Tag Archives: Medicare

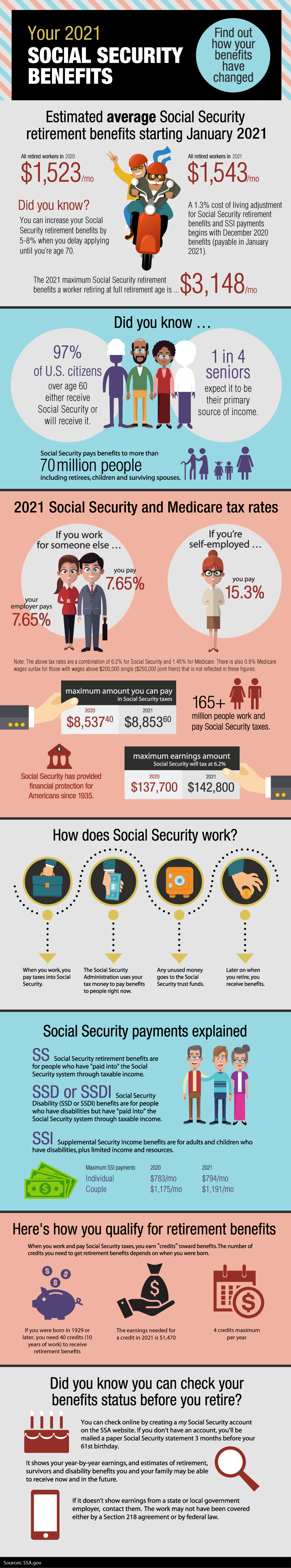

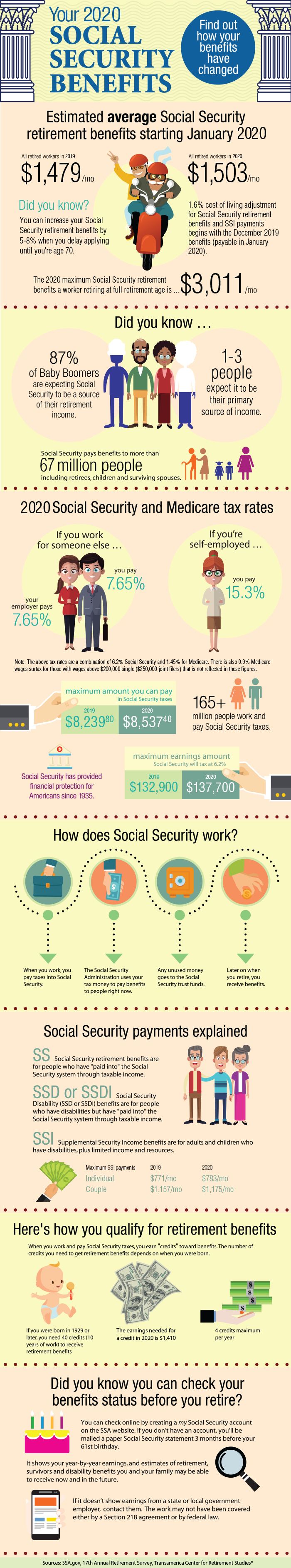

2020 Social Security Benefits

Take a look at how Social Security benefits have changed. Use this infographic to help you plan for the coming year, and to learn a little more about retirement benefits and taxes.

Contractor or Employee? Knowing the Difference is Important

Is a worker an independent contractor or an employee? This seemingly simple question is often the contentious subject of IRS audits. As an employer, getting this wrong could cost you plenty in the way of Social Security, Medicare, and other employment-related taxes. Here is what you need to know.

Is a worker an independent contractor or an employee? This seemingly simple question is often the contentious subject of IRS audits. As an employer, getting this wrong could cost you plenty in the way of Social Security, Medicare, and other employment-related taxes. Here is what you need to know.

The basics

As the worker. If you are a contractor and not considered an employee, you must:

- Pay self-employment taxes (Social Security and Medicare-related taxes)

- Make estimated federal and state tax payments

- Handle your own benefits, insurance and bookkeeping

As the employer. You must ensure your employee versus independent contractor determination is correct. Getting this wrong in the eyes of the IRS can lead to:

- Payment and penalties related to Social Security and Medicare taxes

- Payment of possible overtime including penalties for a contractor reclassified as an employee

- Legal obligation to pay for benefits

Things to consider

When the IRS re-characterizes an independent contractor as an employee, they look at the business relationship between the employer and the worker. The IRS focuses on the degree of control exercised by the employer over the work done and they assess the worker’s independence. Here are some guidelines:

- The more the employer has the right to control the work (when, how and where the work is done), the more likely the worker is an employee

- The more the financial relationship is controlled by the employer, the more likely the relationship will be seen as an employee and not an independent contractor To clarify this, an independent contractor should have a contract, have multiple customers, invoice the company for work done, and handle financial matters in a professional manner

- The more businesslike the arrangement, the more likely you have an independent contractor relationship

While there are no hard-set rules, the more reasonable your basis for classification and the more consistently it is applied, the more likely an independent contractor classification will not be challenged.

Your First Job: An Intro to Taxes

As school winds down, a number of students will hit the job market for summer employment. When this is a first job, it is often one of the first times you experience the world of taxes. Please use this information to help make the move to the workforce a little more understandable.

Form I-9 – When you get the job, your new employer will have you fill out tax form I-9, Employment Eligibility Information. This is a legal requirement to show you have the right to work and it confirms your tax information. You will be asked to provide proof of identity, including showing your Social Security card.

Form W-4 – You will also be asked to fill out a tax withholding form. This form gives employers instructions on how much they should withhold from your paycheck to send in to taxing authorities like the IRS. By filling out the form correctly, enough will be withheld from your pay to ensure you do not owe too much in tax when you file your tax return.

Other Taxes – You will notice your check amount is also reduced for your contributions to Social Security and Medicare. Your paycheck will be reduced by 6.2% for Social Security and 1.45% for Medicare payments. You are not in this alone. Your employer matches your payments and sends both of them to the government.

Self-employed? – If you start up your own summer business like mowing lawns or providing nanny services you will have tax obligations similar to those as an employee. In addition to income taxes, you will need to file estimated tax statements to cover Social Security and Medicare taxes. These two taxes amount to 15.3% of your net income, so plan accordingly. But also remember to save receipts for your job related expenses. They can help reduce your taxable income.

Tips are taxed – If you receive any tips, these too are taxable. Most employers that have tip-earning employees will help you file the appropriate forms. If they do not, you will need to ask for help to ensure your taxes are paid on your tip income.

Review your pay – Remember to review your initial paycheck. There are often errors in setting up employee records. Should you find an error or need an explanation, feel free to ask your employer for help. Errors not caught early can become expensive surprises later on during the year.