed by the responsible party to pay the bill. If large credit amounts are expected, get a person to take personal responsibility to pay the bill. This will provide an additional means to collect your money should the company fail to pay. You will need this signed document if you wish to use a collection agency to collect delinquent accounts.

Look at history. Those to whom you provide a credit line must have their payment history monitored. If they are habitually late payers, reduce their credit line. If they frequently miss payments, move them to prepay only.

Create a notes section on your customer records. Use this to record what a late paying customer tells you. Over time, this will reveal the customers who are honest and the customers who fail that test. This idea also provides continuity of communication for the customer that tries to tell different employees different stories.

Develop a collection system. The best credit rating system starts with a receivable aging report run once a month. This will quickly show you current trouble customers and potential trouble customers. When a bill ages through the report, know what you are going to do to collect bills at 30 days, 60 days, 90 days and anything older than that.

Look for other signs of trouble. Train your team to be on alert for:

- Customers paying smaller invoices while larger invoices go unpaid.

- The customer fails to return your phone calls or shows annoyance at your inquiries.

- Your requests for information, such as updated financial statements, are ignored.

- The customer places multiple, large orders and presses you for a higher credit limit.

- The customer tries to coax you into providing a good credit report to another supplier.

- You get word that the customer’s credit rating has been downgraded.

Remember, great customers can have sincere problems paying a bill. By having a good credit rating system, you can more readily identify the customers you want to accommodate to pay their bills and those customers whose activity should be suspended because they are truly problem accounts.

Tax and financial planning is a year-round proposition. In fact, you can benefit personally from a continuous, 12-month rolling forecast, much like a business does.

What is a rolling forecast?

Rolling forecasts let you continuously plan with a constant number of periods 12 months into the future. For example, on January 1, you would plan what your financial picture looks like each month through January 1 of the following year. When February 1 rolls around, you would then drop the beginning month and add a forecast month at the end of the 12-month period. In this case, you add February of the next year into your 12-month forecast.

The month you add at the end of the 12 months uses the finished month as a starting point. You then make adjustments based on what you think might happen one year from now. For example, if you know you are going to get a raise at the end of the year, your next-year February forecast would reflect this change.

The month you add at the end of the 12 months uses the finished month as a starting point. You then make adjustments based on what you think might happen one year from now. For example, if you know you are going to get a raise at the end of the year, your next-year February forecast would reflect this change.

How to take advantage of a rolling forecast

By doing tax and financial planning in rolling 12-month increments, you may find yourself in position to cash in on tax- and money-saving opportunities within the next 12 months. Here are several strategies to consider:

- Plan your personal budget. Will you need to put a new roof on your house? How about getting a new vehicle? Do you need to start saving for your kids’ college education? A rolling 12-month forecast can help you plan for these expenses throughout the year.

- Plan your healthcare expenses. If you have a flexible spending account (FSA) for healthcare or dependent care expenses, forecast the amount you should contribute for the calendar year. Although unused FSA amounts are normally forfeited at year-end, your employer may permit a 12-month grace period (up from 2½ months) for 2021. This means that you could potentially roll over your entire unused FSA balance from 2021 to 2022. Your forecast can help you see the impact of this change.

- Plan your contributions to a Health Savings Account (HSA). When an HSA is paired with a high-deductible health insurance plan, you can take distributions to pay qualified healthcare expenses without owing any tax on the payouts. For 2021, the contribution limit is $3,600 for an individual and $7,200 for family coverage. In this case, you can forecast an increase in contributions and double-check to ensure you have enough money on hand to pay future bills.

- Plan your estimated tax payments. This is often significant for self-employed individuals and retirees with investment earnings. The quarterly due dates for paying federal and state tax liabilities are April 15, June 15, September 15, and January 15 of the following year (or the next business day if the deadline falls on a holiday or weekend). So, if your personal income is seeing a recovery from the pandemic, your rolling forecast will show this and allow you to plan for the estimated tax payments.

