A recent survey by the National Federation of Independent Businesses (NFIB) found that many companies are struggling to attract and retain qualified workers. While some businesses have countered this shortage of workers by raising hourly rates to record levels according to the NFIB, other businesses don’t have the financial flexibility to do this.

If you’re a business that doesn’t have the financial resources to raise pay, consider differentiating yourself by adding unique employee benefits. After all, the cost of losing a potential or existing employee to a competitor may outstrip the expense of an easy-to-implement employee perk.

If you’re a business that doesn’t have the financial resources to raise pay, consider differentiating yourself by adding unique employee benefits. After all, the cost of losing a potential or existing employee to a competitor may outstrip the expense of an easy-to-implement employee perk.

Here are several unique benefits to consider offering current and prospective employees:

- Flexible schedules. By creatively managing time, you can maintain workflow and keep employees productive. For example, some firms have offered a 9/80 work schedule. Over the course of two weeks, an employee works eight 9-hour days, one 8-hour day, and gets one day off. Another common option is the 4/10 schedule where each employee works four 10-hour days and takes every Friday off.

- On-site health and wellness perks. Some examples include allowing workers to visit a mobile dental clinic or registered nurse during work hours, negotiating a group discount at the local gym and providing employee gym memberships, or making weekly massages and lunch-break yoga classes available.

- Family support. On-site childcare for busy parents, rooms for nursing mothers and generous parental leave policies are family benefit options to consider. Some companies have implemented a program of chore help where the business covers the cost of laundry or cleaning services for workers who work long hours. For some businesses, permitting employees to work from home several days a week is another great perk for workers who have families and may need the location flexibility.

- Pet-friendly office. Let dog owners bring their furry companion to work on a periodic basis. Besides decreasing stress for the pet owner, dogs often facilitate group bonding. Other pet-friendly options include free training classes or discounted veterinary services. For employees who don’t own pets, pet-friendly funds can be applied toward other perks such as gym memberships or free lunches.

- Referral bonuses. If your firm is struggling to attract qualified workers, consider paying existing employees for every person who attends an interview via an employee referral. The existing worker might be offered a lump sum payment or even an allowance for each month the new hire remains on the job.

By being flexible and listening to your employees, you can generate many ideas for unique employee benefits. And the retention that results will benefit both you and your employees.

Legislation provides other business relief provisions

Here’s what you need to know about the Paycheck Protection Program (PPP) loans and other business relief provisions of the recently-passed American Rescue Plan Act.

Here’s what you need to know about the Paycheck Protection Program (PPP) loans and other business relief provisions of the recently-passed American Rescue Plan Act.

PPP loan application deadline extended. The deadline to apply for PPP loans is now May 31, 2021.

Sick leave extended. If your business provides sick leave for COVID-related reasons, you might get reimbursed for the sick pay through a tax credit.

- Businesses which voluntarily provide sick leave through September 30, 2021 qualify for the credit. There are limits for each employee. However, for employees who took 10 days of sick leave in 2020 using this same provision, they can take another 10 days beginning April 1, 2021.

- Refundable tax credits are available through September 30, 2021.

- Covered reasons to get the tax credit now include sick leave taken to get COVID testing and vaccination, and to recover from the vaccination.

- These benefits are also extended to self-employed workers.

Family Medical Leave Act Provisions extended.

- Additional coverage is now available through September 30, 2021.

- Qualified wages for this provision move to $12,000 (up from $10,000) however the credit was not increased.

- The Family Medical Leave Act also applies to the self-employed.

Big increase in Employee Retention Credit.

- Businesses can get up to a $28,000 tax credit per employee in 2021, up from a $5,000 maximum credit in 2020. This credit can be claimed through Dec. 31, 2021.

There are many more provisions in the close to $2 trillion dollar spending package, including money given to states. As everyone digests this new 500-plus page piece of legislation, more clarifications will be forthcoming from the IRS and other sources.

Tax challenges can be VERY expensive

As a small business owner, you may face the issue of whether to classify workers as employees or as independent contractors.

