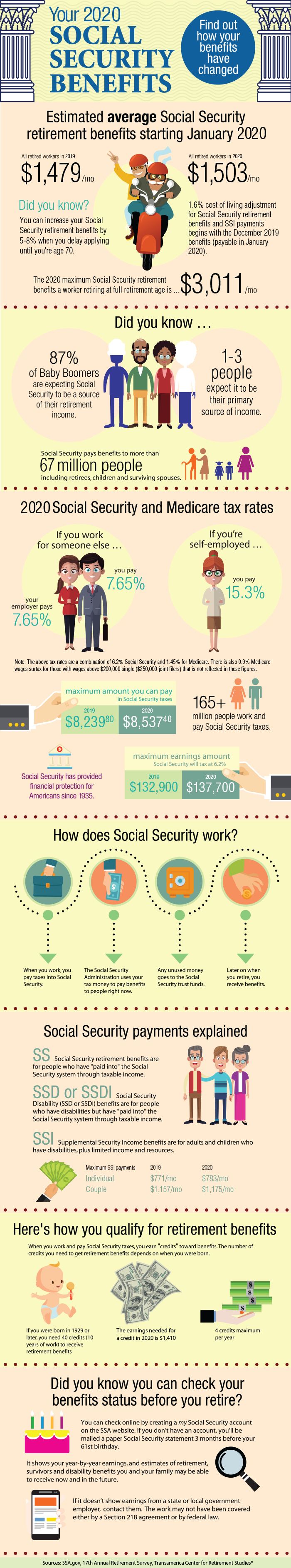

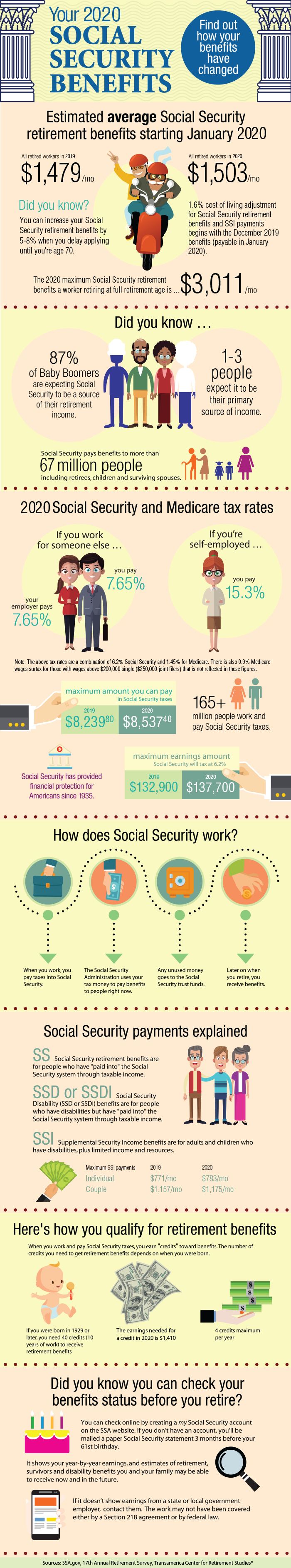

Take a look at how Social Security benefits have changed. Use this infographic to help you plan for the coming year, and to learn a little more about retirement benefits and taxes.

Take a look at how Social Security benefits have changed. Use this infographic to help you plan for the coming year, and to learn a little more about retirement benefits and taxes.

There’s still time to reduce your potential tax obligation and save money this year (and next). Here are some ideas to consider:

There’s still time to reduce your potential tax obligation and save money this year (and next). Here are some ideas to consider:

The Consumer Financial Protection Bureau recently reported in financial exploitation cases that older adults lost an average of $34,200. Unfortunately, these funds are often never recovered. You can ensure this doesn’t happen by learning more about scams and how to protect yourself. Here are some tips:

Did you know? IRS impersonation scams are the No. 1 scam targeting older adults, according to the Treasury Inspector General for Tax Administration, with more than 2.4 million Americans targeted.

With summertime activities in full swing, tax planning is probably not on the top of your to-do list. But putting it off creates a problem at the end of the year when there’s little time for changes to take effect. If you take the time to plan now, you’ll have six months for your actions to make a difference on your 2019 tax return. Here are some ideas to get you started.

Know your upcoming tax breaks. Pull out your 2018 tax return and take a look at your income, deductions and credits. Ask yourself whether all these breaks will be available again this year. For example:

Any changes to your tax situation will make planning now much more important.

Make tax-wise investment decisions. Have some loser stocks you were hoping would rebound? If the prospects for revival aren’t great, and you’ve owned them for less than one year (short-term), selling them now before they change to long-term stocks can offset up to $3,000 in ordinary income this year. Conversely, appreciated stocks held longer than one year may be candidates for potential charitable contributions or possible choices to optimize your taxes with proper planning.

