Know the way loans work…and use it to your advantage!

Every banker knows that the majority of the money they make on a loan is made in the first few years of the loan. By understanding this fact, you can greatly reduce the amount you pay when buying your house, paying off your student loan, or buying a car. Here is what you need to know:

Every banker knows that the majority of the money they make on a loan is made in the first few years of the loan. By understanding this fact, you can greatly reduce the amount you pay when buying your house, paying off your student loan, or buying a car. Here is what you need to know:

Your payment never changes

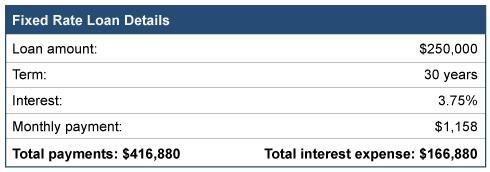

When you obtain a loan, the components of that loan are interest, the number of years to repay the loan, the amount borrowed, and the monthly payment. Assuming a fixed rate note, the payment never changes. Here is an example of a $250,000 loan.

It is important to note that your payment in month one is $1,158 and your monthly payment thirty years later is the same amount…$1,158.

Each payment has two parts

What does change every month is what is inside each payment. Every loan payment has two parts. One is a payment that reduces the amount of money you owe, called principal. The other part of the payment is for the bank, called interest expense. Now look at the component parts of the first payment and then the last payment:

So, while your monthly payment never changes, the amount used to reduce the loan each month varies DRAMATICALLY. Remember your total cost of borrowing $250,000 includes more than $166,000 in interest!

Use the knowledge to your advantage

Here’s how you can use this information to your advantage.

For new loans

- Only sign up for loans that allow you to make pre-payments without penalty.

- When borrowing money, keep some of your cash in reserve. Try to reserve a minimum of 10 to 20 percent of the amount borrowed. So, in this example, try to reserve $25,000 to $50,000 in cash.

- Immediately after getting the loan, consider using the excess cash as a pre-payment on the note. By doing this you can dramatically reduce the interest expense over the life of the note, all while keeping your payment constant. Even though your monthly payment may be a little higher, the extra payment amount will pay back the loan more quickly.

For existing loans

- Create and look at your loan’s amortization table. This table shows how much of each payment is used to pay down the loan balance and how much goes to your lender as interest. In the above example, 67 percent of the first payment is for the bank, while only ½ of 1 percent of the last payment is for the bank.

- Pay more to you than the bank. Aggressively prepay down any loan until more of each payment goes to you versus the bank. This is the crossover point of your loan.

- Find your sweet spot. After hitting the crossover point, next consider the efficiency of each prepayment and determine when you consider your prepayment ineffective. No one would consider prepaying that last payment when interest expense is only $4.00. But if more than 25% of the payment goes to interest? Keep making prepayments.

Final thought

When you make a prepayment on a loan, reduce the loan balance by your prepayment, then look at the amortization table. See how many payments are eliminated with your prepayment and add up all the interest you save. You will be amazed by the result.

With home sales booming throughout much of the country, you may decide that now’s the right time to put your abode on the market. If you do put your primary residence up for sale, try to steer clear of the following mistakes.

With home sales booming throughout much of the country, you may decide that now’s the right time to put your abode on the market. If you do put your primary residence up for sale, try to steer clear of the following mistakes. Your net worth changes over time, reflecting how you spend your money. For example, if you have tons of bills and spend more than you bring in, your bank account balances will be lower. If you spend a lot on your credit cards, your debt will go up. The net effect is a lower net worth.

Your net worth changes over time, reflecting how you spend your money. For example, if you have tons of bills and spend more than you bring in, your bank account balances will be lower. If you spend a lot on your credit cards, your debt will go up. The net effect is a lower net worth. The PPP program was created by the CARES Act in March 2020 to help businesses which were adversely affected by the COVID-19 pandemic. Qualified businesses could apply for and receive loans of up to $10 million. Loan proceeds could be used to pay for certain expenses incurred by a business, including salaries and wages, other employee benefits, rent and utilities.

The PPP program was created by the CARES Act in March 2020 to help businesses which were adversely affected by the COVID-19 pandemic. Qualified businesses could apply for and receive loans of up to $10 million. Loan proceeds could be used to pay for certain expenses incurred by a business, including salaries and wages, other employee benefits, rent and utilities. Remember, your banker probably has their hands full right now. These tips allow them to spend more time on their problem loans, and one of them will not be yours.

Remember, your banker probably has their hands full right now. These tips allow them to spend more time on their problem loans, and one of them will not be yours. And then you get the dreaded phone call. Your credit score wasn’t high enough to approve the loan! Was there anything you could have done to get a higher credit score?

And then you get the dreaded phone call. Your credit score wasn’t high enough to approve the loan! Was there anything you could have done to get a higher credit score? More than 70% of small businesses in America now have loan proceeds from the Paycheck Protection Program (PPP) to help retain employees during the current pandemic. The entire amount of a PPP loan is eligible to be forgiven if the funds are used for qualified expenses. Recent legislation liberalizes the terms of loan forgiveness for funds used for payroll, utilities and rent. It is now based on a 24-week period, not just eight weeks.

More than 70% of small businesses in America now have loan proceeds from the Paycheck Protection Program (PPP) to help retain employees during the current pandemic. The entire amount of a PPP loan is eligible to be forgiven if the funds are used for qualified expenses. Recent legislation liberalizes the terms of loan forgiveness for funds used for payroll, utilities and rent. It is now based on a 24-week period, not just eight weeks.