Classifying your workers as independent contractors generally saves you money. That’s because you avoid paying employment taxes and benefits on their behalf.

Classifying your workers as independent contractors generally saves you money. That’s because you avoid paying employment taxes and benefits on their behalf.

If the IRS determines that you misclassified your employees as contractors, you could end up paying all of the employment taxes and benefits that would have been paid over the years. Depending on the size of your work force, the cost to your business could be substantial.

In determining whether the person providing a service is an employee or an independent contractor, all information that provides evidence of the degree of control and independence must be considered. There are three primary categories of control and independence that the IRS considers when determining if a worker is a contractor or an employee:

- Behavioral. Does the company control or have the right to control what the worker does and how the worker does his or her job? If yes, the worker is an employee.

- Financial. Are the business aspects of the worker’s job controlled by the payer? This includes things like how the worker is paid, whether expenses are reimbursed and whether the employer provides tools and supplies. If yes, the worker is an employee.

- Type of relationship. Are there written contracts or employee-type benefits? If contracts are involved, the worker may be a contractor. If benefits such as a pension plan, insurance and vacation pay are made available, the worker most likely is an employee.

Deciding whether a worker is a contractor or employee can get complicated. And remember that there are significant financial consequences for incorrectly classifying a worker.

If you have employees, you know how important health insurance is for your benefits package. It also takes a big bite out of your budget. Selecting the right insurance for your company is extremely important for employee retention and maintaining your bottom line. Here are tips to help you find the best health insurance for your business:

If you have employees, you know how important health insurance is for your benefits package. It also takes a big bite out of your budget. Selecting the right insurance for your company is extremely important for employee retention and maintaining your bottom line. Here are tips to help you find the best health insurance for your business:

- Know the size of the network. A popular way to lower insurance costs is opting for a smaller network of health care providers. Known as narrow provider networks, coverage is limited to a much smaller group of clinics and hospitals than traditional plans. But while the cost savings are nice, employee satisfaction is likely to decline as some of them will have to change doctors to stay in network. When researching insurance options, be sure to compare the network size to industry averages.

- Watch for coverage limits. Lifetime and annual dollar limits for essential health benefits were banned in 2014, but limits still appear in other ways. Dental services, for example, are exempt from the dollar limits and often have annual and lifetime coverage limits. Another way insurance providers hedge their risk is by limiting the number of a certain type of visits, like for chiropractic care or physical therapy.

- Don’t forget prescription coverage. Many health insurance programs don’t include full coverage for prescription drugs, so you may need to add supplemental insurance. Pay special attention to the coverage differences between brand name and generic drugs. Also review any deductibles and other limits. Another type of coverage available is a prescription discount program. Discount plans simply charge you a subscription cost that allows you to use a contracted discount.

- Understand what isn’t covered. When trying to sell you on their plan, insurance providers do a good job showing you what they cover. What can be harder to figure out is what they don’t cover. Some of the types of services that may not be covered are vision care, nursing home care, cosmetic surgery, alternative therapies like massage therapy or acupuncture, and weight-loss procedures.

- Be prepared to provide employee data. The process of obtaining a quote for health insurance can be an overwhelming task. Health insurance companies will want, at a minimum, a list of employees with some pertinent details like age, sex, coverage details (self, spouse and other dependents), and home zip code. They will want the forms filled out by all employees, even those that are opting out of insurance coverage. If you are working with a benefits broker, they can help you prepare what will be needed in advance to speed up the process.

Shopping for health insurance for your business is complicated. Taking the appropriate time to understand each coverage option and the associated costs will benefit both your business and your employees’ well-being.

Whether you are hiring for the first time, filling an open position, or conducting annual performance reviews, finding a salary range that attracts and retains valued employees can be a difficult task. Here are some suggestions to help make the process a bit easier for you and your company:

- Know what your business can afford. Like any business expense, you need to know how it will affect your budget and cash flow. Make a twelve-month profitability and cash forecast and then plug in the high end of the annual salary range you are considering to see if it’s something your business can absorb. After all, the greatest employee in the world can’t help you if you don’t have the money to pay them. Don’t forget to account for increases in benefit costs, especially the escalating cost to provide healthcare. Once you establish a budget, you can allocate your spending plan to your payroll.