Make tax-wise investment decisions. Have some loser stocks you were hoping would rebound? If the prospects for revival aren’t great, and you’ve owned them for less than one year (short-term), selling them now before they change to long-term stocks can offset up to $3,000 in ordinary income this year. Conversely, appreciated stocks held longer than one year may be candidates for potential charitable contributions or possible choices to optimize your taxes with proper planning.

Adjust your retirement plan contributions. Are you still making contributions based on last year’s limits? Maximum savings amounts increase for retirement plans in 2019. You can contribute up to $13,000 to a SIMPLE IRA, up to $19,000 to a 401(k) and up to $6,000 to a traditional or Roth IRA. Remember to add catch-up contributions if you’ll be 50 by the end of December!

Plan for upcoming college expenses. With the school year around the corner, understanding the various tax breaks for college expenses before you start doling out your cash for post-secondary education will ensure the maximum tax savings. There are two tax credits available, the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit. Plus there are tax benefits for student loan interest and Coverdell Savings accounts. Add 529 college savings plans, and you quickly realize an educational tax strategy is best established early in the year.

Add some business to your summer vacation. If you own a business, you might be able to deduct some of your travel expenses as a business expense. To qualify, the primary reason for your trip must be business-related. Keep detailed records of where and when you work, plus get receipts for all ordinary and necessary expenses!

Great tax planning is a year-round process, but it’s especially effective at midyear. Making time now not only helps reduce your taxes, it puts you in control of your entire financial situation.

Couples consistently report finances as the leading cause of stress in their relationship. Here are a few tips to avoid conflict with your long-term partner or spouse:

Be transparent. Be honest with each other about your financial status. As you enter a committed relationship, each partner should learn about the status of the other person’s debts, income and assets. Any surprises down the road may feel like dishonesty and lead to conflict.

Discuss future plans often. The closer you are with your partner, the more you’ll want to know about the other person’s future plans. Kids, planned career changes, travel, hobbies, retirement expectations — all of these will depend upon money and shared resources. So, discuss these plans and create the financial roadmap to go with them. Remember that even people in a long-term marriage may be caught unaware if they fail to keep up communication and find out their spouse’s priorities have changed over time.

Know your comfort levels. As you discuss your future plans, bring up hypotheticals: How much debt is too much? What level of spending versus savings is acceptable? How much would you spend on a car, home or vacation? You may be surprised to learn that your assumptions about these things fall outside your partner’s comfort zone.

Divide responsibilities; combine forces. Try to divide financial tasks such as paying certain bills, updating a budget, contributing to savings and making appointments with tax and financial advisors. Then periodically trade responsibilities over time. Even if one person tends to be better at numbers, it’s best to have both members participating. By having a hand in budgeting, planning and spending decisions, you will be constantly reminded how what you are doing financially contributes to the strength of your relationship.

Learn to love compromise. No two people have the same priorities or personalities, so differences of opinion are going to happen. One person is going to want to spend, while the other wants to save. Vacation may be on your spouse’s mind, while you want to put money aside for a new car. By acknowledging that these differences of opinion will happen, you’ll be less frustrated when they do. Treat any problems as opportunities to negotiate and compromise. Instead of looking at the outcome as “I didn’t get everything I wanted,” think of it as “We both made sacrifices out of love for each other.”

As the year draws to a close, there are several tax-saving ideas you should consider. Use this checklist to make sure you don’t miss an opportunity before the year is out.

As the year draws to a close, there are several tax-saving ideas you should consider. Use this checklist to make sure you don’t miss an opportunity before the year is out.

Retirement distributions and contributions. Make final contributions to your qualified retirement plan, and take any required minimum distributions from your retirement accounts. The penalty for not taking minimum distributions can be high.

Investment management. Rebalance your investment portfolio, and take any final investment gains and losses. Capital losses can be used to net against your capital gains. You can also take up to $3,000 of capital losses in excess of capital gains each year and use it to lower your taxable ordinary income.

Last-minute charitable giving. Make a late-year charitable donation. Even better, make the donation with appreciated stock you’ve owned more than a year. You often can make a larger donation and get a larger deduction without paying capital gains taxes.

Noncash donation opportunity. Gather up non-cash items for donation, document the items, and give those in good condition to your favorite charity. Make sure you get a receipt from the charity, and take a photo of the items donated.

Gifts to dependents and others. You may provide gifts to an individual of up to $14,000 per year in total. Remember that all gifts given (birthdays, holidays, etc.) count toward the annual total.

Organize records now. Start collecting and organizing your end-of-year tax records. Estimate your tax liability and make any required estimated tax payments.