- Plan your retirement contributions. If you participate in your company’s 401(k) plan, you can defer up to $19,500 to your account in 2021 ($26,000 if you’re 50 or over). Contributions and earnings compound tax-deferred. As the year winds down, you might boost your deferral to save even more for retirement.

While initially setting up a rolling 12-month forecast can be a bit of a pain, once established, it is pretty easy to keep up-to-date as you are simply rolling forward last month into the future. A well-planned system can often be the first sign of future challenges or potential windfalls!

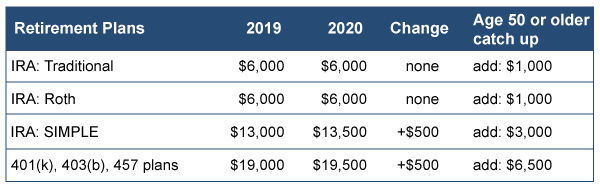

As part of your 2020 planning, now is the time to review funding your retirement accounts. By establishing your contribution goals at the beginning of each year, the financial impact of saving for your future should be more manageable. Here are annual contribution limits:

Take action

If you have not already done so, please consider:

- Reviewing and adjusting your periodic contributions to your retirement savings accounts to take full advantage of the tax advantaged limits

- Setting up new accounts for a spouse or dependent(s)

- Using this time to review the status of your retirement plan

- Reviewing contributions to other tax-advantaged plans including flexible spending accounts and health savings accounts

Couples consistently report finances as the leading cause of stress in their relationship. Here are a few tips to avoid conflict with your long-term partner or spouse:

Be transparent. Be honest with each other about your financial status. As you enter a committed relationship, each partner should learn about the status of the other person’s debts, income and assets. Any surprises down the road may feel like dishonesty and lead to conflict.

Discuss future plans often. The closer you are with your partner, the more you’ll want to know about the other person’s future plans. Kids, planned career changes, travel, hobbies, retirement expectations — all of these will depend upon money and shared resources. So, discuss these plans and create the financial roadmap to go with them. Remember that even people in a long-term marriage may be caught unaware if they fail to keep up communication and find out their spouse’s priorities have changed over time.

Know your comfort levels. As you discuss your future plans, bring up hypotheticals: How much debt is too much? What level of spending versus savings is acceptable? How much would you spend on a car, home or vacation? You may be surprised to learn that your assumptions about these things fall outside your partner’s comfort zone.

Divide responsibilities; combine forces. Try to divide financial tasks such as paying certain bills, updating a budget, contributing to savings and making appointments with tax and financial advisors. Then periodically trade responsibilities over time. Even if one person tends to be better at numbers, it’s best to have both members participating. By having a hand in budgeting, planning and spending decisions, you will be constantly reminded how what you are doing financially contributes to the strength of your relationship.

Learn to love compromise. No two people have the same priorities or personalities, so differences of opinion are going to happen. One person is going to want to spend, while the other wants to save. Vacation may be on your spouse’s mind, while you want to put money aside for a new car. By acknowledging that these differences of opinion will happen, you’ll be less frustrated when they do. Treat any problems as opportunities to negotiate and compromise. Instead of looking at the outcome as “I didn’t get everything I wanted,” think of it as “We both made sacrifices out of love for each other.”

As the end of the year approaches, there is still time to make moves to manage your tax liability. Here are some ideas to consider.

As the end of the year approaches, there is still time to make moves to manage your tax liability. Here are some ideas to consider.

Maximize your retirement plan contributions. This includes traditional IRAs, Roth IRAs, and SEP IRAs for self-employed. Now is the time to maximize the contribution potential for this year and plan for next year’s contributions.

Estimate your current and next year taxable income. With this estimate you can determine which year receives the greatest benefit from a reduction in income. By understanding what the tax rate will be for your next dollar earned, you can understand the tax benefit of reducing income in this year versus next year.

Make charitable contributions. Consider which tax year will benefit most from your charitable giving of cash and non-cash items. Shift your giving into the year that will provide you the most benefit.