- Understand the laws. In general, the federal government sets the minimum requirements (minimum wage of $7.25 per hour, overtime rules and record keeping requirements). States and localities often add their own set of rules. For example, the state of Illinois, Cook County and the city of Chicago all have different minimum wage requirements. If you are located in Chicago you need to adhere to the highest rate. So research all payroll rules that apply to your location at the beginning of the process. When reviewing the rules, don’t forget that different rules often apply depending on the number of employees in your business.

- Review and update job descriptions. Take some time to review key jobs and update them as appropriate. With new positions, note the exact tasks and responsibilities you envision for the role. Then, think about the type of person that will succeed performing these responsibilities. Once you have a clear picture of who you are looking for, you can begin to build a detailed job description and narrow in on a specific salary range.

- Establish value ranges and apply them. Value is key when determining the perfect salary amount. Define the range of value for the position and then apply that valuation to the current person’s performance within the defined pay range. Use websites and recruiters to establish the correct range of pay, then apply experience and employee performance to obtain a potential new salary amount. Remember, size of company, location and competitiveness of the job market are all factors to consider.

- Factor in company benefits. A strong suite of employee benefits is a powerful tool to couple with a competitive salary. Don’t be afraid to communicate their value to prospective and current employees (they help with retention, too!). According to Glassdoor, health and dental insurance are the most important, but flexibility is close behind – over 80 percent of job seekers take flexible hours, vacation time and work-from-home options into consideration before accepting a position.

Finding the right salary can be tricky, but with some preparation and research, you can find the balance that satisfies the needs of your business and your employees.

