Tax and financial planning is a year-round proposition. In fact, you can benefit personally from a continuous, 12-month rolling forecast, much like a business does.

What is a rolling forecast?

Rolling forecasts let you continuously plan with a constant number of periods 12 months into the future. For example, on January 1, you would plan what your financial picture looks like each month through January 1 of the following year. When February 1 rolls around, you would then drop the beginning month and add a forecast month at the end of the 12-month period. In this case, you add February of the next year into your 12-month forecast.

The month you add at the end of the 12 months uses the finished month as a starting point. You then make adjustments based on what you think might happen one year from now. For example, if you know you are going to get a raise at the end of the year, your next-year February forecast would reflect this change.

The month you add at the end of the 12 months uses the finished month as a starting point. You then make adjustments based on what you think might happen one year from now. For example, if you know you are going to get a raise at the end of the year, your next-year February forecast would reflect this change.

How to take advantage of a rolling forecast

By doing tax and financial planning in rolling 12-month increments, you may find yourself in position to cash in on tax- and money-saving opportunities within the next 12 months. Here are several strategies to consider:

- Plan your personal budget. Will you need to put a new roof on your house? How about getting a new vehicle? Do you need to start saving for your kids’ college education? A rolling 12-month forecast can help you plan for these expenses throughout the year.

- Plan your healthcare expenses. If you have a flexible spending account (FSA) for healthcare or dependent care expenses, forecast the amount you should contribute for the calendar year. Although unused FSA amounts are normally forfeited at year-end, your employer may permit a 12-month grace period (up from 2½ months) for 2021. This means that you could potentially roll over your entire unused FSA balance from 2021 to 2022. Your forecast can help you see the impact of this change.

- Plan your contributions to a Health Savings Account (HSA). When an HSA is paired with a high-deductible health insurance plan, you can take distributions to pay qualified healthcare expenses without owing any tax on the payouts. For 2021, the contribution limit is $3,600 for an individual and $7,200 for family coverage. In this case, you can forecast an increase in contributions and double-check to ensure you have enough money on hand to pay future bills.

- Plan your estimated tax payments. This is often significant for self-employed individuals and retirees with investment earnings. The quarterly due dates for paying federal and state tax liabilities are April 15, June 15, September 15, and January 15 of the following year (or the next business day if the deadline falls on a holiday or weekend). So, if your personal income is seeing a recovery from the pandemic, your rolling forecast will show this and allow you to plan for the estimated tax payments.

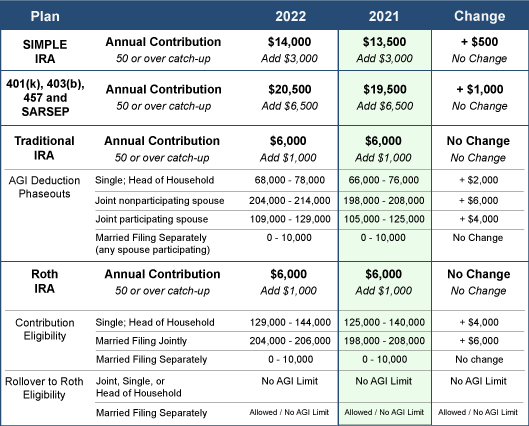

- Plan your retirement contributions. If you participate in your company’s 401(k) plan, you can defer up to $19,500 to your account in 2021 ($26,000 if you’re 50 or over). Contributions and earnings compound tax-deferred. As the year winds down, you might boost your deferral to save even more for retirement.

While initially setting up a rolling 12-month forecast can be a bit of a pain, once established, it is pretty easy to keep up-to-date as you are simply rolling forward last month into the future. A well-planned system can often be the first sign of future challenges or potential windfalls!

Contribute to retirement accounts. Tally up all your 2021 contributions to retirement accounts so far, and estimate how much more you can stash away between now and December 31. So, consider investing in an IRA or increase your contributions to your employer-provided retirement plans. Remember, you can reduce your 2021 taxable income by as much as $19,500 by contributing to a retirement account such as a 401(k). If you’re age 50 or older, you can reduce your taxable income by up to $26,000!

Contribute to retirement accounts. Tally up all your 2021 contributions to retirement accounts so far, and estimate how much more you can stash away between now and December 31. So, consider investing in an IRA or increase your contributions to your employer-provided retirement plans. Remember, you can reduce your 2021 taxable income by as much as $19,500 by contributing to a retirement account such as a 401(k). If you’re age 50 or older, you can reduce your taxable income by up to $26,000! The month you add at the end of the 12 months uses the finished month as a starting point. You then make adjustments based on what you think might happen one year from now. For example, if you know you are going to get a raise at the end of the year, your next-year February forecast would reflect this change.

The month you add at the end of the 12 months uses the finished month as a starting point. You then make adjustments based on what you think might happen one year from now. For example, if you know you are going to get a raise at the end of the year, your next-year February forecast would reflect this change.