Take capital losses. Each year you can net capital losses against capital gains. You can also deduct up to $3,000 in excess losses against your other income. Start to identify which investments may make sense to sell to take advantage of this. If planned correctly, these losses can offset ordinary income.

Consider donating appreciated stock. This strategy gives you a charitable deduction for the market value of the stock, while not having to pay capital gains tax on the charitable gift. If you provide an annual pledge sheet to your church, this can be a great way to maximize your gift while giving needed funds to your church at the beginning of the year.

Retirement plan distributions. If you are age 70½ or older, take your required minimum distributions for the year. If you are retired, but younger than 70½, consider taking tax efficient distributions from your retirement accounts. By paying some tax now, you may avoid paying higher taxes later when you have to follow the minimum distribution rules.

Consider tax legislation. Please recall that tax laws passed in late 2016 made many temporary tax savings permanent and extended others into 2017. So save classroom related receipts if you are a teacher. Consider charitable contributions from your retirement plan if you are a senior. Keep receipts of large purchases to track a potential sales tax deduction.

The turn it on and forget it nature of automatic payments can create “zombie billing” cycles that go on without being reviewed or challenged, even after the product or service you pay for is no longer of value.

The turn it on and forget it nature of automatic payments can create “zombie billing” cycles that go on without being reviewed or challenged, even after the product or service you pay for is no longer of value.

Here are some ideas to keep this from happening to you.

Create a list. Make a list of the companies you authorize to use automatic bill payment. Include the account number each company uses, as well as payment amounts and frequency. When there’s a change in a card or bank account, you can consult the list to find the companies you need to notify.

Watch for fees. Make sure the bill-payment system you’re using is low-cost or no-cost. Some companies will charge you a fee for automatic payments. If your biller wants to charge you, pay them with a traditional check. Consider consolidating all your automatic payments within one bill-paying service. Your bank may even offer online bill payment with no fee.

Review underlying bills. Automated billing usually means you’re not getting paper copies of your bill. If you’re not receiving a physical copy, changes to your service may go unnoticed. If possible, opt to continue receiving email or paper billing statements. Review statements monthly to verify that your payment has not changed and there are no additional fees or errors.

Drop underused services. Periodically review all automatic payments. Drop products and services that are no longer of value.

Automatic billing is meant to simplify your life, but if you allow it to turn into zombie billing, it will have the opposite effect. Take care to review your accounts and statements to protect yourself and keep your finances under your control.

Two-thirds of the Baby Boomer generation are now working or plan to work beyond age 65, according to a recent Transamerica Institute study. Some report they need to work because their savings declined during the financial crisis, while others say they choose to work because of the greater sense of purpose and engagement that working provides. Whatever your reason for continuing to work into your golden years, below is Part 1 of a 2-part series with tips to make sure you get the greatest benefit from your efforts.

- Consider delaying Social Security. You can start receiving Social Security retirement benefits as early as age 62, but if you continue to work it may make sense to delay taking it until as late as age 70. This is because your Social Security benefit may be reduced or be subject to income tax due to your other income. In addition, your Social Security monthly benefit increases when you delay starting the retirement benefit. These increases in monthly benefits stop when you reach age 70.

- Don’t get bracket-bumped. Keep in mind that you may have multiple income streams during retirement that can bump you into a higher tax bracket and make other income taxable if you’re not careful. For instance, Social Security benefits are only tax-free if you have less than a certain amount of adjusted gross income ($25,000 for individuals and $32,000 for married filing jointly in 2017), otherwise as much as 85 percent of your benefits are taxable. Required distributions from pensions and retirement accounts can also add to your taxable income. Be aware of how close you are to the next tax bracket and adjust your plans accordingly.

- Be smart about health care. When you reach age 65, you’ll have the option of making Medicare your primary health insurance. If you continue to work, you may be able to stay on your employer’s health care plan, switch to Medicare, or adopt a two-plan hybrid option that includes Medicare and a supplemental employer care plan. Look over each option closely. You may find that you’re giving up important coverage if you switch to Medicare prematurely while you still have the option of sticking with your employer plan.