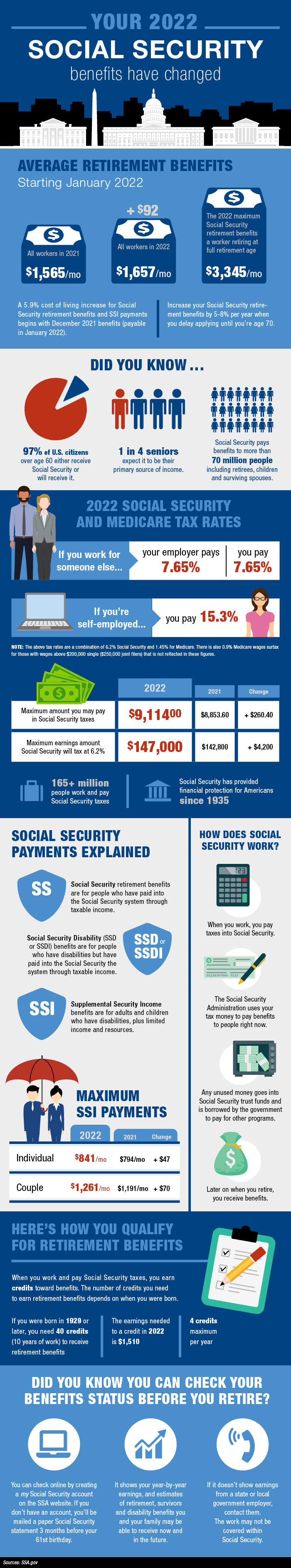

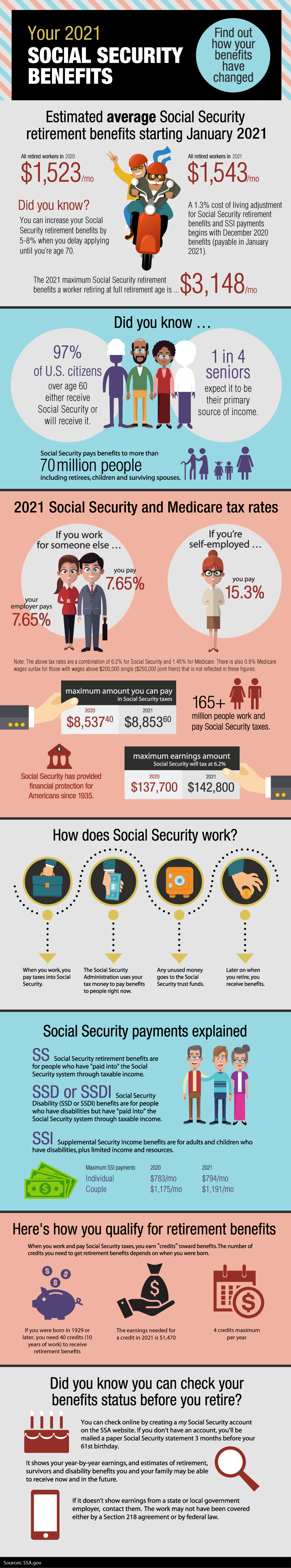

The Social Security Administration is now doing a better job in sending out earnings reports by mailing paper statements to workers every five years beginning at age 25. The reports are also available online at https://www.ssa.gov. These reports recap historic earnings and contain an estimate of potential benefits.

When you receive your report, spend a few minutes reviewing the statement. Here are some suggestions on how to do this.

- Review your earnings history – Towards the back of the report is a recap of your earnings record. This should accurately reflect reported earnings on your tax return. This number is a summary of all your earnings subject to Social Security as reported by your employer on your W-2 forms. But if you are self-employed or have many employers, you must make sure that the income properly reflects what you earned.

Action: Employees: Pull out your W-2s and make sure the totals match. Self-employed: Pull out your tax return and confirm totals match. Review history: Review historic figures as well. Your Social Security benefits use your full work history to calculate future benefits.

- Review your potential retirement benefits – The Social Security statement will provide you with an estimate of your benefit amount using current dollars and current work history. The value of your benefit will show three benefit amounts. One for the minimum retirement age of 62, one for the maximum amount if you start your benefits at age 70, and one for your full retirement age between the ages of 65 and 67.

Action: Consider these monthly benefit amounts in terms of your retirement plan to help create a realistic picture of what you will have available to you when you retire.

- Note other benefits – Remember, Social Security is not just about your retirement benefits. There are also estimates presented for disability and surviving family benefits. Please review these estimates to understand the potential benefits these programs may provide.

- Remember current benefits are just estimates – The benefits noted on this statement are estimates. Actual benefit amounts rise with inflation, change with tax laws, and adjust with your future earnings. Your benefit statement will show you the assumptions used in creating your estimated amounts.

Action: Review the assumptions used by the Social Security Administration. Pay special attention to the future earnings used by them to create the benefit amounts. If you do not think they are accurate, you may need to create revised estimates with more accurate assumptions.

Should you find any errors in the statement correct them immediately. The last page of the statement provides a means for doing this.

Are you one of those who have carefully planned ahead for your retirement – setting up tax-advantaged savings accounts and researching the best place to live? You might be surprised to learn about the many tax issues that apply to retirees which should be taken into consideration when planning your retirement.

For example, you could face taxes on distributions from retirement or investment accounts, required minimum distributions from some retirement accounts and potential taxes on Social Security payments. You also need to consider state and local income, sales or property taxes – as well as state taxes on retirement benefits and estates.

The good news is, there’s still time to anticipate and reduce some of those complications. Take the time now to properly plan your tax burden so your retirement is secure.

Roughly 10,000 American Baby Boomers turn 65 every day. One important decision they’re facing is when to file for their Social Security benefits, because that can have a significant impact on the amount they receive. For example, if you retire before you reach full retirement age, you could reduce your benefit by as much as 30%. For every additional year you stay on the job until age 70, you could raise your benefit as much as 8%.

Married couples have the added responsibility to strategize to boost the benefit amounts they receive over time. For example, one spouse may decide to file sooner or later based on both spouses’ lifetime earnings history and health situation. Or, depending on how they coordinate their retirement planning, one spouse might start taking a spousal benefit based on the other’s earning before reaching full retirement age.

Before filing, research all the options so as to maximize the benefits and avoid the pitfalls.