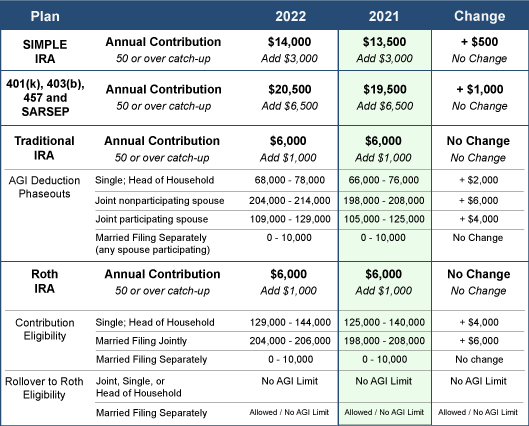

There’s good news for your retirement accounts in 2022! The IRS recently announced that you can contribute more pre-tax money to several retirement plans in 2022. Take a look at the following contribution limits for several of the more popular retirement plans:

What You Can Do

- Look for your retirement savings plan from the table and note the annual savings limit of the plan. If you are 50 years or older, add the catch-up amount to your potential savings total.

- Make adjustments to your employer provided retirement savings plan as soon as possible in 2022 to adjust your contribution amount.

- Double check to ensure you are taking full advantage of any employee matching contributions into your account.

- Use this time to review and re-balance your investment choices as appropriate for your situation.

- Set up new accounts for a spouse and/or dependents. Enable them to take advantage of the higher limits, too.

- Consider IRAs. Many employees maintain employer-provided plans without realizing they could also establish a traditional or Roth IRA. Use this time to review your situation and see if these additional accounts might benefit you or someone else in your family.

- Review contributions to other tax-advantaged plans, including flexible spending accounts (FSAs) and health savings accounts (HSAs).

Now is a great time to make 2022 a year to remember for retirement savings!