Two-thirds of the Baby Boomer generation are now working or plan to work beyond age 65, according to a recent Transamerica Institute study. Some report they need to work because their savings declined during the financial crisis, while others say they choose to work because of the greater sense of purpose and engagement that working provides. Whatever your reason for continuing to work into your golden years, below is Part 2 of a 2-part series with tips to make sure you get the greatest benefit from your efforts.

4. Consider your expenses. If you’re reducing your working hours or taking a part-time job, you also have to consider the cost of your extra income stream. Calculate how much it costs to commute and park every day, as well as the expense of meals, clothing, dry cleaning and any other expenses. Now consider how much all those expenses amount to in pre-tax income. Be aware whether the benefits you get from working a little extra are worth the extra financial cost.

5. Time to downsize or relocate? Where and how you live can be an important factor determining the kind of work you can do while you’re retired. Downsizing to a smaller residence or moving to a new locale may be a good strategy to pursue a new kind of work and a different lifestyle.

6. Focus on your deeper purpose. Use your retirement as an opportunity to find work you enjoy and that adds value to your life. Choose a job that expresses your talents and interests, and that provides a place where your experiences are valued by others.

Two-thirds of the Baby Boomer generation are now working or plan to work beyond age 65, according to a recent Transamerica Institute study. Some report they need to work because their savings declined during the financial crisis, while others say they choose to work because of the greater sense of purpose and engagement that working provides. Whatever your reason for continuing to work into your golden years, below is Part 1 of a 2-part series with tips to make sure you get the greatest benefit from your efforts.

Three of every four Americans got a refund check last year and the average amount was $2,777, according to IRS statistics. Because the amount of a refund is often uncertain, we may be tempted to spend it without too much planning. One way to counteract this natural tendency is to come up with a plan beforehand to spend your refund purposefully.

Here are some ideas:

Pay off debt. If you have debt other than your home mortgage, a great spending priority can be to reduce or eliminate it. The longer you hold debt, the more the cumulative interest burden weighs on your future plans. You have to work harder for longer just to counteract the effect of the debt on your financial health. Start by paying down debts with the highest interest rates and work your way down the list until you bring your debt burden down to a manageable level.

Save for retirement. Saving for retirement works like debt, but in reverse. The longer you set aside money for retirement, the more time you give the power of compound earnings to work for you. This money can even continue working for you long after you retire. Consider depositing some or all of your refund check into a Traditional or Roth IRA. You can contribute a total of $5,500 to an IRA every year, or $6,500 if you’re 50 years old or older.

Save for a home. Home ownership is a source of wealth and stability for many Americans. If you don’t own a home yet, consider building up a down payment fund using some of your refund. If you already own a home, consider using your refund to start paying your mortgage off early.

Invest in yourself. Sometimes the best investment isn’t financial, but personal. If there’s a course of study or conference that would improve your skills or knowledge, that could be a wise use of your money in the long run.

Give some of it away. Helping people, and being able to deduct gifts and charity from your next tax return, isn’t the only benefit of giving to a good cause. Research shows that it makes us feel good on a neurological level. In fact, donating money activates our brains’ pleasure centers more than receiving the equivalent amount.1

If a refund is in your future, start planning now on how it can best help your financial situation.

You’ve done your retirement homework. Your assets are reviewed, you have planned your financial needs, and your retirement tax plan is in place. Are you ready to enjoy retirement? Probably, but not without a plan to address what happens to many people after they retire – boredom.

Here are some ideas to make sure your retirement is everything it should be:

Go to school – Many colleges and communities offer classes for retired students. Pick topics of interest and take advantage of this cost effective way to stay alert through learning. Many classes can have built in activities. Examples could be local history classes with field trips, photography classes, writing, and gardening. As an added benefit, you will meet others with your shared interest while you continue learning.

Pick up part-time work – If you are outgoing, why not pick up a few hours at a local retail establishment?

Volunteer – Many retirees volunteer at libraries, museums, and parks. Others volunteer at their local church, deliver meals, and help young people with literacy. The possibilities are endless.

Schedule physical activity – Staying physically active will keep your body and mind in shape. Create a weekly routine that keeps you moving. Volunteer to take the grand kids to swimming lessons while their parents are working. Bike or walk to do everyday chores.

Look for combinations – With a little creativity you can combine some of these ideas. For example, if you coached your kids in soccer why not consider refereeing kids’ games? You might earn a little pay, stay connected with kids, and get some physical activity.

Get Connected – When you retire, many of your social connections will change. This is especially true for work connections and availability of friends that are still working. Look for other ways to make new connections. Use some of the ideas here to actively get connected with others that share your interests.

Blend in your dreams – If you’ve always dreamed of moving to a new place in retirement, you may want to test-drive it first. A dream move may turn out to be different than you anticipated. You may miss your kids and friends. Services and connections you take for granted may become a problem. By renting a place and staying in the new location prior to committing, you will be prepared with a fall back if it does not work.